Another positive day for stock markets here in Asia as risk switches back to on following the big rebound on Wall Street from Friday night although local stocks struggled to make headway. The USD is trying to fight back as it remains weak against Euro and Pound Sterling although is pushing higher against Yen this afternoon, as traders await this week’s FOMC meeting. Meanwhile the Australian dollar is trying hard to stay back above the 63 cent level after recently making a new monthly low.

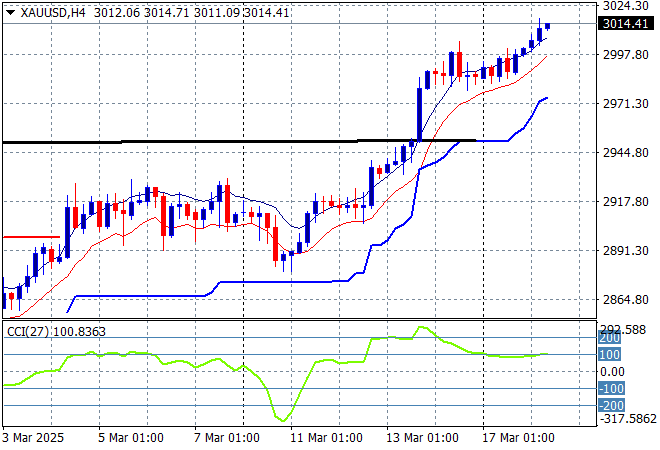

Oil markets are also trying to recover with Brent crude building some short term momentum above the $70USD per barrel level while gold is pushing further higher above the $3000USD per ounce level with momentum looking very good in the short term:

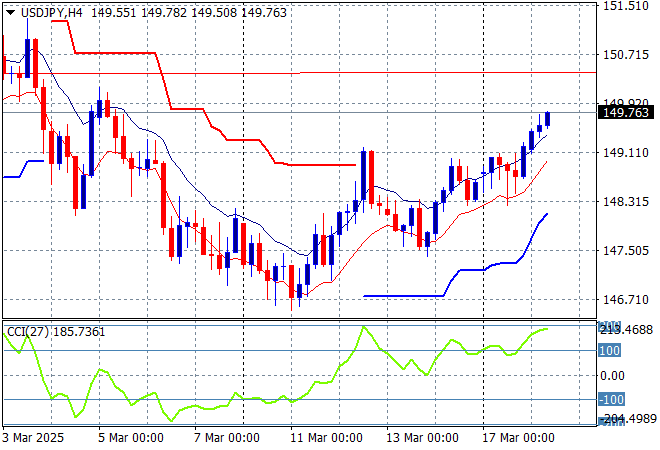

Mainland Chinese share markets are only slightly higher in afternoon trade with the Shanghai Composite up just 0.1% while the Hang Seng Index has pushed nearly 2% higher as traders continue to react to the potential for more stimulus measures. Japanese stock markets are also on the rise again with the Nikkei 225 up nearly 1.2% to close at 37871 points while the USDPY pair has rebounded well above the 149 level:

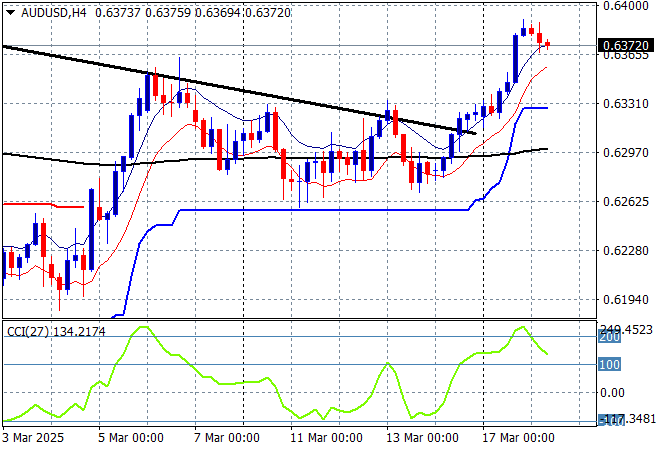

Australian stocks are treading water with the ASX200 closing barely 0.1% higher at 7860 points while the Australian dollar has held on but is still hitting resistance slightly above the mid 63 cent level while it respects support just below:

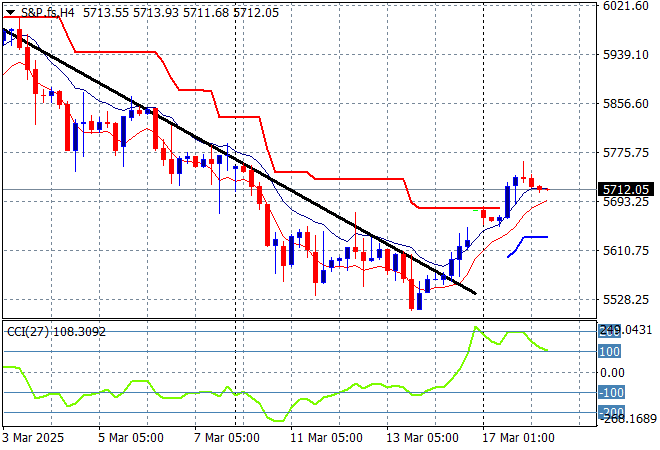

S&P and Eurostoxx futures are consolidating after their post weekend moves higher as we head into the London session with the S&P500 four hourly chart showing this breakdown could be reversed properly in the next session although resistance looms overhead:

The economic calendar includes the closely watched German ZEW survey then Canadian inflation and US industrial production numbers.

