Oh dear. The Australian.

Jim Chalmers will extend energy bill rebates for another six months in Tuesday’s budget, adding an extra $1.8bn to the pre-election spending splurge with an aim of setting up a cost-of-living fight with Peter Dutton.

Despite energy bills being set to increase by up to 9 per cent next financial year, the Albanese government has fallen short of expectations it would extend the $300 rebate for another year when it expires on June 30.

Instead, households and small businesses will receive $150 off their bill from July to December with a 2.5 year run of electricity subsidies to end in January.

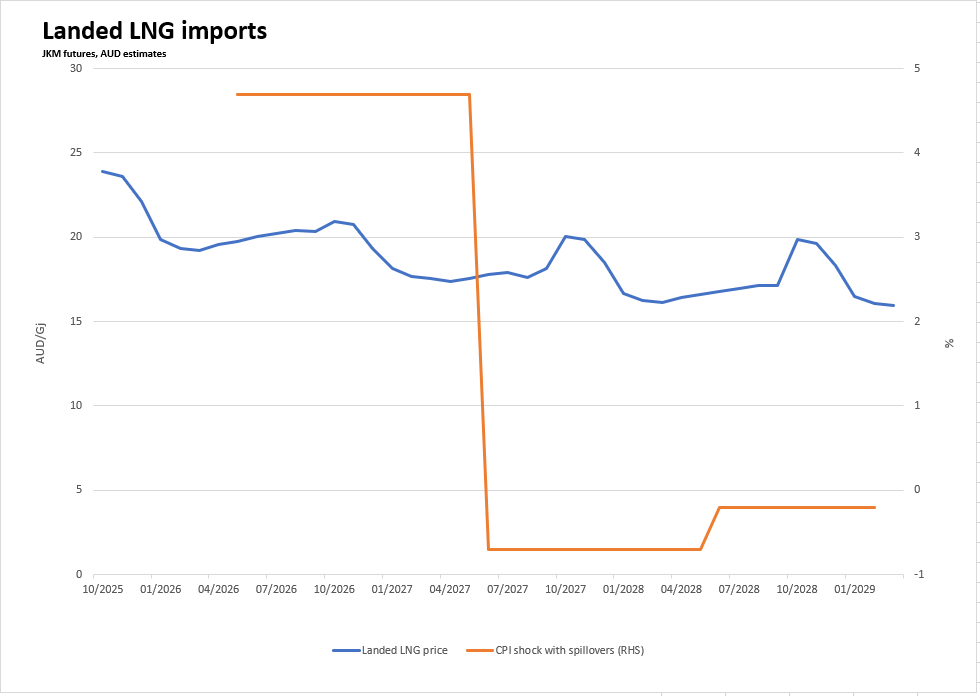

The Gasmageddon of LNG imports starting later this year will trigger local supply cuts by the gas export cartel. The new marginal price setter in the East Coast gas market will be import parity plus a Twiggy margin.

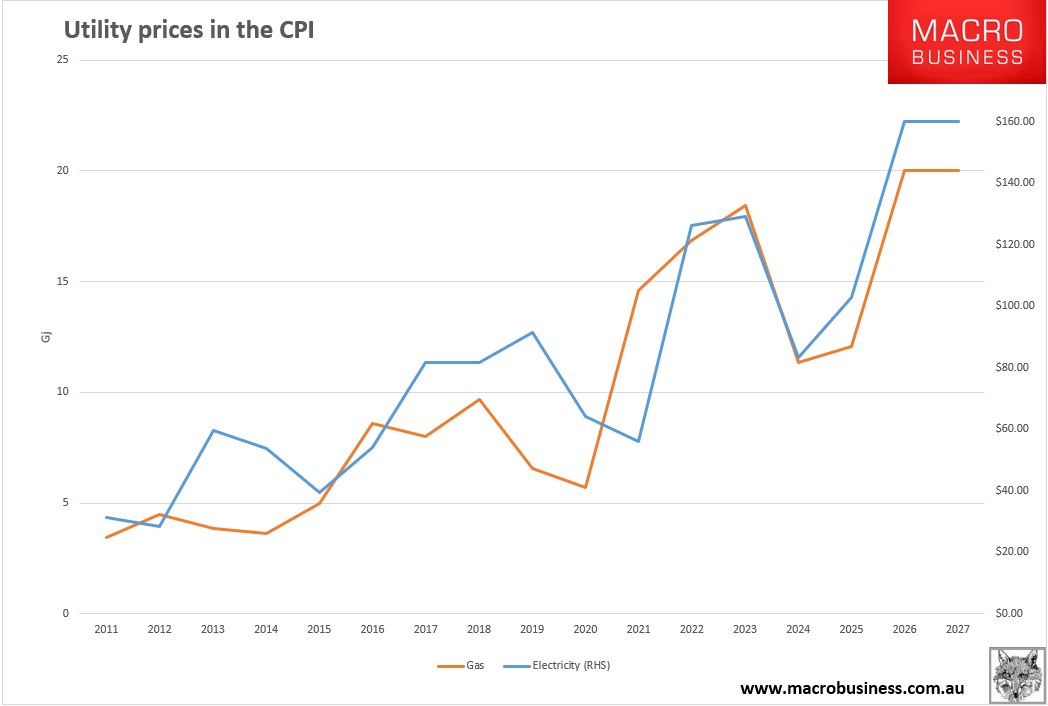

According to current Asian gas futures markets, this will raise gas bills by 70% and electricity bills by 30% in 2026/27. A 4-5% CPI shock if spillovers to business are included.

As rebates also roll off, the CPI shock will be nearly double that as bills skyrocket.

Your only local hope for this to not happen is a Labor/Greens minority government that demands East Coast domestic reservation that dislocates the local price from the global. And/or imposes an export levy.

Even then, with Jim “chicken” Chalmers at the helm, the odds of that do not look good. He appears so terrified of the cartel that he is prepared to slay your living standards on its behalf.

The only international hope of preventing this is El Trumpo delivering peace in Ukraine and restoring Russian gas flows to Europe, cratering the Asia gas price.

Without these, the Gasmageddon will devastate East Coast households in 26/27 as utility bills more or less double overnight while sidelining the RBA amid paralysed fiscal support as bulk commodities crash with iron ore.

This is why the dirt magnates have all expanded into East Coast gas—Forrest (Squadron), Rinehart (Senex), Stokes (Beach)—it is a hedge against the coming crash in their primary earner.

If the AUD falls in response to the household, if not headline, recession, the price of gas will keep going up, and the RBA may be forced to chase it higher and house prices break down in what can only be described as an emerging market external debt crisis.

You’re about to discover the true cost of your cheap gas being stolen by extractive industries and their mates in China (and Japan).