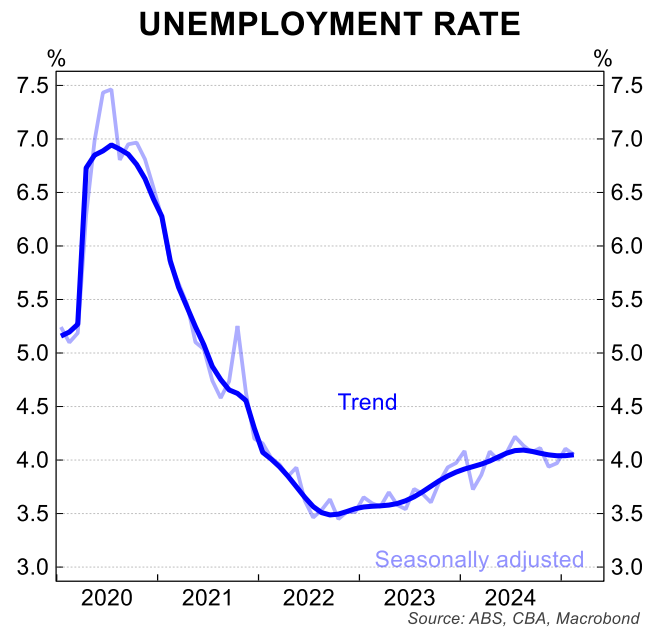

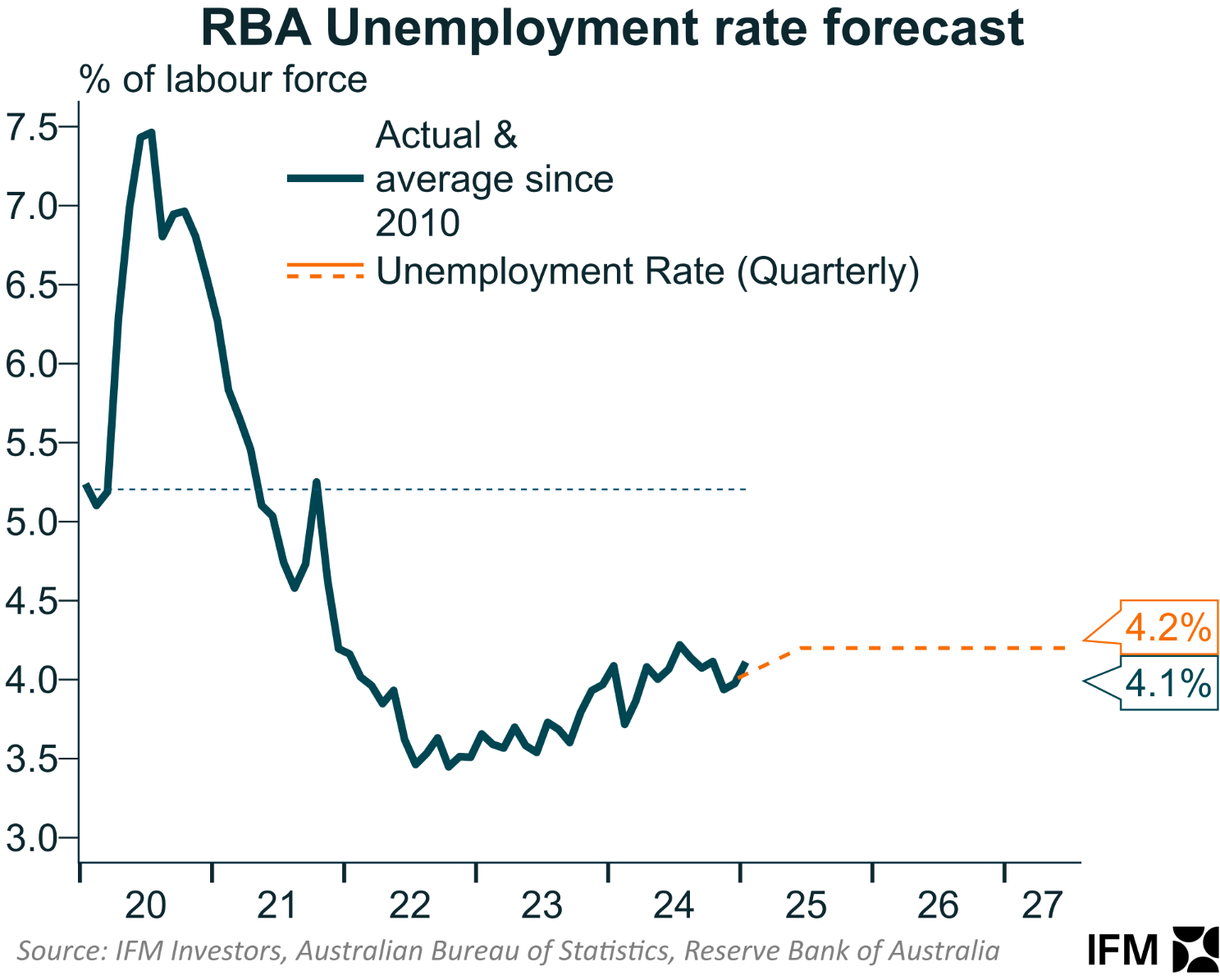

Thursday’s labour market release from the Australian Bureau of Statistics (ABS) was superficially good, with the headline unemployment rate remaining at a low 4.1% in February (4.05% in unrounded terms).

This meant that Australia’s headline unemployment rate remained slightly below the Reserve Bank of Australia’s (RBA) projections.

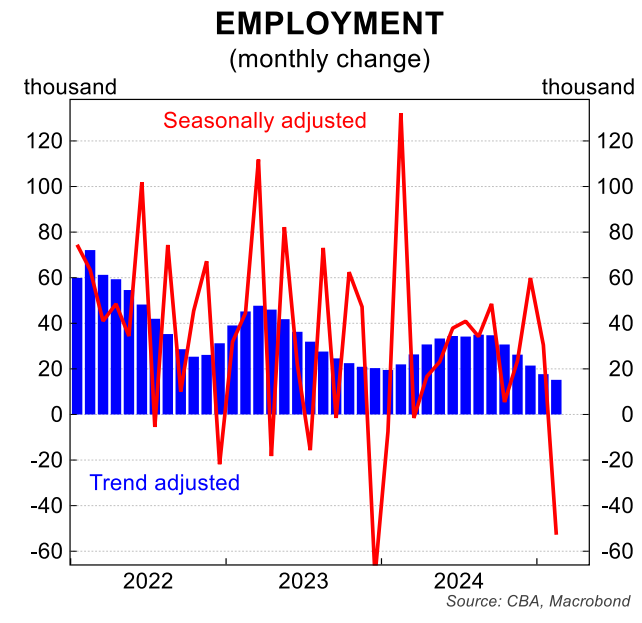

That was where the good news ended, however, with a steep 52,800 (-0.4%) monthly decline in employment, which was much weaker than economists’ expectations.

The ABS commented that “fewer older workers returning to work in February contributed to the fall in employment this month, with lower levels of employment in the older age groups in February 2025 compared with 2024”.

Full-time employment fell by 35,700 in February and part-time jobs declined by 17,000.

The result followed a downwardly revised increase of 30,500 jobs in January (previously reported as +44,000).

The annual rate of employment growth fell to 1.9% in February from 3.2% in January.

The decline in unemployment resulted in a commensurate 0.4% fall in the employment-to-population ratio and the participation rate (hence the stable unemployment reading).

Hours worked also contracted by 0.4% over the month following a smaller 0.2% gain in January.

The combination of falling employment, participation, and hours meant this was a ‘soft’ jobs report.

