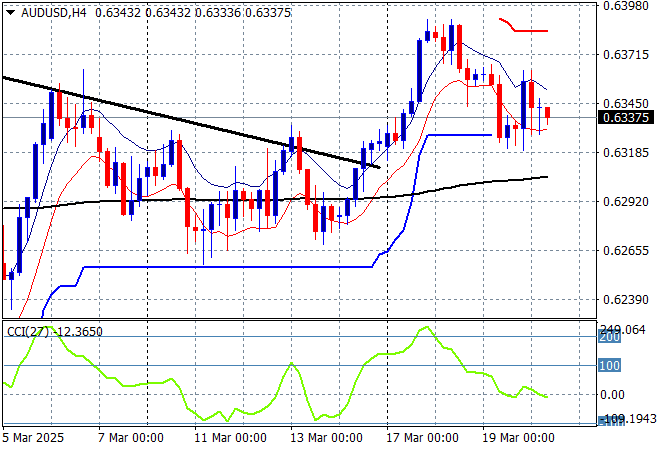

A very mixed session across Asian stock markets despite a rebound on Wall Street overnight with steady Chinese interest rates not lifting stocks in the Middle Kingdom as expected while local stocks ending up higher on the latest unemployment numberwang print. The USD is trying to fight back as it remains weak against Euro and Pound Sterling although following last night’s FOMC meeting there is some strength building. Meanwhile the Australian dollar is trying hard to stay back above the 63 cent level after recently making a new monthly low.

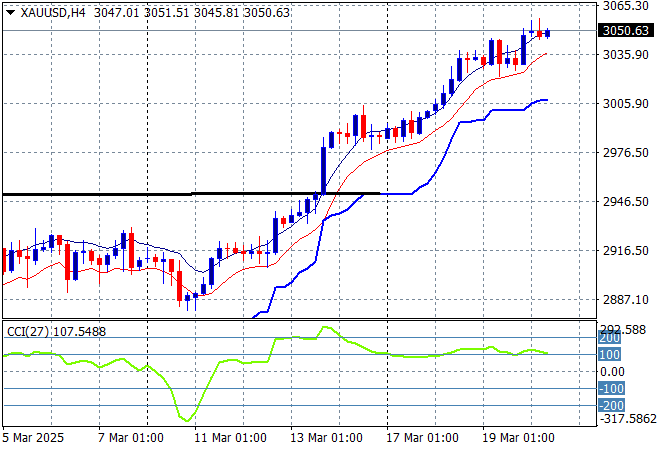

Oil markets are failing to recover with Brent crude losing ground slightly above the $70USD per barrel level while gold is pushing further higher above the $3000USD per ounce level with momentum looking very good in the short term:

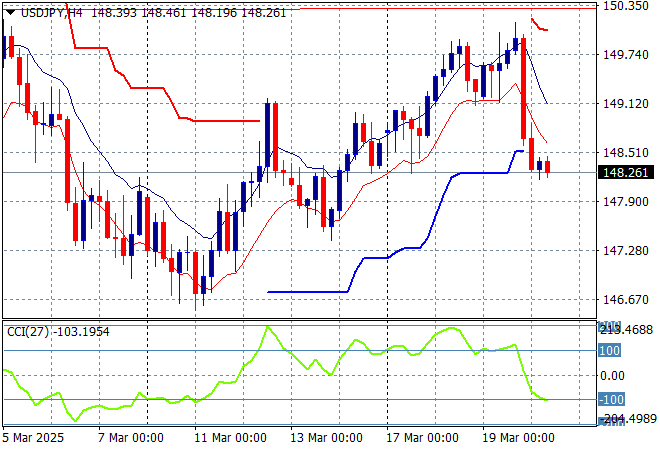

Mainland Chinese share markets are moving lower in afternoon trade with the Shanghai Composite down more than 0.4% while the Hang Seng Index has lost a lot of ground, down 1.6% so far at 24360 points. Japanese stock markets also saw little action as they absorb the BOJ meeting with the Nikkei 225 steady at 37851 points while the USDPY pair is now dicing with the 148 level after yesterday’s BOJ meeting:

Australian stocks were the best in the region with the ASX200 closing 1% higher at 7918 points on the unemployment print while the Australian dollar has held on but only just as it continues to hit resistance slightly above the mid 63 cent level while it respects support just below:

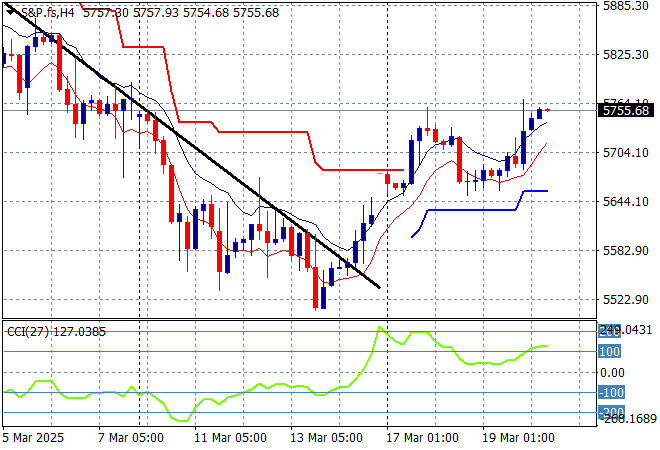

S&P and Eurostoxx futures are moving slightly higher as we head into the London session with the S&P500 four hourly chart showing this breakdown may be getting a proper reversal:

The economic calendar includes UK unemployment followed by the latest BOE meeting.