The ACCC is in panic mode about the gas shortage.

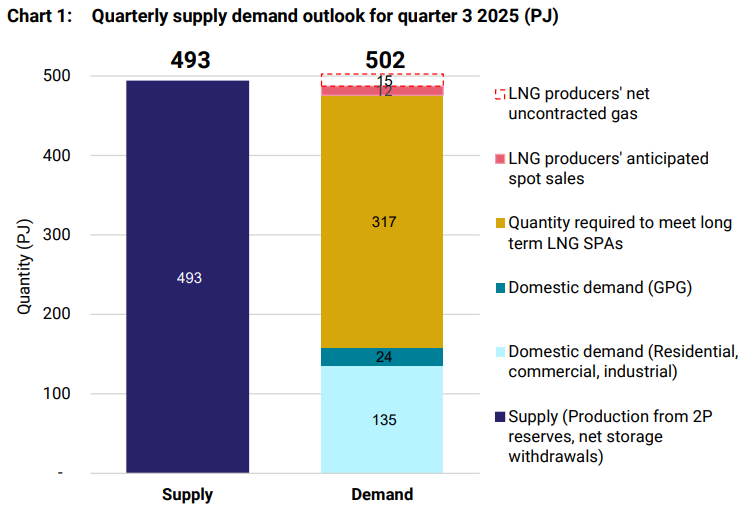

We forecast a shortfall of 9 PJ in the east coast market over July-September 2025 (quarter 3) if LNG producers export all their uncontracted gas, and a surplus of 6 PJ if they only export their anticipated spot sales. This is a 22 PJ decline in the east coast supply-demand balance compared to the forecasts contained in our December 2024 report.

Quarter 3 historically sees the highest domestic gas demand and the potential for a shortfall will increase pressure on the east coast gas market.

The worsened outlook has been primarily caused by a 13.6 PJ decline in forecast production across multiple basins and projects. The forecast supply shortfall for the southern states is now projected to be 40 PJ for quarter 3, an historic high (below).

LNG producers have also forecast a 7 PJ reduction in the amount of gas supplied to the domestic market via seasonal gas swaps and an increase of 3 PJ in gas exports under their long-term foundational contracts.

The most recent forecast significantly differs to our last forecast of a surplus in quarter 3 2025 even if LNG producers exported all their uncontracted gas.

This change reflects the inherent uncertainty of forecasting, but also the susceptibility of the outlook to short-term changes in gas production and availability of LNG producer gas in circumstances of declining production from existing fields in the southern states.

In short, this winter, the gas cartel will engineer a new gas and power price shock by selling all surplus gas to China.

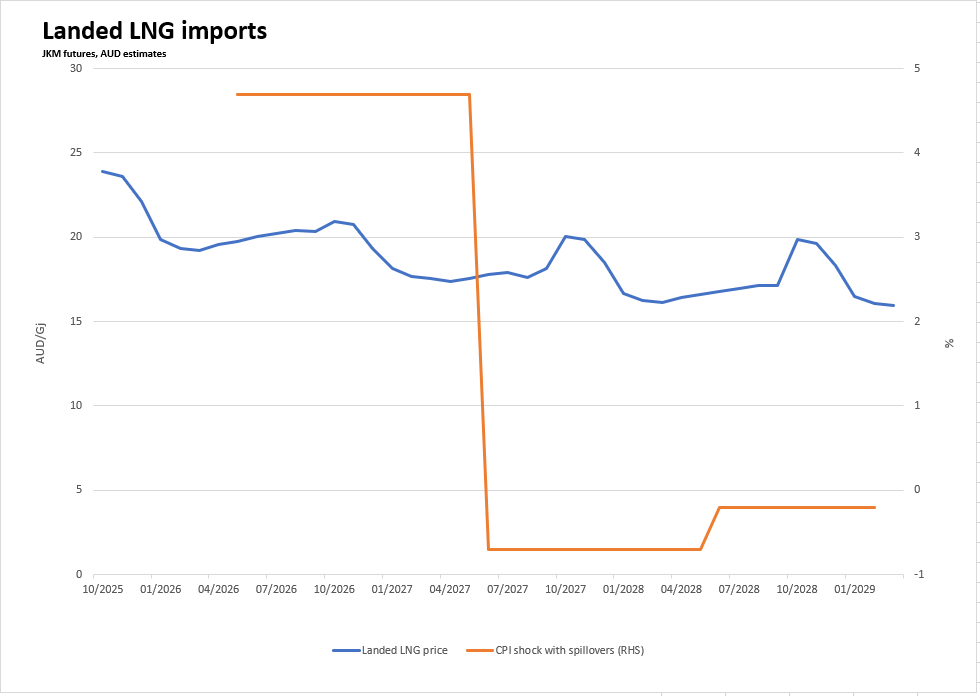

This is just as LNG imports begin, and the export cartel drives the local marginal price to import parity.

