Here comes your next gas cartel bill shock

It is probably fair to say that you get the energy prices you deserve. If you choose to loosen the bonds of national identity, dumb down the populace and castrate public debate then you’re not equipped to deal with complex problems.

Maybe you’re not even equipped to deal with simple problems, such as the theft of your energy by greedy foreign powers.

Certainly our national papers have no idea. Or they are paid not to. I can’t tell any more.

How a national business paper can discuss the forthcoming round of electricity bill shocks without once mentioning the real cause is a mystery to me. I’m just not dumb enough to understand it.

I give you the AFR.

Cash-strapped households should not expect much relief to come from lower power bills this year, with some experts predicting consumer prices will climb by up to 5 per cent when the annual tariff reset comes in July.

The Australian Energy Regulator was due to release its draft ruling on standing tariffs for electricity on Thursday amid expectations current prices will be largely maintained, if not increased modestly, amid stubbornly robust wholesale prices and mounting spending on “poles and wires”.

…The impact of the Coalition’s plan to build seven nuclear reactors across the country on consumer bills is also a hotly debated topic, as are future costs for consumers from Labor’s renewables-based strategy.

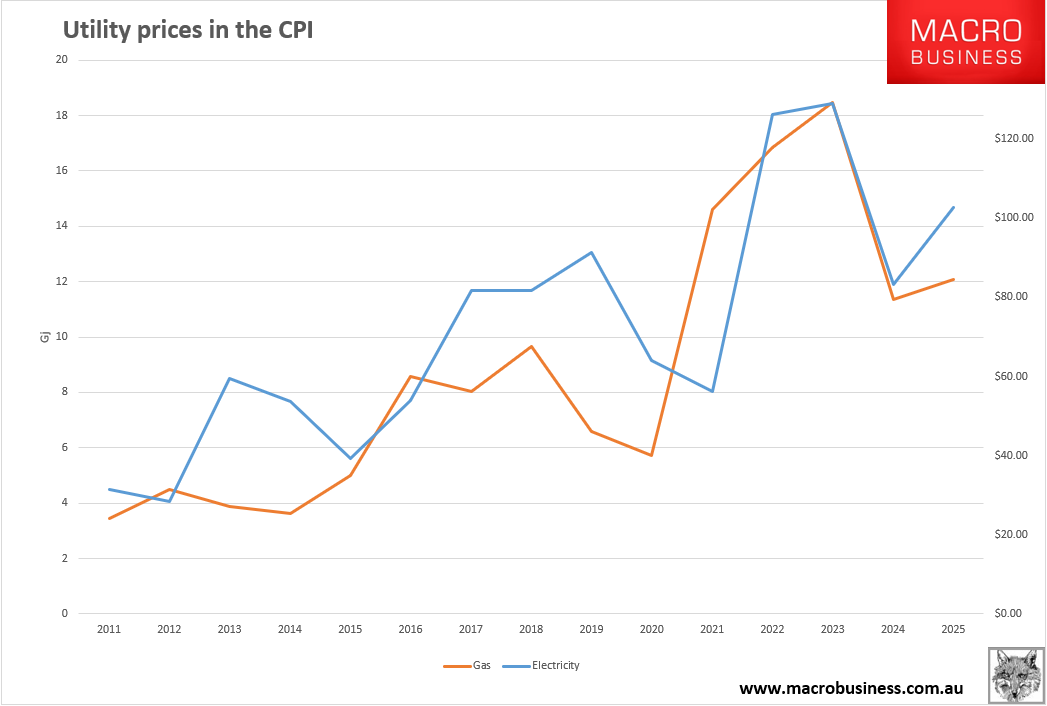

As I have said for months, the next bill hike will be 5-10% in March for 25/26.

How did I know? It wasn’t renewables. It wasn’t nuclear. It wasn’t poles and wires. It wasn’t hotly debated poop thrown between monkeys.

