Asian share markets are seeing generally positive results across the board but have been overshadowed by the spike in cryptocurrencies on the latest Trump spewing of verbal diarrhea that continues to evaporate confidence in the USD. Indeed King Dollar is falling against most of the majors with the Australian dollar coming back with a reprieve back above the 62 cent level after recently making a new monthly low.

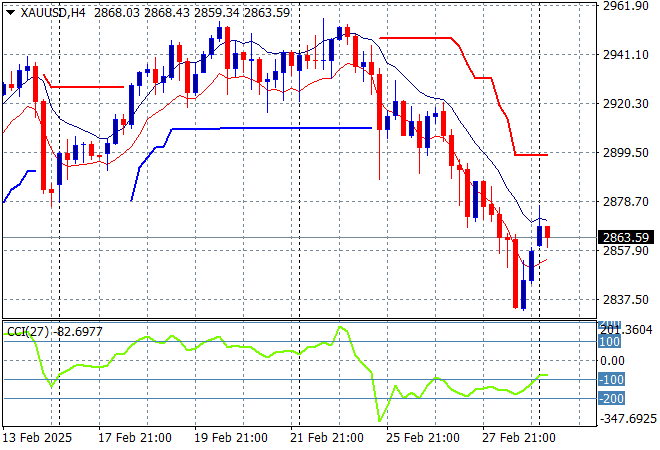

Oil markets are failing to recover with Brent crude still below the $73USD per barrel level while gold has bounced back over the weekend gap but remains well below the $2900USD per ounce level with momentum remaining still negative in the short term:

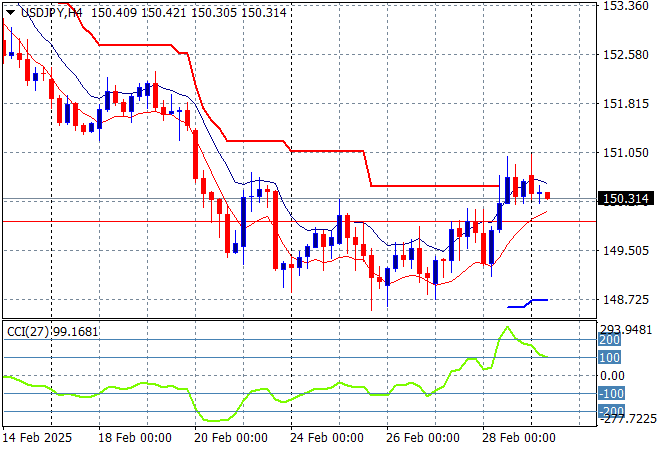

Mainland Chinese share markets have moved a little lower in afternoon trade with the Shanghai Composite down just 0.2% while the Hang Seng Index has bounced back some 0.5% to just get back above the 23000 point level. Japanese stock markets are rebounding fast with the Nikkei 225 up nearly 1.6% to close at 37745 points while the USDPY pair is steady at just above the 150 handle but momentum is normalising here:

Australian stocks had a good run tooo with the ASX200 closing nearly 1% higher at 8245 points while the Australian dollar has continued to go lower after almost breaking down on Friday night as it now drifts down to the 62 level with support evaporating there:

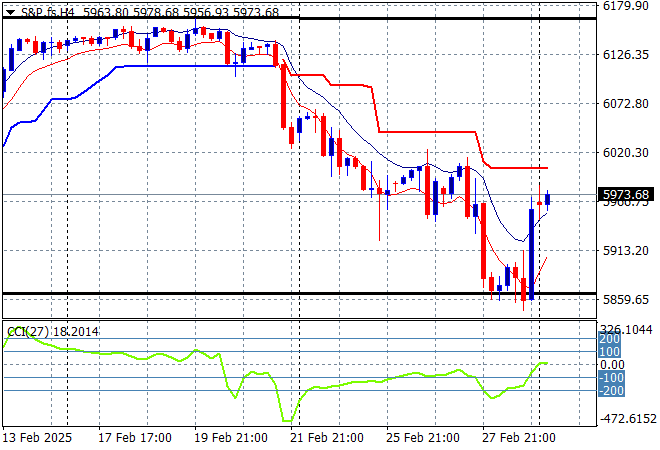

S&P and Eurostoxx futures are heading lower as we head into the London session with the S&P500 four hourly chart showing this breakdown now slowly down below the 5900 point level as the possibility of a bounce increases:

The economic calendar starts the trading week with the latest US ISM production survey numbers.