There is no limit to the insanity the federal government will go to to pump the property ponzi.

Last week, the Albanese government announced that it will offer $3,000 interest-free loans to households to help them buy essentials.

Over the weekend, Prime Minister Anthony Albanese announced that Labor would expand ‘Help to Buy’ to encourage more people into the property Ponzi via government equity by expanding the income and price caps on the properties they can purchase.

Under the Help to Buy shared equity scheme, the federal government provides first home buyers with 30% of the purchase price of an existing home, or 40% for a new home.

The first home buyer needs to contribute at least a 2% deposit, with the scheme capped at 10,000 places a year, with a total of 40,000 places over four years.

Under the changes, income caps will be lifted as follows:

- $100,000 for individuals

- $160,000 for couples and single parents.

Property price caps will also be increased and aligned with average house prices by state and territory.

The federal government will also pump $800 million in additional equity investment.

Housing minister Clare O’Neil spruiked that “Help to Buy makes it easier to get into a home of your own. These changes mean over 5 million properties will now fall under the new price caps—giving first home buyers more choice in a tough market”.

“This is about backing the workers who keep our communities running—aged care workers, childcare workers, retail staff, nurses, and early educators”, she said.

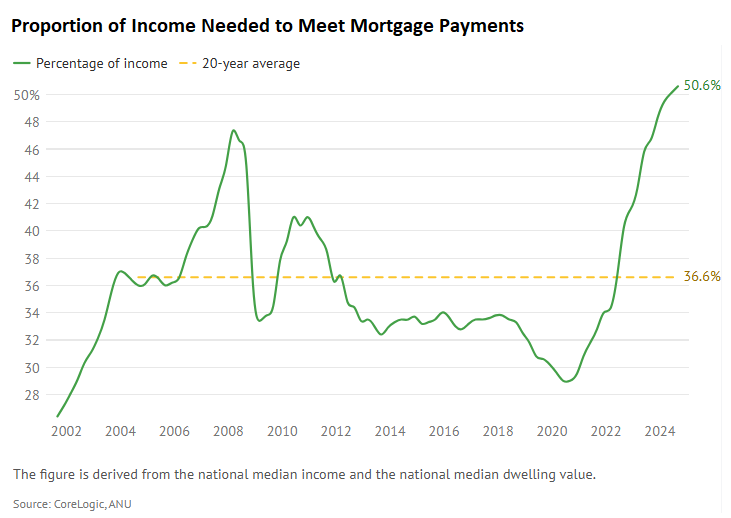

In reality, Help to Buy is about papering over the collapse in Australian housing affordability and supporting the bubble.

The end result of Help to Buy will be to increase housing demand and push up prices. It will be self-defeating in terms of affordability.

AMP’s chief economist, Shane Oliver, previously described shared equity programs as a “band-aid solution” at best and detrimental at worst:

“To the extent that it brings forward demand, there’s a risk this worsens the problem and benefits those already in the property market through higher prices”, Oliver warned.

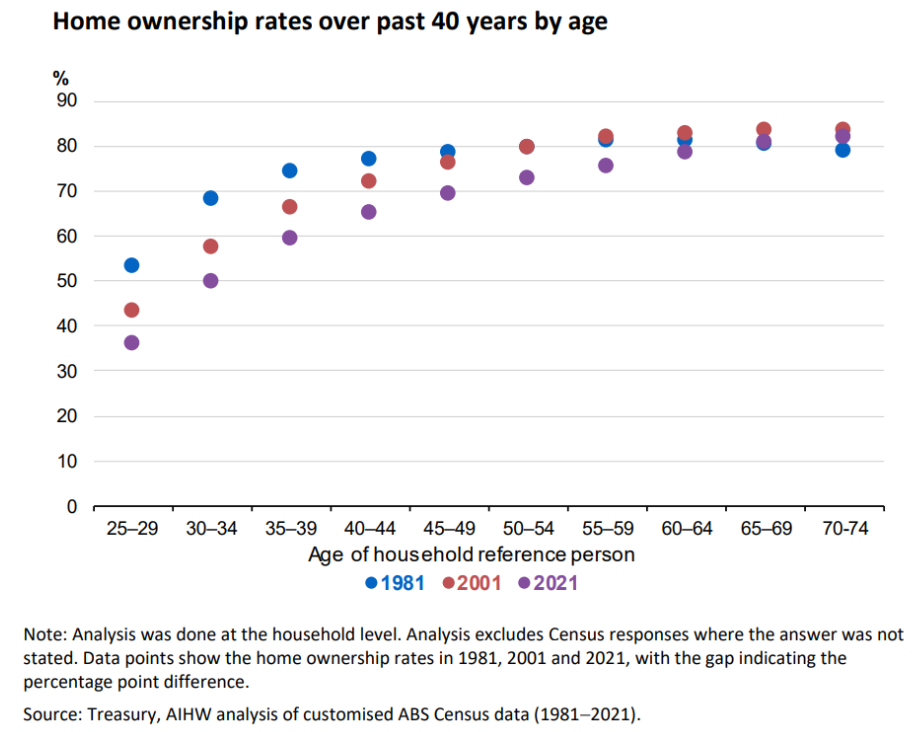

Ultimately, first home buyers are being excluded from the housing market because prices are too high in relation to salaries.

The number one solution is to reduce immigration, which is particularly harmful to first-time home buyers for two reasons.

- Excessive immigration raises the cost of renting, making it difficult for prospective first home buyers to save a deposit.

- Excessive immigration raises property prices, pushing homeownership further out of reach.

The federal government should also limit investment property concessions, particularly as part of a broader tax reform that moves the burden away from workers via income taxes and towards other kinds of taxation (such as resources, consumption, and wealth).

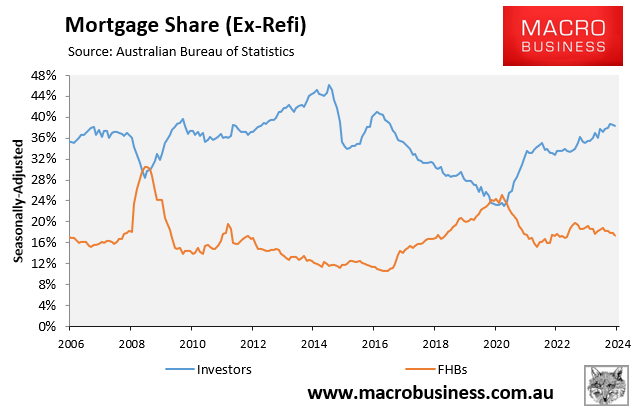

The Australian Bureau of Statistics housing financing data clearly shows that investors are outbidding and crowding out first home buyers.

As a result, reducing investor demand by providing less favourable tax settings would increase first home buyer demand and the national home ownership rate.

Unfortunately, the Albanese government is not interested in “solving” the housing situation.

Labor, like the Coalition, pretends to care by offering phony solutions while steadily inflating home prices through stimulatory demand-side policies like Help to Buy.