Electric vehicle industry panics as subsidies unwind

Last year, the electric vehicle (EV) ‘revolution’ hit a wall.

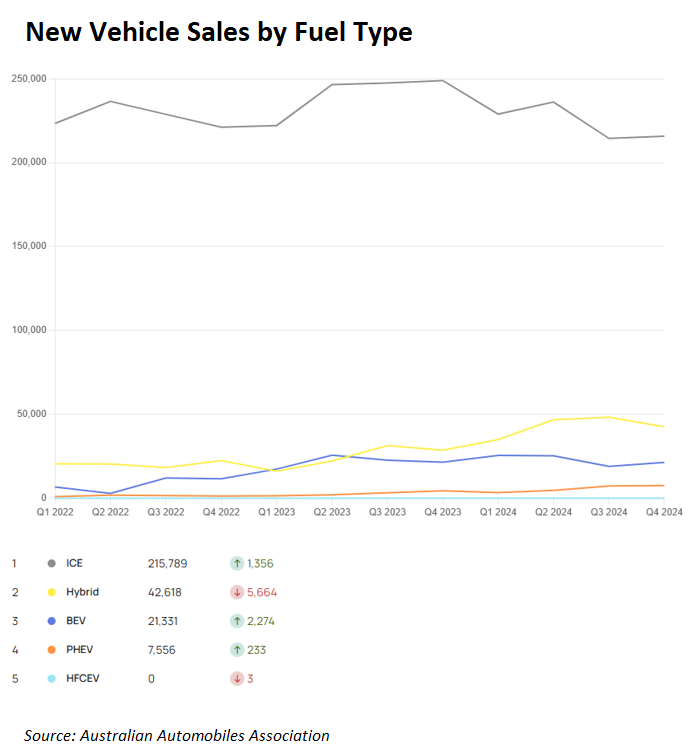

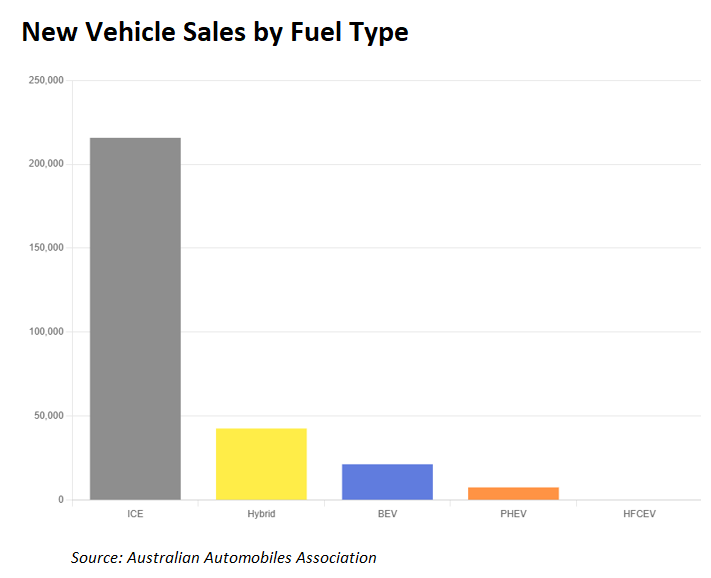

Sales of battery electric vehicles (BEVs) stalled in 2024, whereas sales of hybrid vehicles continued to boom.

According to the Australian Automobiles Association’s Electric Vehicle Index, only 91,293 BEVs were sold last year, an increase of only 4.7% on the 87,217 BEVs sold in 2023.

However, quarterly BEV sales peaked in Q2 2023 at 25,696 and quarterly sales volumes have fallen since.

BEV’s share of total car sales was just 7.7% in 2024, up marginally from 7.5% in 2023.

By contrast, demand for hybrid cars boomed.

Sales of standard hybrid vehicles soared to 172,630 in 2024, up 74,191 (75%) on the 98,439 sales in 2023.

Sales of plug-in hybrid electric vehicles (PHEVs) grew to 22,980 in 2024, up 11,691 (104%) on the 11,219 sales in 2023.

Combined, 195,610 hybrid vehicles were sold in 2024, more than double the 91,293 BEVs sold in the same period.

The poor BEV sales are despite generous government subsidies and financial incentives from federal and state governments.

Subsidies include an increase in the luxury car tax threshold and exempting BEVs from fringe benefits tax and customs charges.

BEVs are also exempt from paying road user charges in the form of the 50.6 cents per litre fuel excise, which is a subsidy.

The latest Carsales EV Consumer Survey report also revealed that only 18% of respondents believed they would drive a BEV by 2030, a sharp decline from 40% in the June 2022 survey.

The loyalty of current EV owners has also declined. While 83% of BEV owners said that they are likely to purchase another BEV in the future, this represented a decline from 95% in May 2023.

The federal government will remove the fringe benefits tax exemption for PHEVs on April 1, which has the industry concerned.

“While people are now switching away from electric vehicles to plug-in hybrids, it’s the worst time possible for this kind of thing, because the people just don’t want to buy electric vehicles and they’re going to be removing the only real subsidy that is currently sort of gaining traction”, CarExpert.com.au founder Paul Maric said.

Several industry associations feel the FBT exemption should be extended well beyond April 1 to facilitate the transition to electric vehicles.

They are concerned that abolishing incentives may encourage more individuals to continue with or return to an internal combustion engine (ICE).

“We know the FBT exemption is an important tool that is helping more Australians afford and access the latest EVs”, Electric Vehicle Council policy head Aman Gaur said.

National Automotive Leasing and Salary Packaging Association chief executive Rohan Martin added that removing the tax cut is a “lost opportunity” as it helped many transition from a petrol or diesel car to something that was low and then a zero-emission vehicle.

“Once the bulk of people move into a plug-in hybrid, they’re on their electrification journey”, he said.

There is nothing like other people’s money.

The reality is that without generous taxpayer subsidies, BEV and PHEV sales would be significantly lower.

BEVs, in particular, remain prohibitively expensive. They lack fast and convenient charging options. They have a short range (particularly on highways without regenerative braking or when heavy heating or air conditioning is required). They incur high insurance and repair costs. And they depreciate dramatically.

Standard hybrids address most of these drawbacks, which explains why their sales have soared without subsidies.

Toyota has produced reliable and reasonably priced hybrid vehicles since the late 1990s, when it introduced the Prius.

Hybrid vehicles offer excellent fuel economy and range, are convenient, and hold their value.

By comparison, BEVs are inconvenient if you lack off-street parking or engage in long road trips. They also depreciate rapidly.