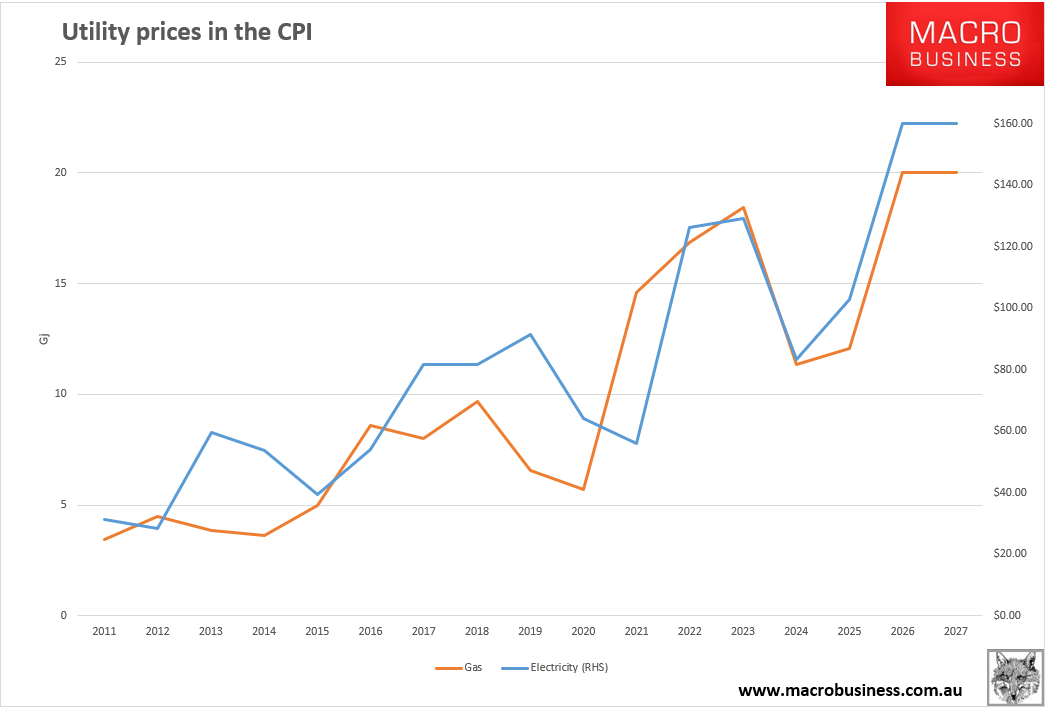

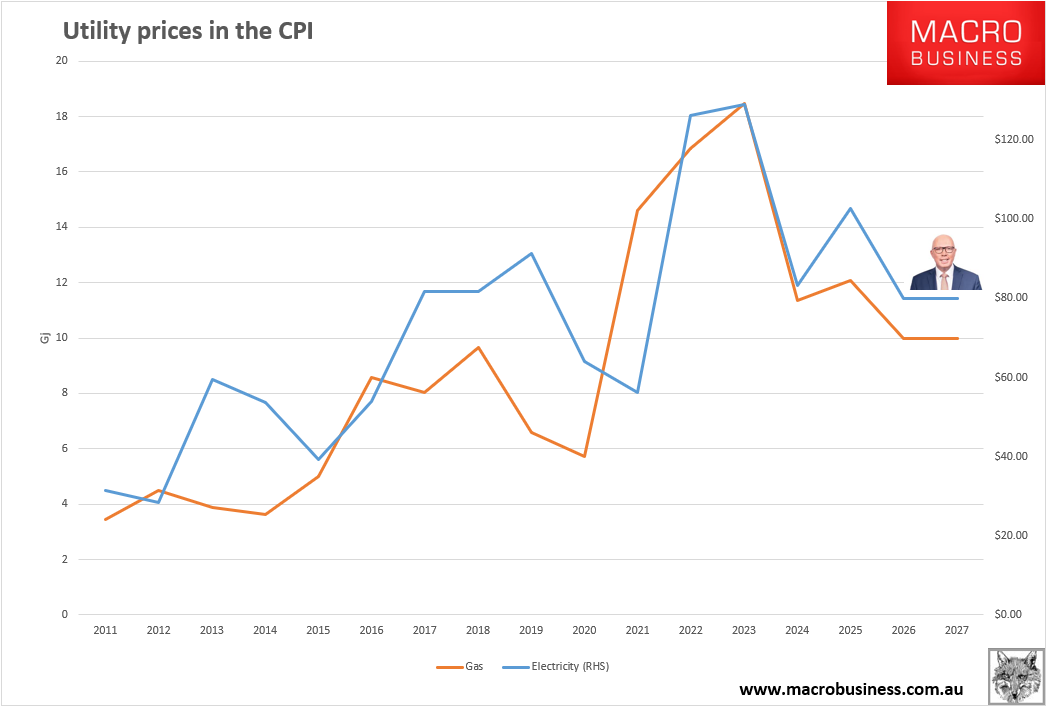

According to Asia gas futures markets, this will push the local gas price to $20Gj or above and local power prices up by another 40% just as power rebates roll off.

It will be a household income and inflation catastrophe.

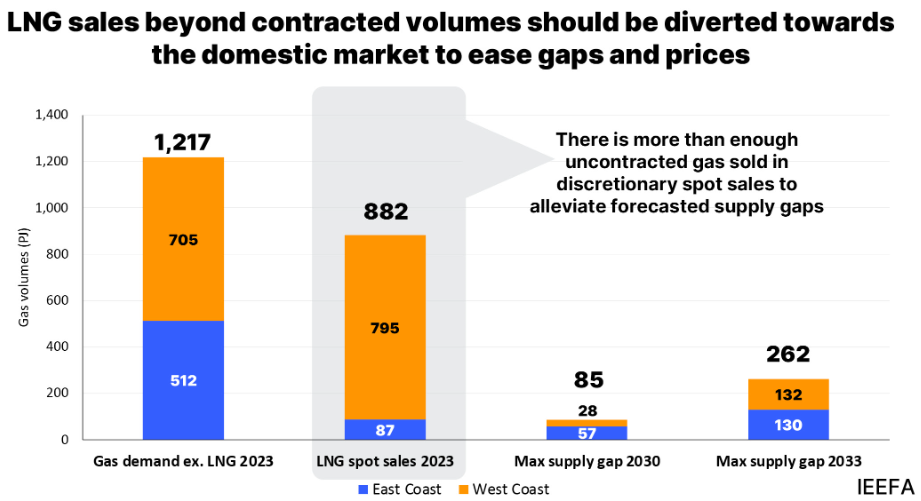

But you now have a choice. The Dutton opposition has released its plan for a national gas reservation policy. It will force uncontracted gas into the local market until the price is below $10Gj by pushing the gas cartel with fines.

There is plenty of gas to do this.

And it will drive down energy bills even as rebates are scrapped.

Moreover, this policy makes the ALP’s Building Australia Plan to save industry obsolete. By making energy half the price it will be otherwise, it will stop the bleeding in a much wider cross-section of manufacturing versus Albo’s rubbish plan of assembling Chinese components to make solar panels, which is hardly “manufacturing”.

By itself, it will also add to disinflation, save the budget billions, and lower interest rates.

It will also finally restore strained relations with foreign gas customers as approvals are accelerated and contracts are met.

Finally, it is unlikely to boost carbon output as more gas exports displace more coal in Asia. This impact will be greater than local coal plants that are kept operating a little longer in the open instead of secretly by corrupt Labor state governments because they have no gas.

As LVO says, this is not the perfect policy. Energy prices should be lower still. Decarboisation should be faster.

But it ends the worst ten years of energy policymaking in Australian history and stops the imminent threat of the LNG import Gasmageddon.

Nuclear energy is more expensive than renewable energy in the long run, but it will still be gas that is the marginal price setter for electricity, and the capability to split the atom has obvious national security benefits. Especially in support of AUKUS. Even more so without it!

This policy alone means everybody should vote for the LNP in their own interest and that of the nation.