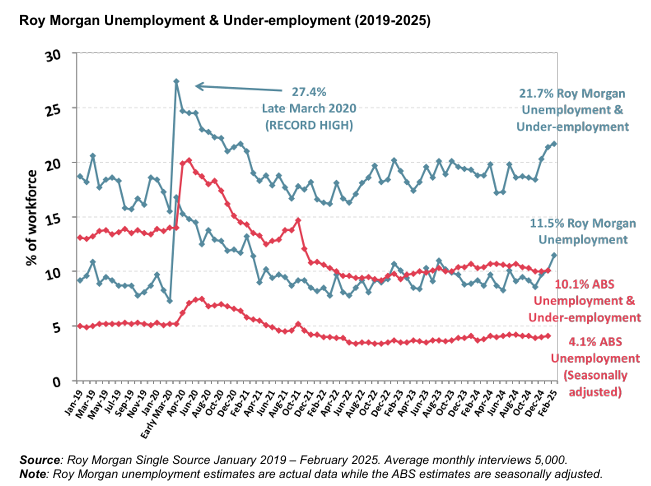

Earlier this month, Roy Morgan released its shadow labour market report, which reported a significant increase in unemployment to 11.5% in February, with underutilisation (i.e., unemployment plus underemployment) surging to 21.7%.

Roy Morgan’s underutilisation rate is the highest on record outside of the pandemic.

Roy Morgan CEO Michelle Levine addressed the Mumbrella Retail Marketing Summit last week, where she described the surge in labour market underutilisation as “calamitous”.

Levine was blunt about the economic picture: “It hasn’t bottomed out; it hasn’t turned”…

Roy Morgan says the number of people unemployed or underemployed has hit 21.7%—the highest number since the start of Covid. It was, she said, “calamitous”.

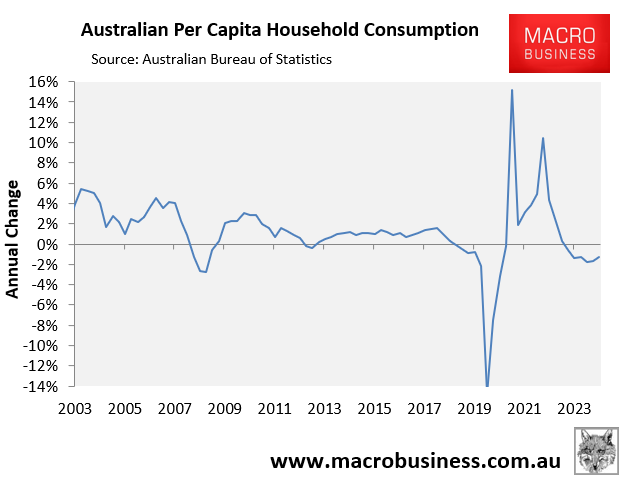

Calamitous for the individuals involved. But also calamitous for the wider economy when these people focus on paying their mortgage, not on buying stuff.

I am not as negative as Levine, instead describing the labour market as “structurally weak”.

