It’s green across the board here in Asia after the weekend gap with the short covering exercise on Wall Street extending across the regions share markets. The USD is failing to fight back as it remains weak against Euro and Pound Sterling although is holding against Yen this afternoon, as traders await this week’s FOMC meeting. Meanwhile the Australian dollar is trying hard to stay back above the 63 cent level after recently making a new monthly low.

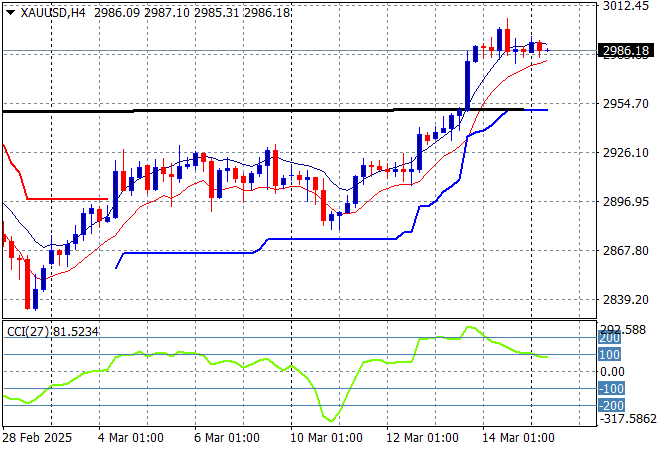

Oil markets are also trying to recover with Brent crude staying just above the $70USD per barrel level while gold is stalling in its quest to get above the $3000USD per ounce level with momentum getting reverting from its overbought settings in the short term:

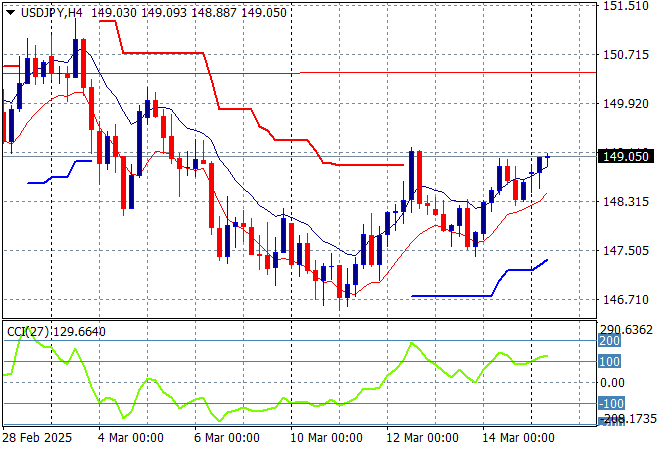

Mainland Chinese share markets are only slightly higher in afternoon trade with the Shanghai Composite up nearly 0.2% while the Hang Seng Index has pulled more than 1% higher. Japanese stock markets are also on the rise again with the Nikkei 225 up nearly 1.2% to close at 37479 points while the USDPY pair has rebounded back above the 149 level:

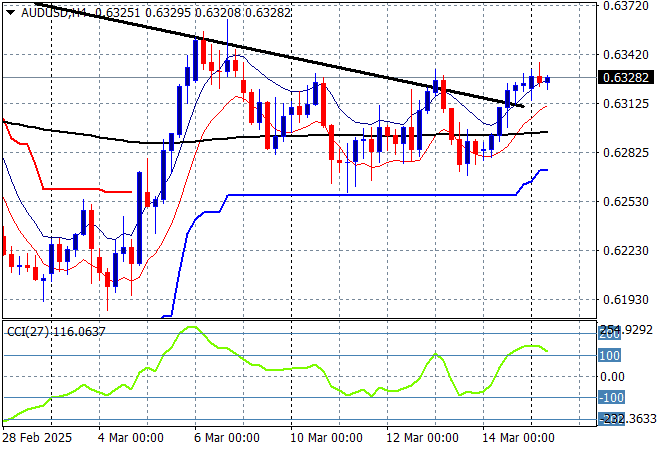

Australian stocks finally stopped selling off with the ASX200 closing nearly 0.9% higher at 7854 points while the Australian dollar has held on but is still hitting resistance slightly above the 63 cent level while it respects support just below:

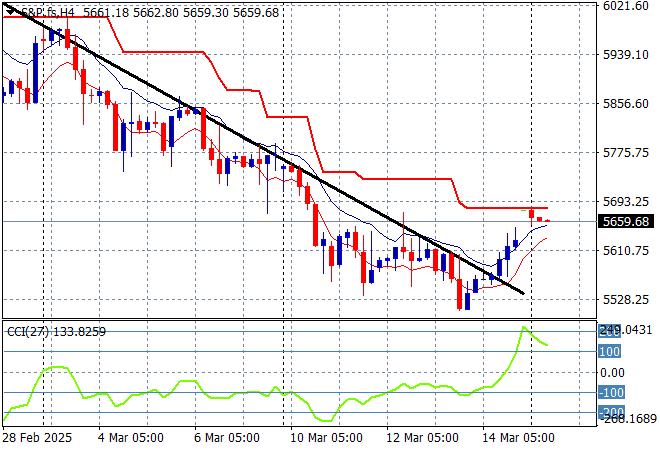

S&P and Eurostoxx futures are gapping higher over the weekend as we head into the London session with the S&P500 four hourly chart showing this breakdown could be reversed properly in the next session although resistance looms overhead:

The economic calendar starts the trading week with the latest US retail sales and a speech by ECB President Lagarde.

MB Radio: Europe, Eurasia and the Post Russia – Ukraine war economic landscape

A chat about the economic outcomes from the War in Ukraine with Ben Aris