Asian share markets are reeling again as King Trump goes full swagger with his tariff threats, shooting the US consumer in both feet with confirmed tariffs on Canada, Mexico and China. The retaliations have been swift, so we’re off to a trade war! This has seen confidence evaporate in the USD just as we ramp up for this week’s non-farm payroll print and quite a few other key economic releases. The Australian dollar however is feeling the threat of lower iron ore prices with a failure to extend further above the 62 cent level after recently making a new monthly low.

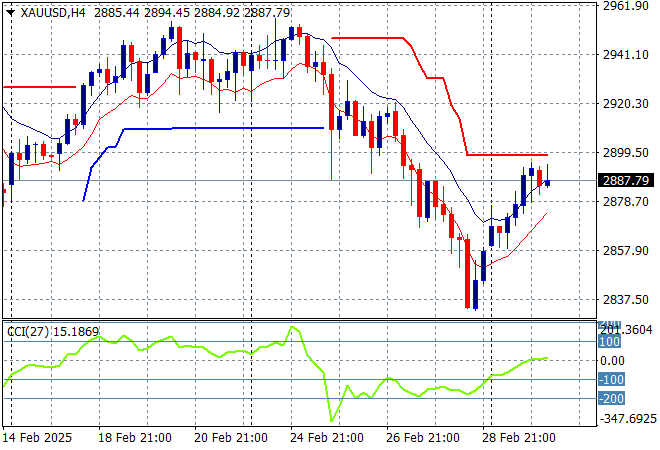

Oil markets are failing to recover with Brent crude now dropping below the $71USD per barrel level while gold has bounced back over the weekend but remains just below the $2900USD per ounce level with momentum getting back to neutral settings in the short term:

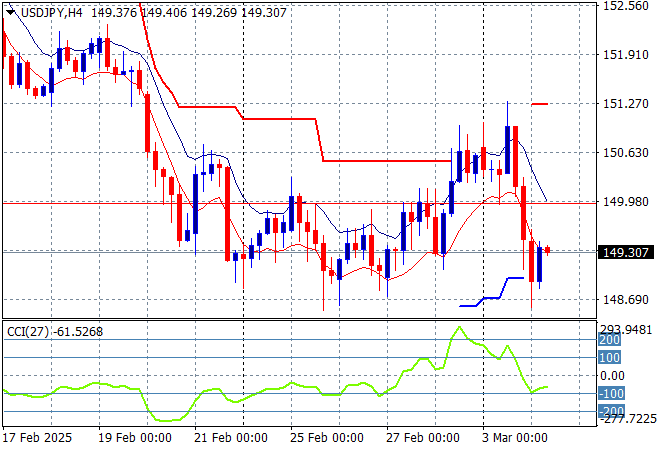

Mainland Chinese share markets have moved a little higher in afternoon trade with the Shanghai Composite up around 0.2% while the Hang Seng Index has steadied around the 23000 point level. Japanese stock markets however are giving up their recent gains with the Nikkei 225 down nearly 1.3% to close at 37306 points while the USDPY pair is retracing yet again to return to the low 149 level as USD craters:

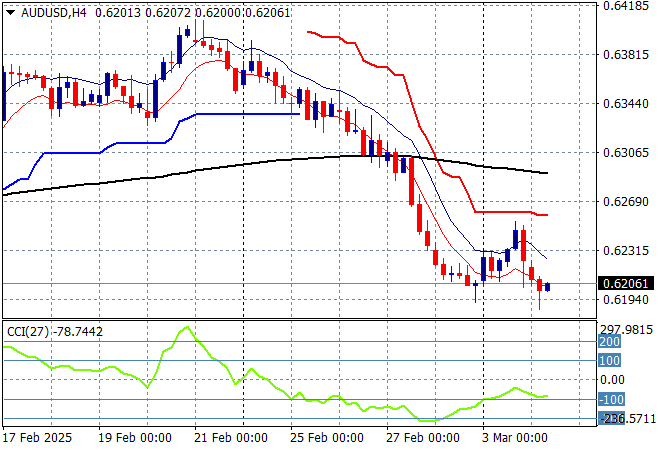

Australian stocks had a small selloff with the ASX200 closing nearly 0.6% lower at 8198 points while the Australian dollar has continued to go lower after almost breaking down on Friday night as it now drifts back to the 62 level with support evaporating there:

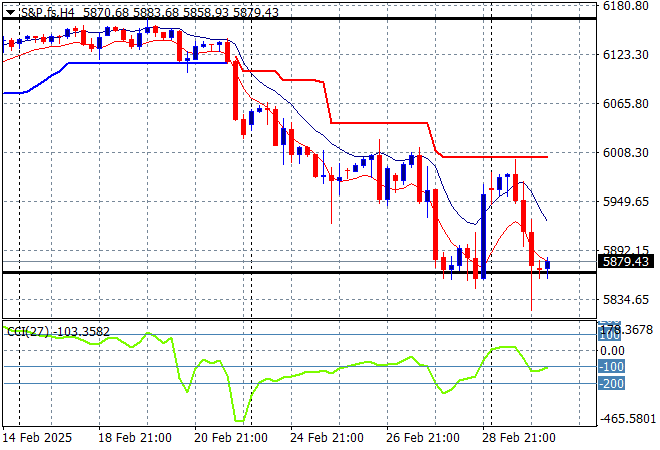

S&P and Eurostoxx futures are heading lower as we head into the London session with the S&P500 four hourly chart showing this breakdown ready to go below the 5900 point level as the possibility of a bounce evaporates amid Trump’s Terrible Tariffs:

The economic calendar continues what could be an epic week with a few quiet releases tonight before ramping up.