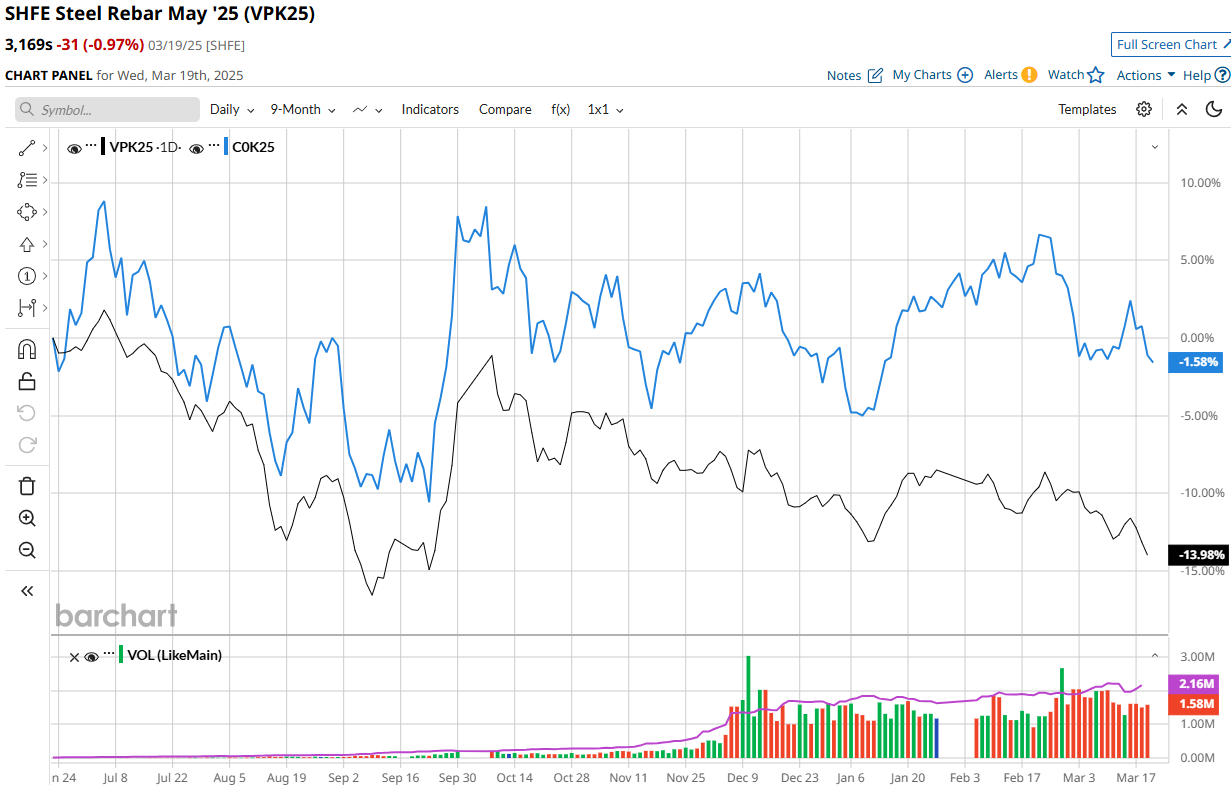

Steel prices are in free fall as tariffs mount. The iron ore jaws are wide.

Macquarie has thrown in the towel now.

Macquarie, a global financial services group, predicted the seaborne iron ore market will be in surplus by about 50 million tons this year as China is likely to cut steel production. If steel production is forced to be reduced, China’s steel output is expected to drop by 2.5% to 858 million tons in 2025, and iron ore demand will decrease by 37 million tons accordingly.

Advertisement