It was gas because gas is the only fuel that matters to electricity prices for now and far into the future because it is the marginal price setter in the AEMO bid stack.

During the last AER reference period, the gas price rebounded above Albo’s $12Gj cap joke and, as night follows day, so did wholesale electricity.

Of course, Labor will also lift its energy rebate so you’ll not pay the bill shock directly. Rather, through higher taxes as the rebate cost approaches $4bn per annum.

Yet all of this pales versus what is coming. This Friday, Australian energy ministers from across the east coast—which could easily mistaken for a troop of chimpanzees—will sign off on their glorious new plan to underwrite LNG imports from H2 this year.

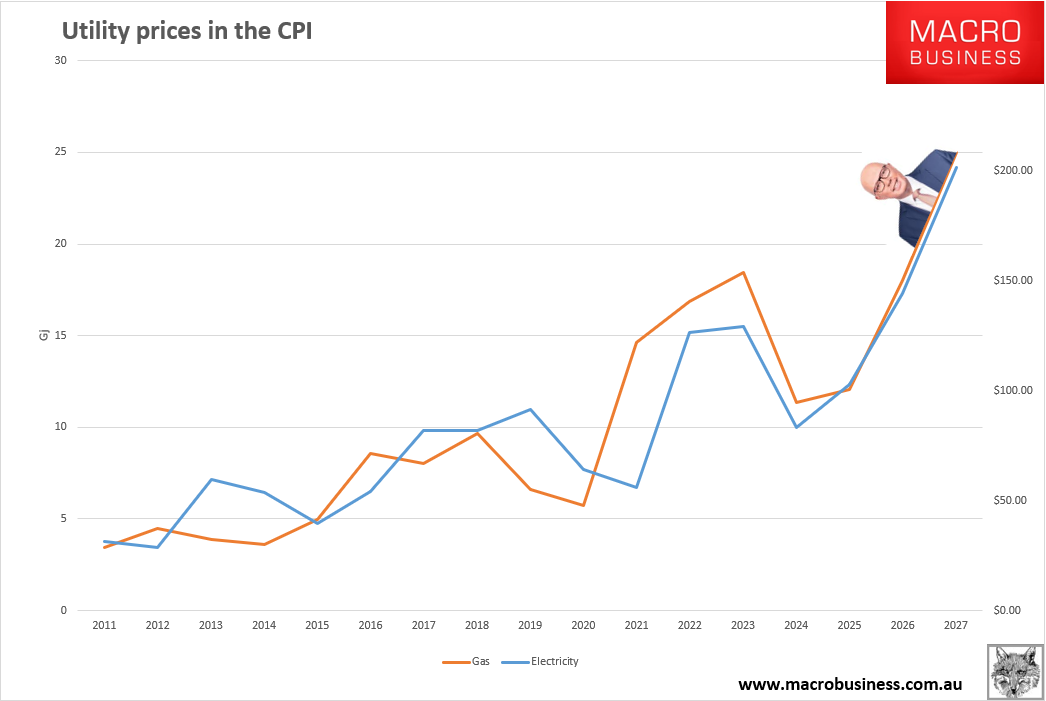

This will immediately result in the gas export cartel reducing local supply further to ensure the marginal price setter of local gas price becomes import parity.

That price is $25Gj today, double the local price. Assuming the gas export cartel gets it done relatively swiftly, this same conversation in twelve months will be very fraught indeed.

An average gas price of $25Gj will deliver an electricity bill shock of around 40%.

The LNP has committed to the removal of the rebates, indicating it is the more brainless of the apes, so if it wins power then the shock will look like this.

If it is Labor then the bill for the bill rebates will approach $6bn which will, of course, come out in higher taxes in due course.

It is almost as if some terrible virus destroyed the human beings that built an advanced energy powered civilisation and now a group of apes is using the power stations as their home base, randomly pressing the pretty flashing buttons.

Alas, there is no button for domestic gas reservation for them to accidentally stand on.