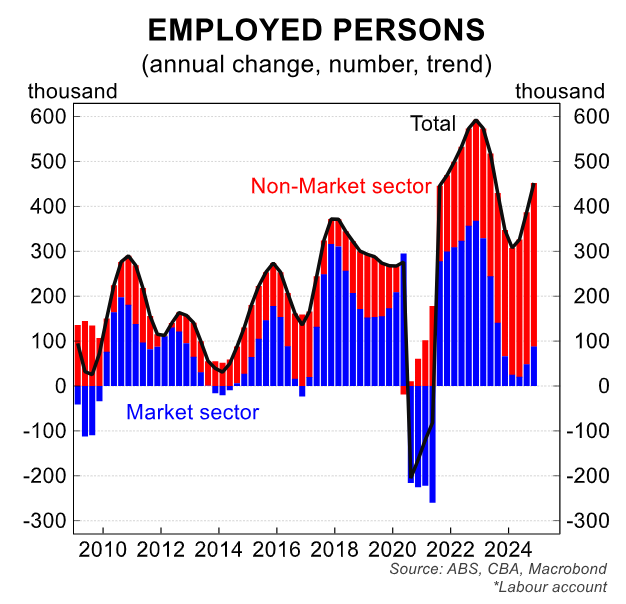

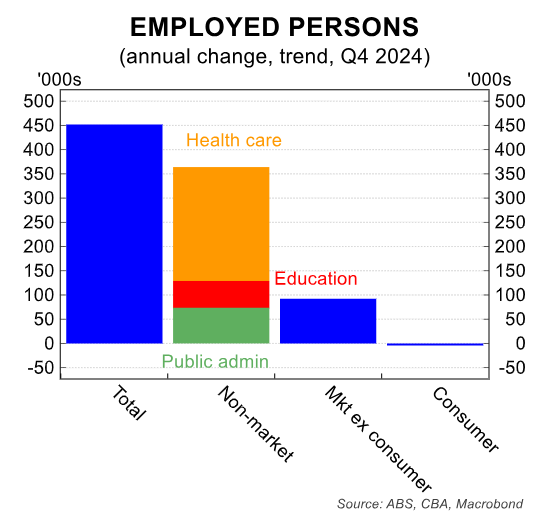

The reality is that most job growth has been driven by the non-market sector, primarily via the NDIS.

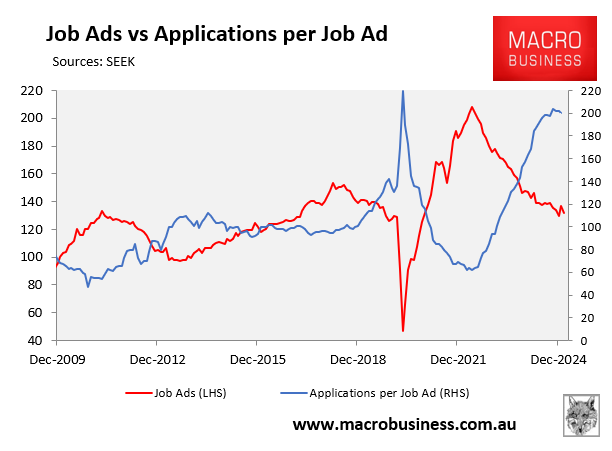

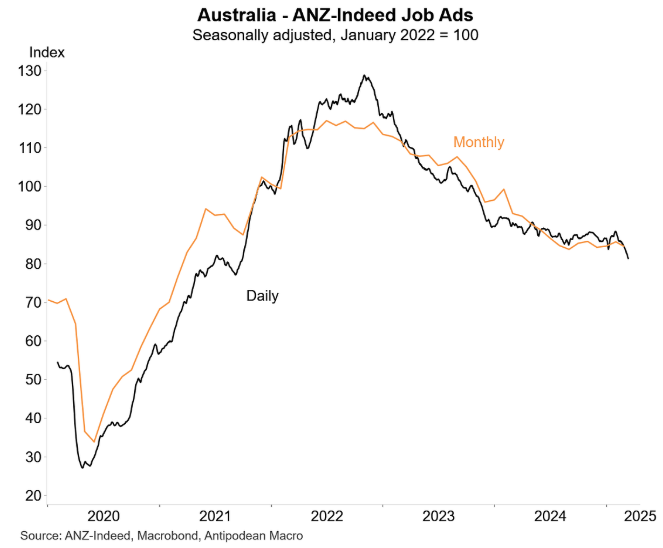

Partial job market data also suggests that job demand is easing.

SEEK has reported a significant reduction in job ads and a substantial rise in the number of applicants per job ad.

As Justin Fabo from Antipodean Macro shows below, Indeed’s daily job ads series for Australia has softened through mid-March.

Clearly, Australia’s labour market has a soft underbelly, with the market (private) sector struggling to create jobs.

Michelle Levine’s comments to the Mumbrella Retail Marketing Summit might have been referring to the consumer sector, which remains in recession.

For them, “calamitous” is probably a fair way to describe the labour market.