A new report by the Australian Council of Social Service (ACOSS) claims that the capital gains tax (CGT) discount and negative gearing “disproportionately” benefit Australia’s wealthiest while also fuelling the housing affordability crisis.

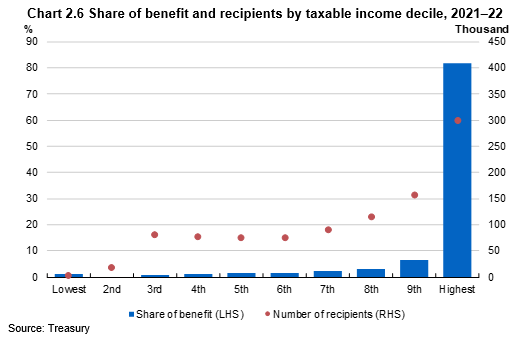

ACOSS says the wealthiest 10% of households own two-thirds of all investment properties and are receiving 82% of the $16 billion in tax relief the two breaks provide.

“These tax breaks disproportionately benefit the well-off in our society while millions struggle to pay the rent, let alone save a deposit to buy their first home”, ACOSS chief executive Dr Cassandra Goldie said.

The report also found that since the introduction of the capital gains discount in 1999, the average house price has increased by 142% while wages have risen by 44%.

“Australia’s absurdly generous tax breaks are supercharging the housing crisis and rising inequality in our society”, Goldie said.

“As long as our tax system encourages speculative investment in housing, the housing affordability crisis won’t be solved just by building more homes”.

ACOSS has called on the government to reduce the CGT discount 50% to 25% over five years, restrict negative gearing for new investments, and also halve the CGT deduction for superannuation funds.

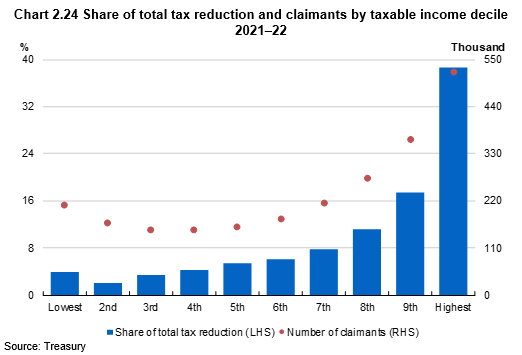

Analysis of the 2021-22 tax year by the Australian Treasury showed that 81% of the total tax reduction from rental deductions went to people with above-median income, with 39% of the reduction going to people in the top taxable income decile (Chart 2.24).

Rental losses are most commonly claimed by those with higher taxable incomes, with individuals in the top 30% of taxable income accruing 75% of the total benefit, according to the Treasury.

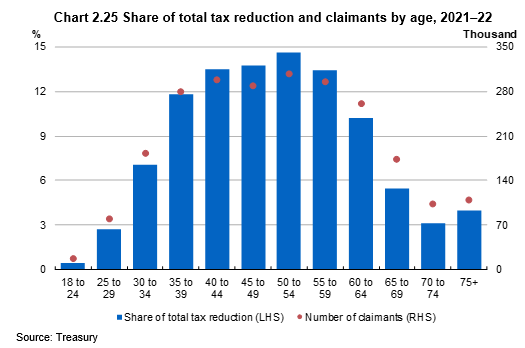

Most deductions are also claimed by generations X and Y, because baby boomers tend to own their rental homes outright or have stopped working.

Around 82% of the benefit from CGT discount was received by people in the top income decile (Chart 2.6).

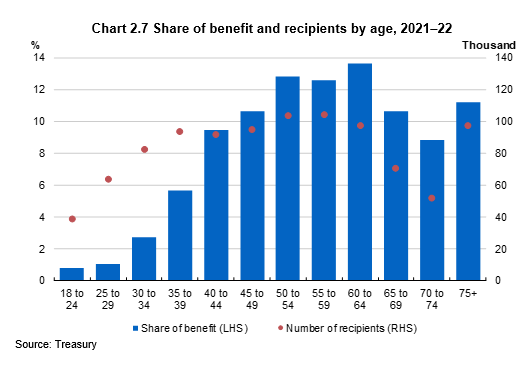

Older Australians also received the greatest benefits (Chart 2.7). Those aged 50 to 64 received the greatest share of the benefit, whereas the largest share of the benefit (13.6%) went to those aged 60 to 64.

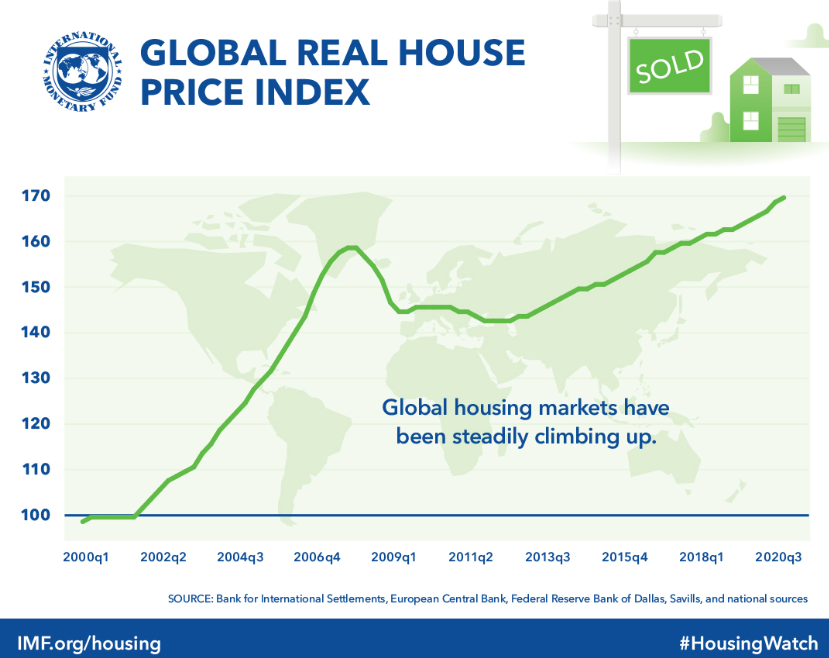

I do not blame these tax breaks for the absurd rise in home prices since the turn of the century, given that prices rose across the world.

This suggests that the global liberalisation of mortgage credit played the major role.

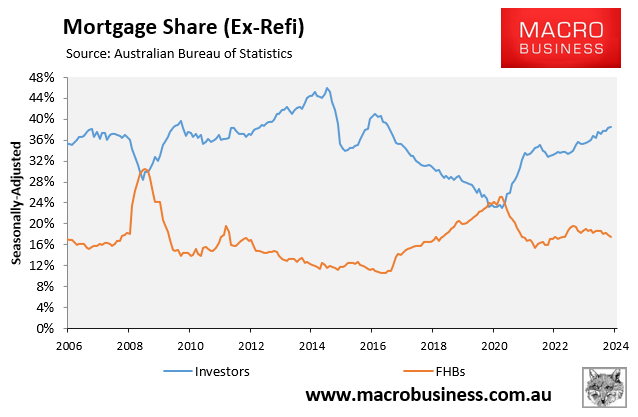

Nevertheless, Australia’s property tax concessions are costly to the federal budget and unambiguously stimulate investor demand, which crowds out first-home buyers and lowers the nation’s homeownership rate.

It is a statistical fact that if we want Australia’s homeownership rate to increase, then we necessarily need fewer investors participating in the market and crowding-out first-home buyers.

On budget sustainability and homeownership grounds alone, Australia’s property tax concessions should be unwound.