Every time I read one of these articles, the Grattan Institute appears as the independent voice of reason. SMH.

As the risk of shortfalls edges closer, state and federal energy ministers are becoming increasingly worried that talks between LNG terminal developers and prospective customers appear deadlocked, with neither party able to agree on price and terms. At a meeting this month they tasked officials to draft legislation that could empower AEMO to potentially provide underwriting support for one or more of the planned terminals.

“Serious commercial arrangements have to be put in place involving the gas producers, terminal operators, the big customers and probably the government,” says Tony Wood, energy director at the Grattan Institute.

“I think everybody recognises that we’ve got to find a way to get these terminals working.”

Really? Everybody? Or just the East Coast gas cartel that sponsors Grattan Institute? That “everybody”.

Why does the media never mention this sponsorship from Origin Energy? Tony Wood used to work there as well.

Origin is the owner-creator of one of the three LNG export terminals in QLD that have created the local gas shortage.

For over ten years, Grattan advice about gas has been catastrophic for Australia, and marvellous for the Origin export cartel.

Indeed, Grattan advice was central to the cartel’s creation. Recall Tony Wood in 2013.

“With more than $160 billion forecast to be invested in LNG production, the export industry is good for the economy. Governments should therefore resist self-interested calls from some industries to reserve gas or cap prices for the domestic market”.

“One reason that reserving gas is a bad idea is that there is no shortage of gas. The challenge is to ensure that the gas gets delivered to where it is required, and this means commercial buyers and sellers need to reach commercial terms on new arrangements”.

“Capping prices for the domestic gas market is a very bad idea. It amounts to a tax on producers and a subsidy for domestic gas users. Protectionism of this sort may provide some short-term price relief for targeted industries, but it tends to mean inefficient businesses and less investment”.

“Ultimately it leads to higher prices and damages the economy for us all”.

Has not reserving gas kept prices down? Has it been good for the economy?

Don’t make me laugh. It has been central to price spikes across the National Electricity Market, delivered Ukraine War energy profiteering, gutted manufacturing, played a central role in the huge decline in household living standards over the past three years, and so destabilised the energy transition that we have churned through governments like confetti.

And for what? A few lousy jobs in QLD and cheap gas for China to build destroyers to send back.

This advice from the Origin Energy-sponsored Grattan Institute has been a political economy catastrophe.

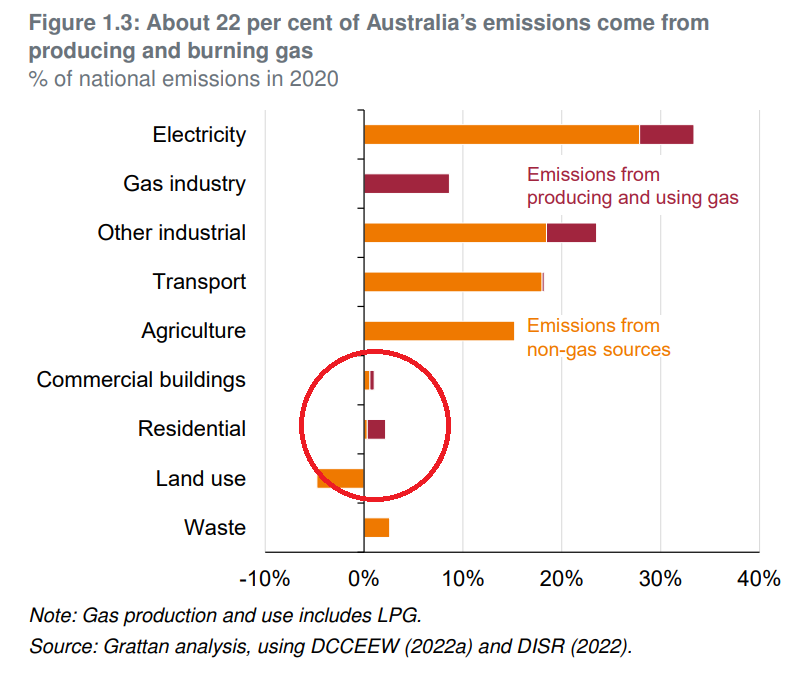

Grattan had to cover it up somehow. So, next up, it launched the great distraction of getting households off the gas. Even though it will have a near-zero impact on carbon output.

In fact, it likely makes it worse because, without the gas, we need more coal, except publicly subsidised.

Australia needs to get off natural gas if it is to have any hope of achieving net-zero carbon emissions by 2050, according to a new Grattan Institute report.

Getting off gas: why, how, and who should pay? shows that all-electric homes are cheaper to run and better for people’s health, and that alternative technologies such as hydrogen or biomethane are too costly and too far off for widespread use in homes and small businesses.

The report calls on each state and territory government to set a date for the end of gas.

And guess who’s the winner? Origin Energy and its Eraring coal-fired power station, now burning taxpayer dollars as well as coal. Along with Yallourn and Loy Yang, which have secret deals with Victoria’s communist government, further undermining the political economy.

Basically, Wood’s household gas bull is an incredible financial impost on Victorians, achieving nothing, that prevents anybody from looking at where the carbon is really coming from: the gas industry!

Now, Grattan is right behind LNG import terminals, and ‘nobody disagrees’.

Except for anybody with a brain.

