Asian share markets are somewhat mixed again as Diaper Don swings away again with tariff threats and retreats as this engineered recession and market correction gathers pace, this time hitting Australia with steel and aluminium tariffs – for no reason whatsoever. The USD is trying to fight back but is seeing continued weakness against Euro and Pound Sterling with a mild bounceback in Yen this afternoon, with the Australian dollar trying to get back above the 63 cent level after recently making a new monthly low.

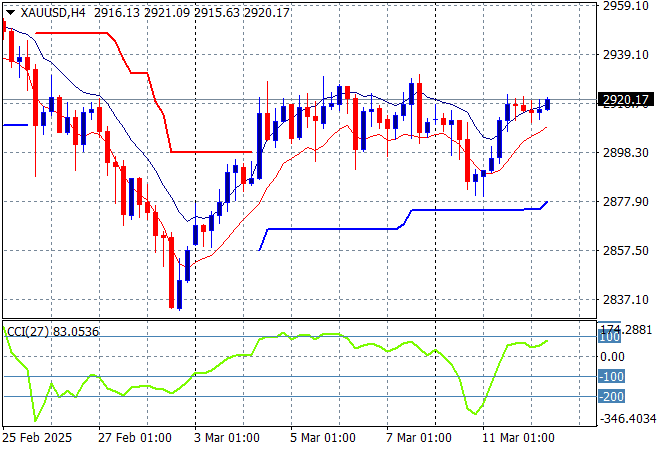

Oil markets are failing to recover with Brent crude now dropping below the $70USD per barrel level while gold has bounced back to be above the $2900USD per ounce level with momentum getting back to positive settings in the short term:

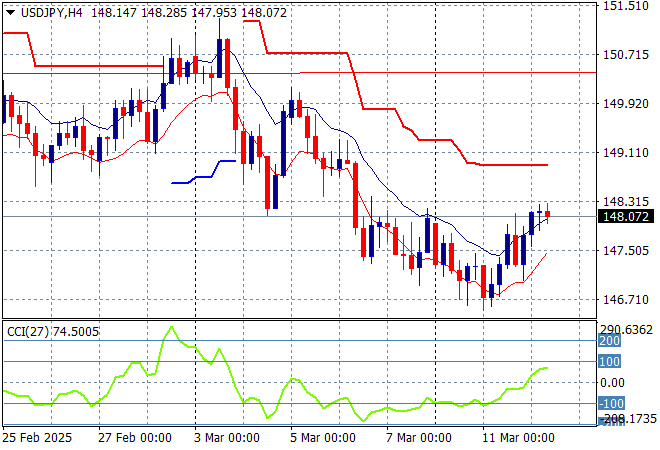

Mainland Chinese share markets have moved a little higher in afternoon trade with the Shanghai Composite up around 0.2% while the Hang Seng Index has pulled back slightly to the 23700 point level. Japanese stock markets however are on the rise again as Yen weakens with the Nikkei 225 up nearly 0.4% to close at 36919 points while the USDPY pair is pushing above the 148 level:

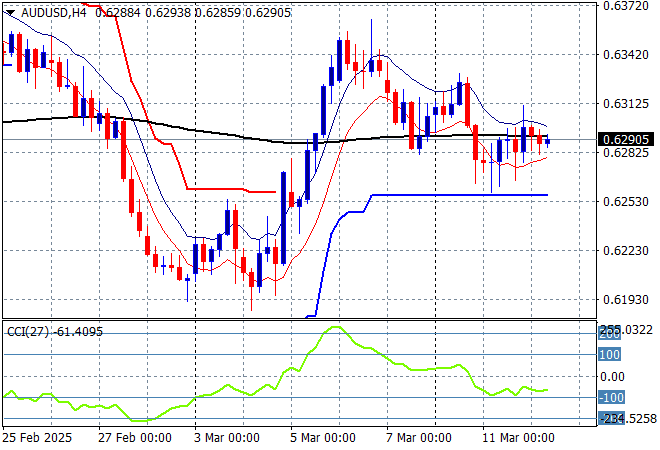

Australian stocks had the biggest selloff with the ASX200 closing nearly 1.4% lower at 7786 points while the Australian dollar has held on but is still just below the 63 cent level as it respects support just below:

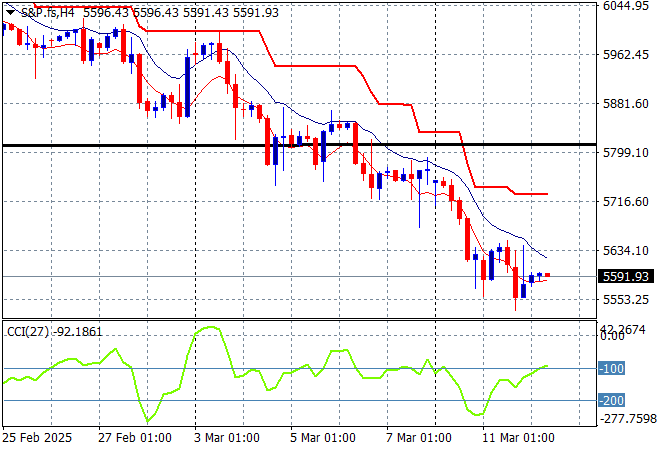

S&P and Eurostoxx futures are trying to stabilise but seem to be heading lower as we head into the London session with the S&P500 four hourly chart showing this breakdown ready to go below the 5500 point level as the correction continues:

The economic calendar includes the latest US CPI core inflation print plus the Bank of 51st State meeting.