Over the weekend, veteran budget watcher Chris Richardson published a stinging critique of Australia’s “third world” tax system, which punishes workers and collects too little tax from efficient sources.

“Australia may be a first-world nation, but we increasingly have a third-rate tax system”, Richardson wrote. “It last got a spit and polish a quarter of a century ago, with the subsequent neglect leaving it ever more reliant on a handful of increasingly damaging taxes”.

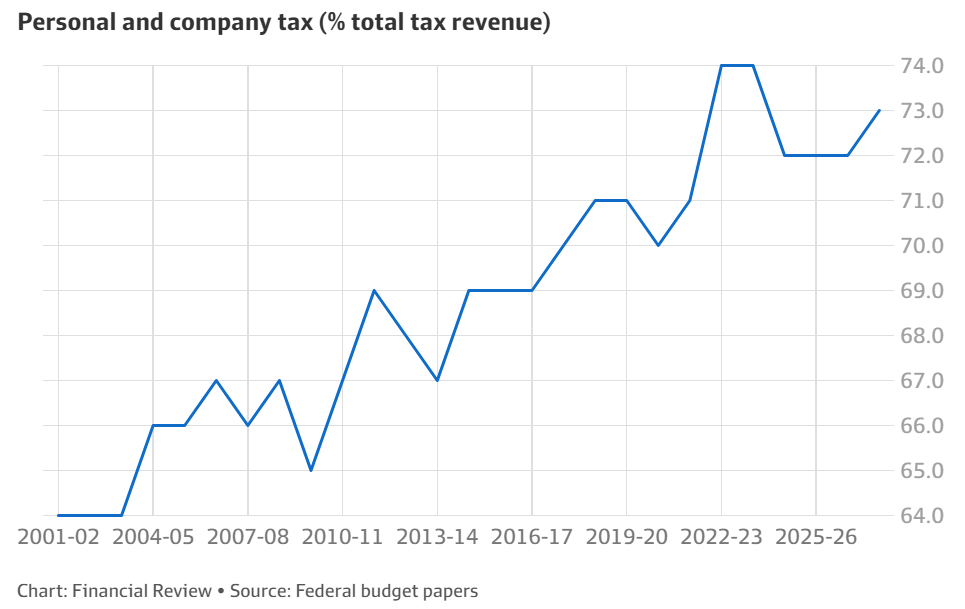

“The official figures say the tax take will leap, and they do so by assuming there won’t be another personal tax cut in the next decade. That means bracket creep will get decidedly creepy, with average full-time wages busting into the 37 cent tax bracket halfway through the coming decade”, Richardson wrote.