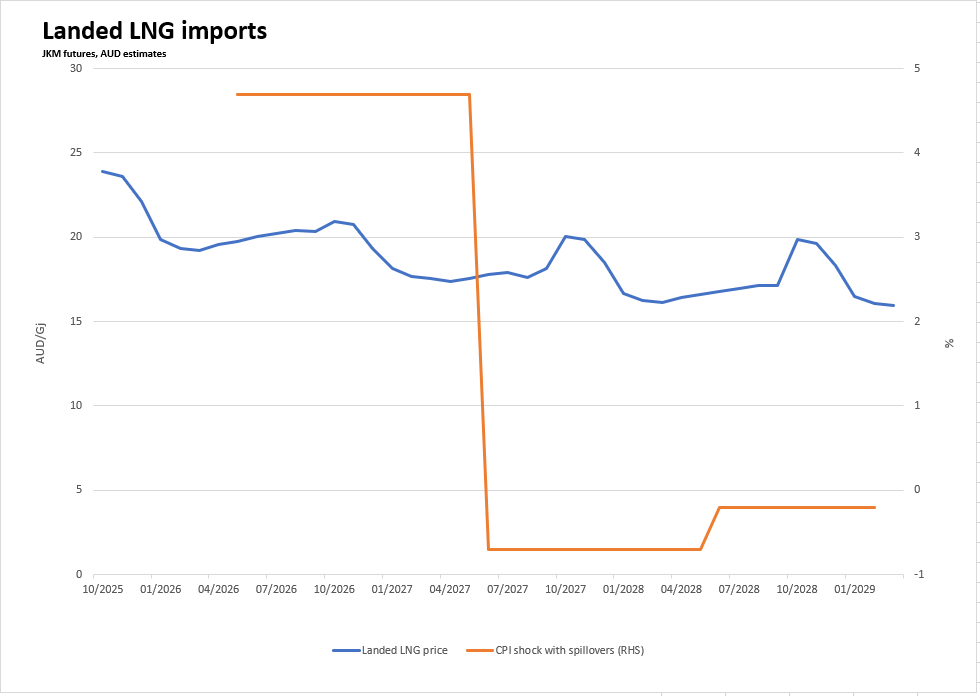

This is what LNG imports will do to prices, according to JKM futures.

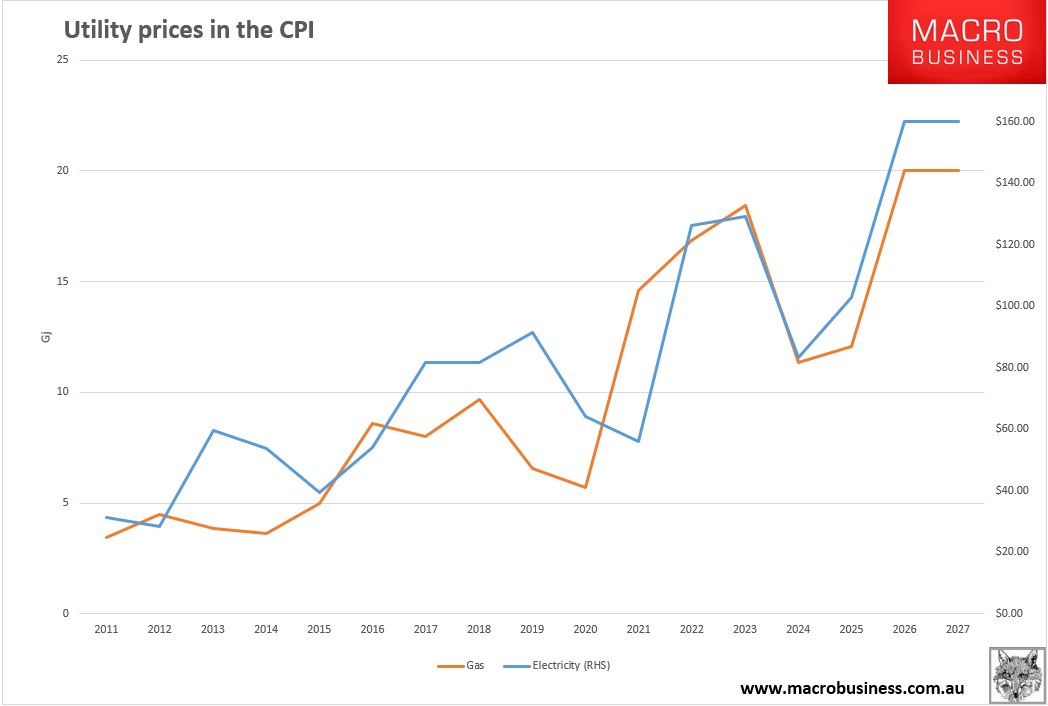

We’ll jump from a $12Gj average to a $20Gj average as Grattan’s gas export cartel further reduces supply to guarantee that the local price rises to import parity plus a Twiggy margin.

Electricity prices will skyrocket just as governments pull back rebates.

Australia will have the world’s cheapest and highest-quality energy fuels—coal, gas, uranium, sun and wind—combined with the highest energy prices anywhere in the world.

That’s the Grattan Institute recipe for Aussie energy, brought to you by gas cartelier, Origin Energy.

When all we need to do to fix everything is use a pen, to activate the ADGSM and/or apply an export levy to Origin and its mates.