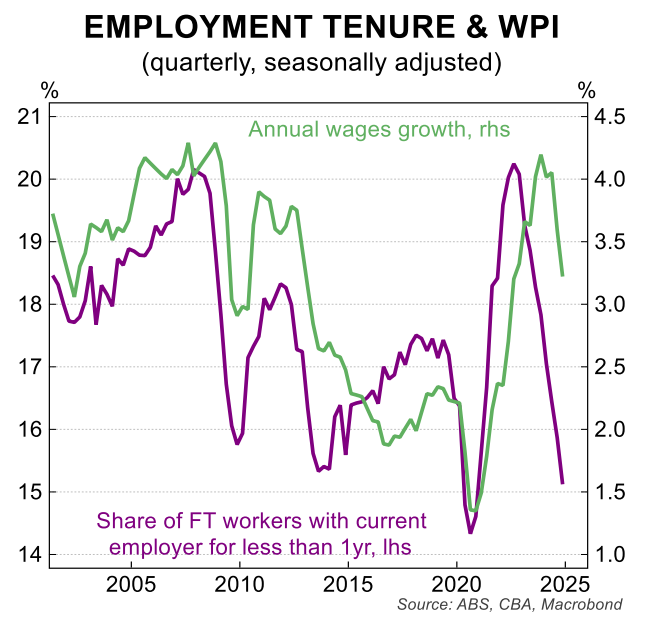

As noted by CBA head of Australian economics, Gareth Aird, “The share of full-time workers with their current employer for less than 1 year has fallen significantly. Historically as this measure moves down then wages growth will follow lower”.

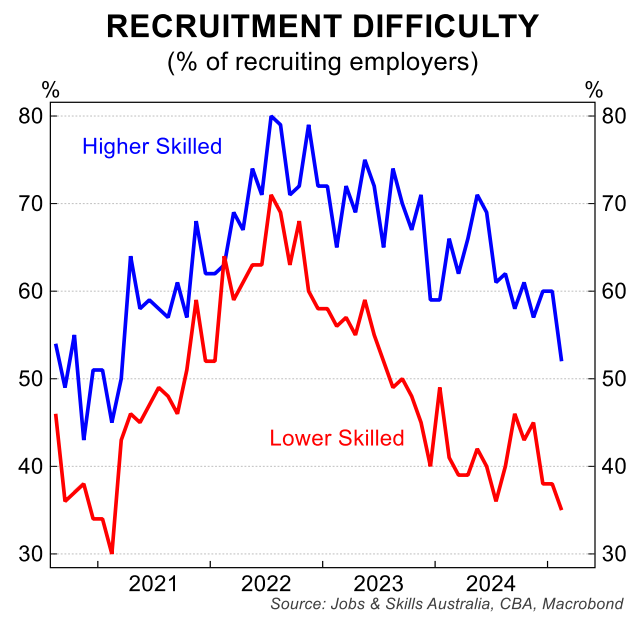

Aird also noted that labour shortages have eased, as evidenced by the fall in job ads and recruitment difficulty.

The decline in these measures “should continue to see wages pressures moderate over 2025, which will assist the RBA’s job in pulling back the underlying rate of inflation to around the mid-point of the target band”, noted Aird.

Despite the weaker-than-expected labour market report, Gareth Aird believes the RBA will keep rates on hold at its upcoming 1 April meeting, with the next 0.25% cut likely at the following meeting in mid-May after the Q1 CPI has been released:

“We don’t think the RBA will be swayed by today’s labour market data at the April Board meeting. That is, we still expect the Board to leave the cash rate on hold and resume normalising the cash rate in May with a 25bp rate decrease”.

“But at the margin it adds a little more weight to the ABS February monthly CPI indicator, due 26 March (see here for Stephen Wu’s preview, published earlier today)”.

“If the inflation data sends a strong signal that the Q1 25 trimmed mean CPI is likely to print comfortably below the RBA’s 0.7%/qtr forecast then the April Board meeting could shift to ‘live’”…

“Our central scenario has the RBA cutting the cash rate by 75bp over the remainder of 2025 for an end year cash rate of 3.35%”.

The Albanese government will be hoping for an April rate cut, which would greatly increase its chances of reelection.