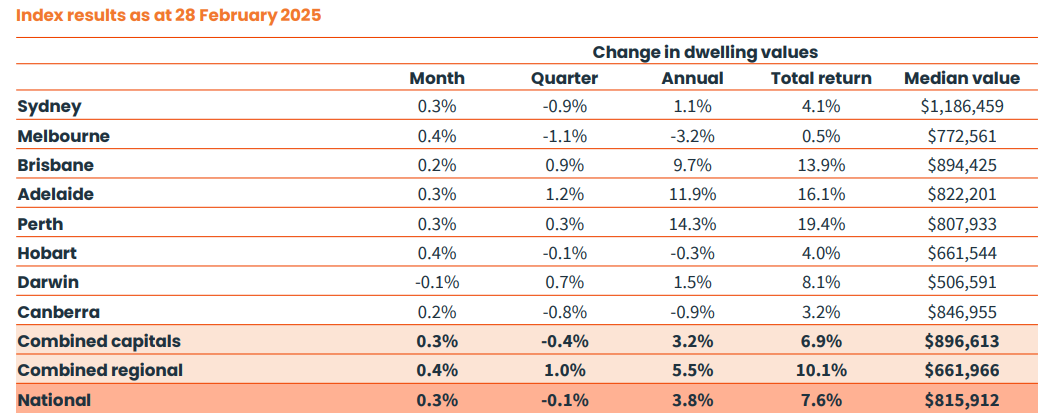

CoreLogic’s results for February show that Melbourne is now the cheapest major capital city housing market in the nation.

Melbourne’s median dwelling value was $772,561 at the end of February 2024, $124,052 (14%) below the national capital city median.

Source: CoreLogic

The improved affordability of Melbourne’s housing market follows subdued growth over the past five years.

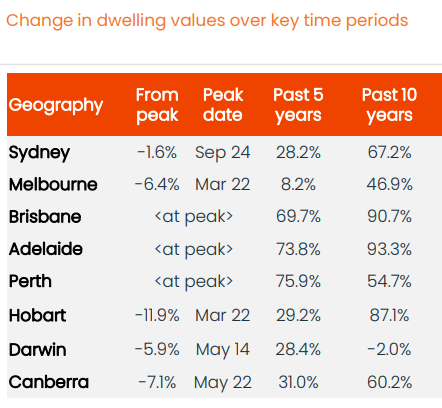

As illustrated in the following table, Melbourne dwelling values have risen by only 8.2% over the past five years, the slowest growth of all the capital cities.

Source: CoreLogic

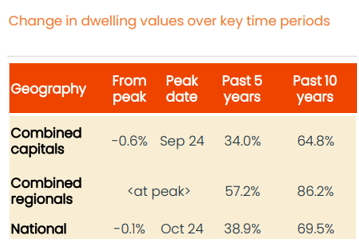

For comparison, dwelling values across the combined capital cities have risen by 34.0% over the past five years, with regional values rising by 57.2%.

Source: CoreLogic

As a Melburnian with two teenage children, the stagnation of Melbourne dwelling values brings a smile to my face.

Although I am technically less wealthy because my house has not appreciated much in value over recent years, it means that my children may eventually have the opportunity to afford a home.

It also means that I may not have to help them as much financially via the ‘Bank of Mum and Dad’.

In this regard, housing affordability is one area the Victorian Labor Government has arguably gotten right.

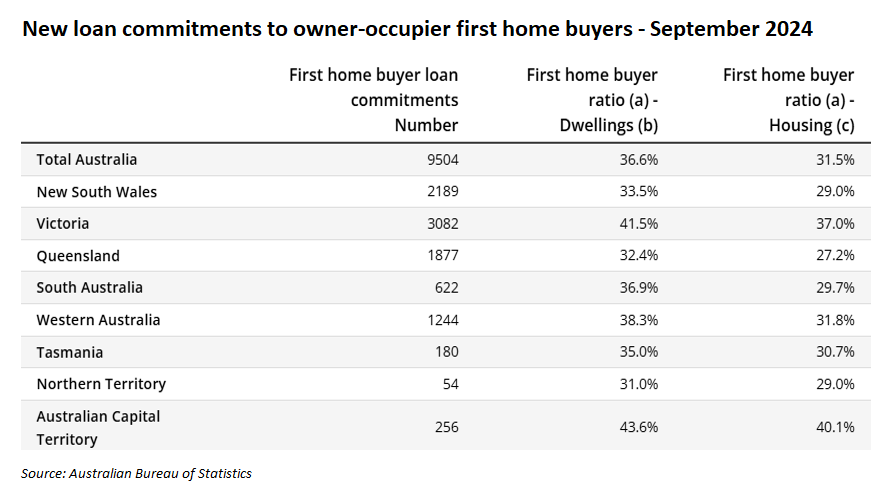

By stifling investor demand via state government land tax hikes, Victoria has the highest share of first-time home buyers of any state in Australia.

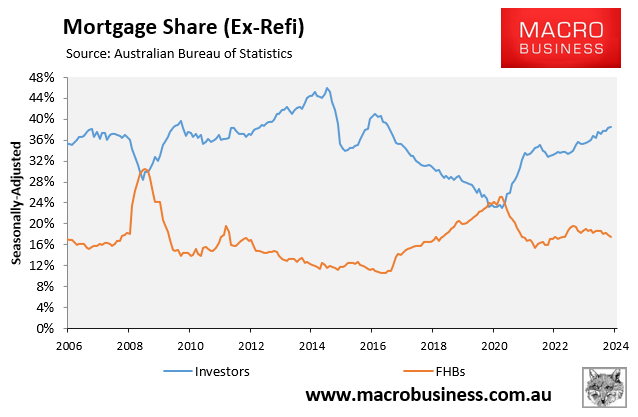

This reflects the historical inverse relationship between investor mortgage demand and first-home buyer mortgage demand.

Investors’ pain has been first home buyers’ gain.