Uncertainty has returned for stock markets here in Asia in response to the stumbles on Wall Street overnight with local stocks ending up lower. The USD is trying to fight back as it remains weak against Euro and Pound Sterling although the BOJ hold today helped it keep Yen lower this afternoon, as traders await tonight’s FOMC meeting. Meanwhile the Australian dollar is trying hard to stay back above the 63 cent level after recently making a new monthly low.

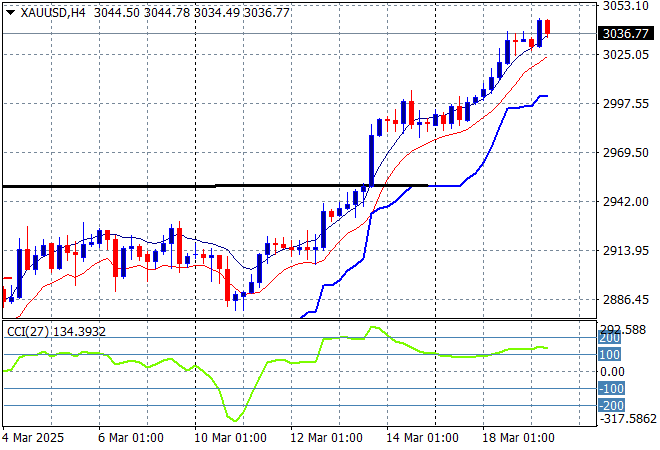

Oil markets are failing to recover with Brent crude losing ground below the $70USD per barrel level while gold is pushing further higher above the $3000USD per ounce level with momentum looking very good in the short term:

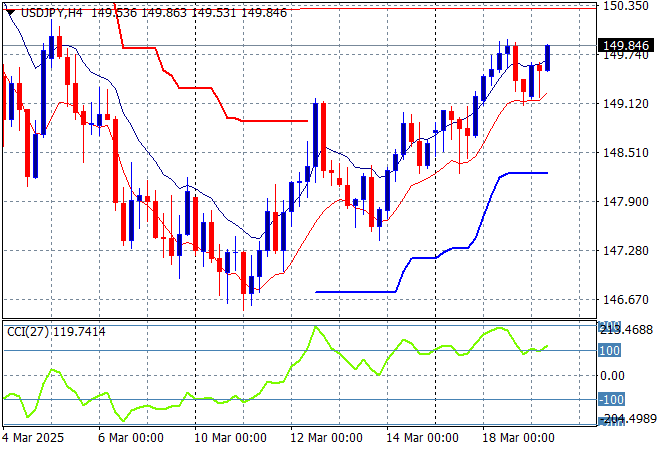

Mainland Chinese share markets are slightly lower in afternoon trade with the Shanghai Composite down more than 0.2% while the Hang Seng Index has put in a scratch session on buying exhaustion, currently at 24727 points. Japanese stock markets also saw little action as they absorb the BOJ meeting with the Nikkei 225 steady at 37851 points while the USDPY pair has rebounded well above the 149 level:

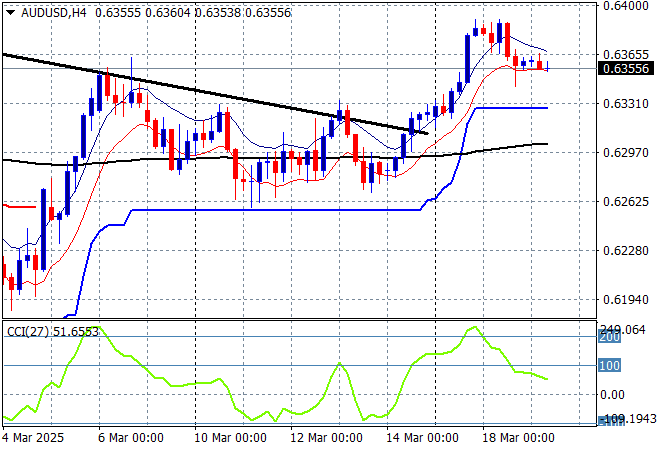

Australian stocks were the worst in the region with the ASX200 closing 0.4% lower at 7828 points while the Australian dollar has held on but only just as it continues to hit resistance slightly above the mid 63 cent level while it respects support just below:

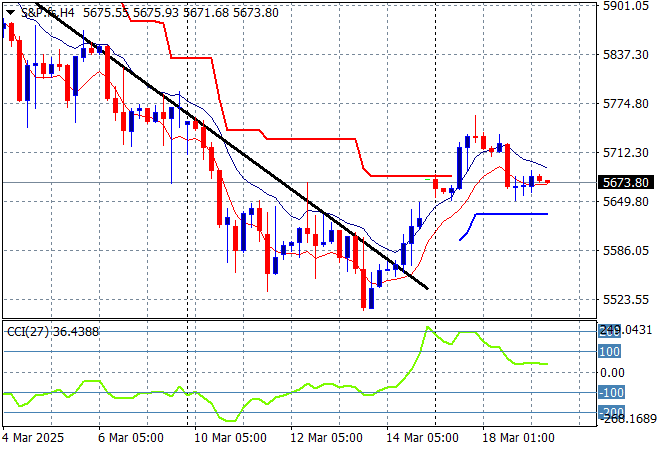

S&P and Eurostoxx futures are consolidating with the former steadying somewhat after last night’s selloff as we head into the London session with the S&P500 four hourly chart showing this breakdown may not yet be over as this turns into a dead cat bounce:

The economic calendar is relatively quiet in the European session before the FOMC meeting later on tonight/this morning.