Noise around the latest tariff tirade from Trump, this time on cars from – well everywhere – has not really affected Asian stock markets that much relatively speaking as regional concerns outweigh the dummy spitting from the White House. The USD is lifting slightly against the major currency pairs, particularly Euro while the Australian dollar pushes slightly above the 63 cent level after the most recent monthly CPI print.

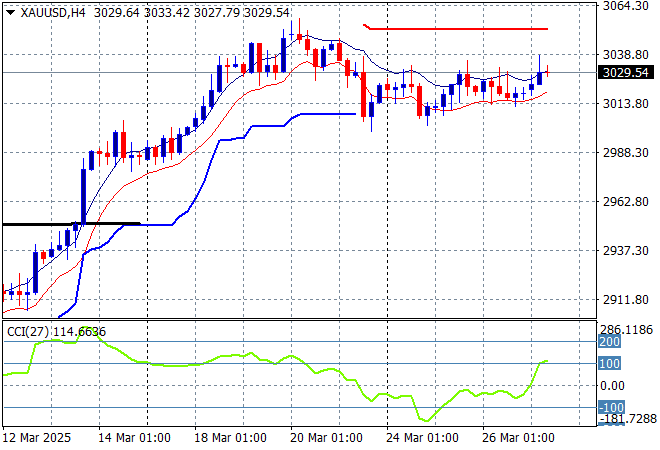

Oil markets are building upside momentum with Brent crude heading above the $73USD per barrel level while gold continues to consolidate just above the $3000USD per ounce level with short term momentum trying to get out of its negative funk:

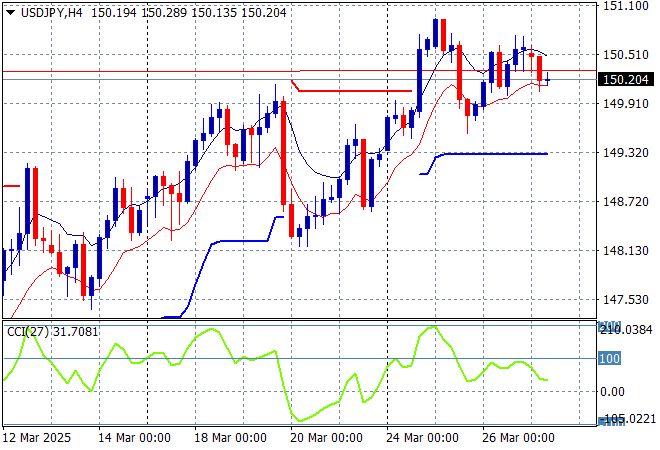

Mainland Chinese share markets are lifting slightly in afternoon trade with the Shanghai Composite up 0.3% while the Hang Seng Index is moving in similar fashion, up 0.6% to 23637 points. Japanese stock markets however have reversed their recent gains with the Nikkei 225 about to close 1% lower at 37640 points while the USDPY pair is trying to hold above last week’s highs at the 150 level:

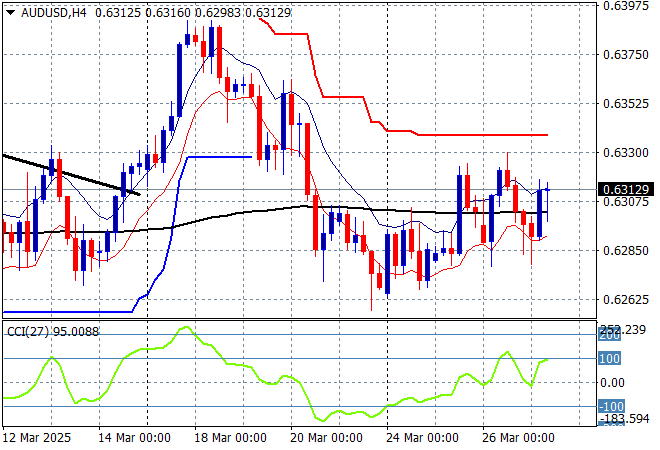

Australian stocks are failing to make headway with the ASX200 closing more than 0.4% lower to stay well below the 8000 point level while the Australian dollar has maintained its position despite yesterday’s weaker than expected monthly CPI print as it hovers around the 63 cent level against the USD:

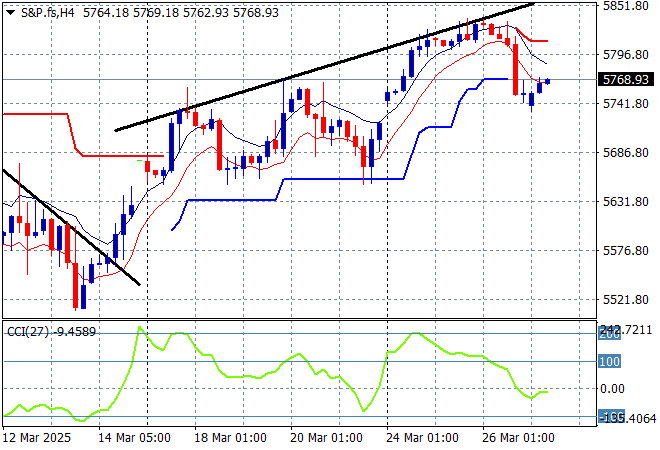

S&P and Eurostoxx futures are moving slightly higher as we head into the London session trying to recover the overnight losses with the S&P500 four hourly chart showing a return to the 5750 point level following the post Trump election breakdown:

The economic calendar continues tonight with the latest US initial jobless claims print, some final Q4 numbers and some ECB speeches to watch out for.