Another very mixed session across Asian stock markets reflecting the growing unease over the weekend as the April 2 “tariff letter” deadline starts to come into focus. While Wall Street managed a positive return on Friday night it was marginal at best with Chinese markets now pulling back while local stocks also treaded water. The USD is making a comeback against the major currency pairs following last week’s BOE and FOMC meeting while the Australian dollar is failing to get back above the 63 cent level after recently making a new monthly low.

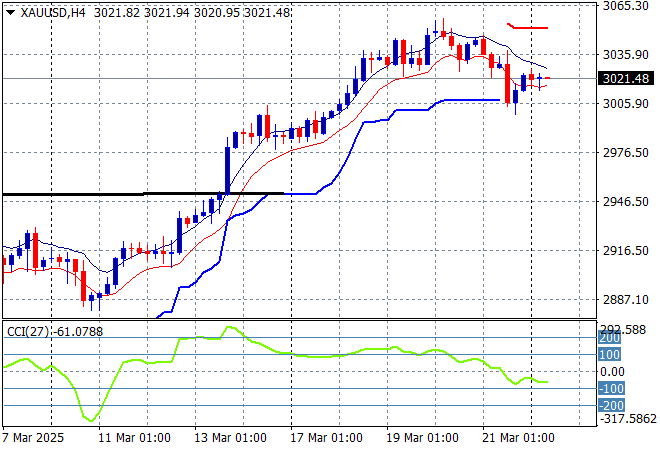

Oil markets are failing to recover with Brent crude losing ground slightly above the $71USD per barrel level while gold is consolidating just above the $3000USD per ounce level with short term momentum still in a negative funk:

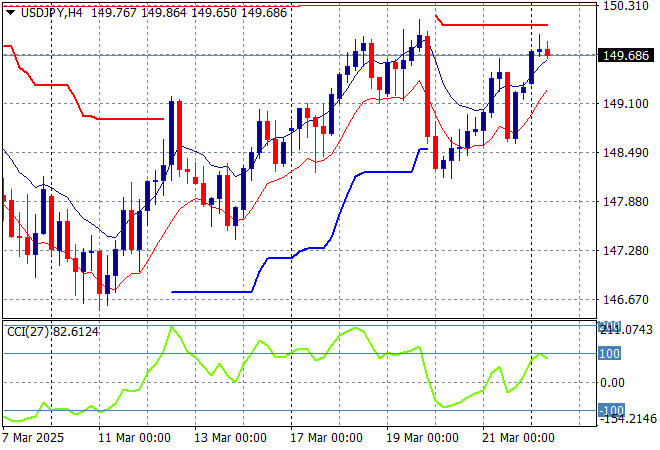

Mainland Chinese share markets are falling again in afternoon trade with the Shanghai Composite down more than 0.7% while the Hang Seng Index has slipped just 0.2%, currently at 23647 points. Japanese stock markets also saw little action with the Nikkei 225 steady at 37686 points while the USDPY pair is trying to get back to last week’s highs just below the 150 level:

Australian stocks were barely able to make headway in the first session of the trading week with the ASX200 closing just a few points higher at 7936 points while the Australian dollar is kept in its place just below the 63 cent level against the USD:

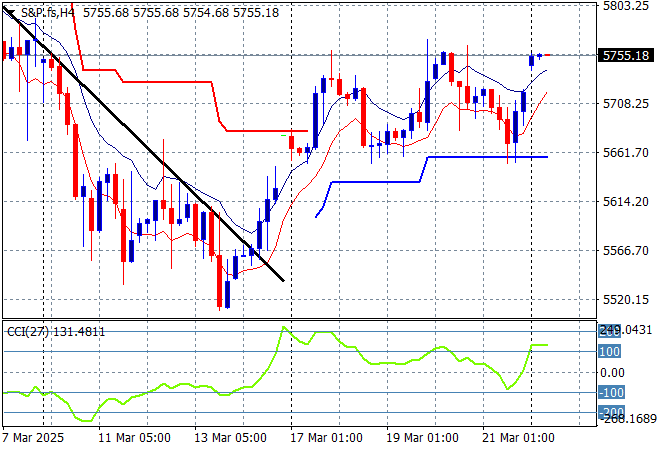

S&P and Eurostoxx futures are gapping higher as we head into the London session with the S&P500 four hourly chart showing this breakdown may be getting a proper reversal above the 5750 point level:

The economic calendar starts the week with a slew of services and manufacturing PMI prints on both sides of the Atlantic.