Tax breaks benefit top 10 per cent while stoking housing crisis, report finds

Two tax breaks are “disproportionately” benefiting Australia’s richest while simultaneously fuelling the housing affordability crisis, a new report by the Australian Council of Social Service (ACOSS) has found.

The report criticises the capital gains tax deduction for property, where only 50 per cent of capital gains made from an asset are taxed when it is sold, and negative gearing, which allows investment expenses to be deducted from income.

According to ACOSS’s findings, the richest 10 per cent of households own two-thirds of all investment properties and are receiving 82 per cent of the $16 billion in tax relief the two breaks provide.

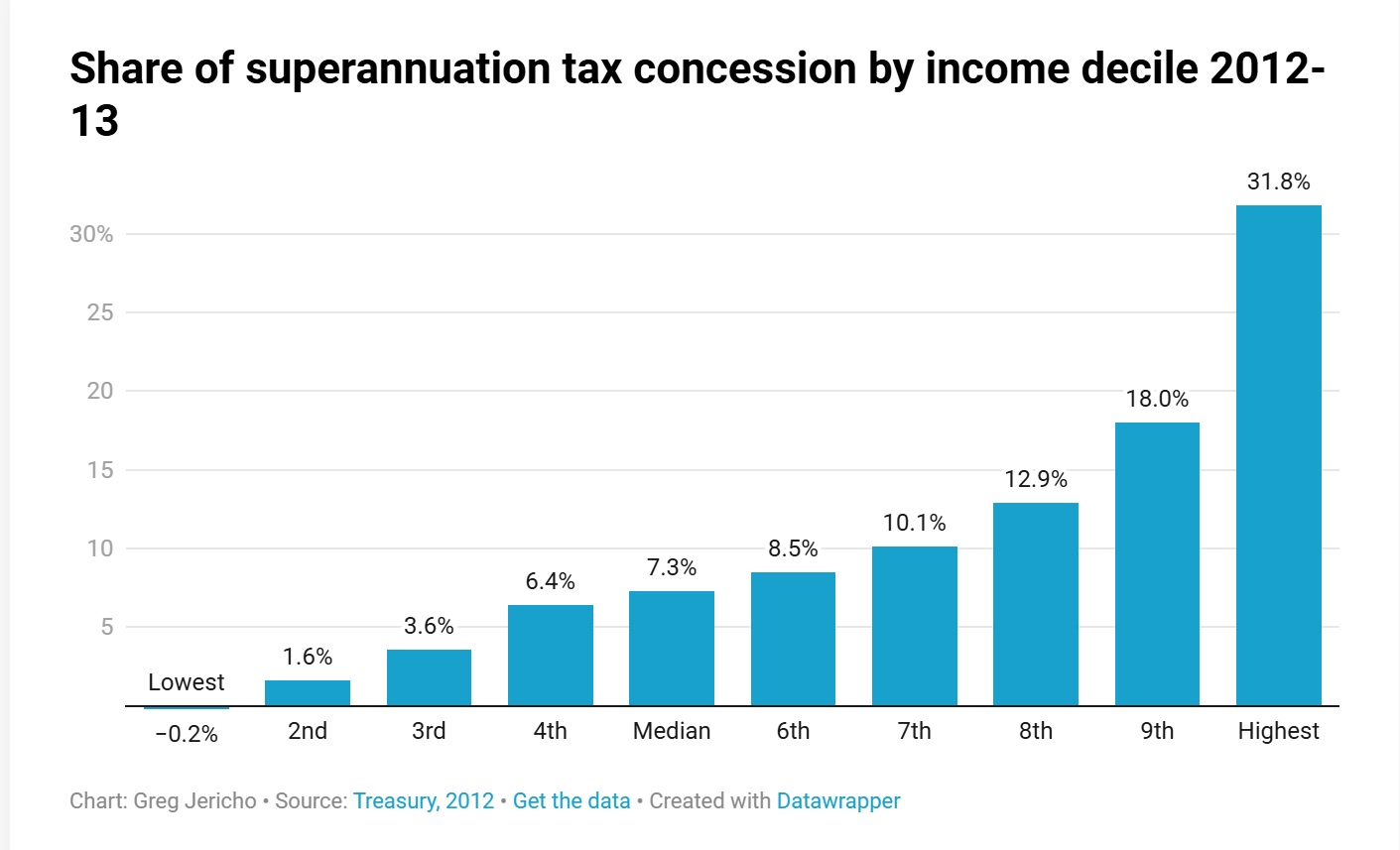

The annual taxation data shows that while those with a total income above $150,000 account for 7% of all individuals and 27% of all income, they make up 32% of all personal superannuation contributions:

So large have these concessions become to the wealthy that in 2020 the Treasury estimated that “higher-income earners receive more lifetime Government support in dollar terms than lower- and middle-income earners”.

That means people on high incomes get more from the government through tax concessions than low-middle income people via the aged pension.