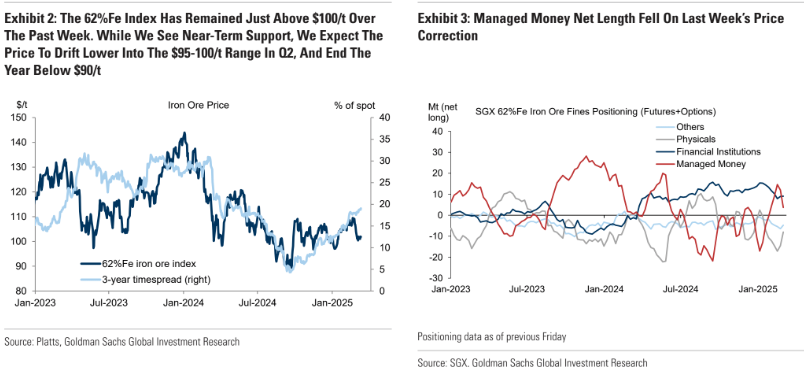

Sense never lasts long in the iron ore market.

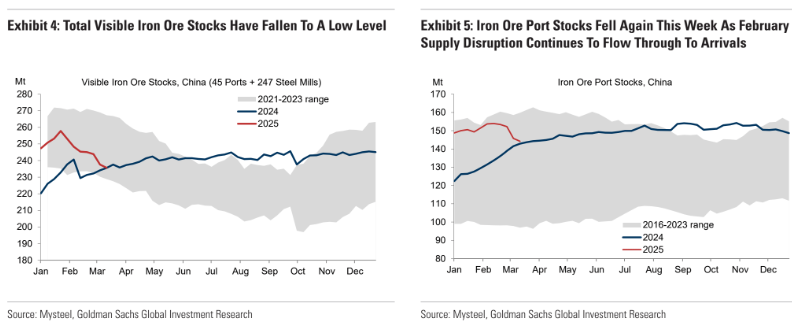

The market is still trading the long gone Pilbara cyclones. With China stocks down.

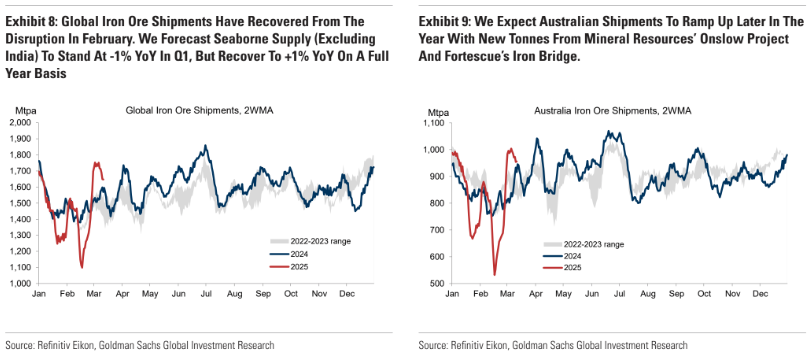

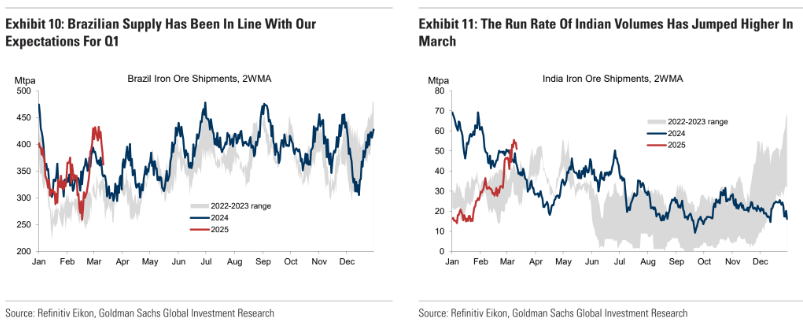

Even though production is well and truly recovered.

Advertisement

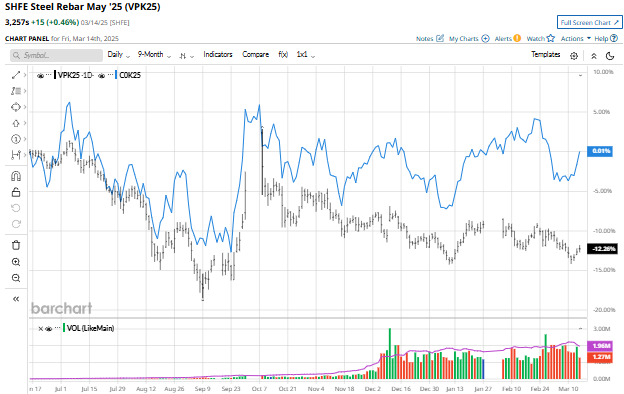

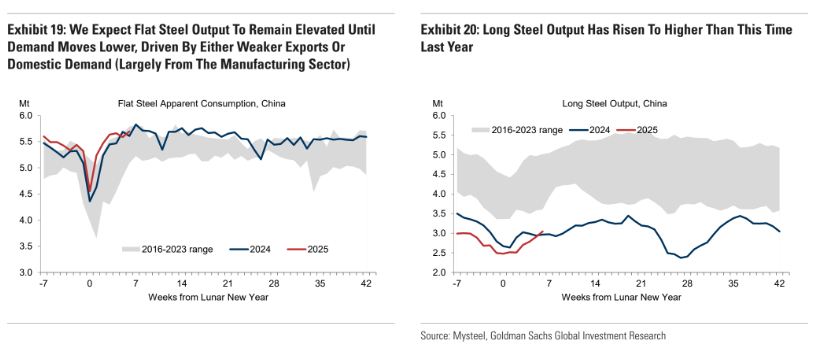

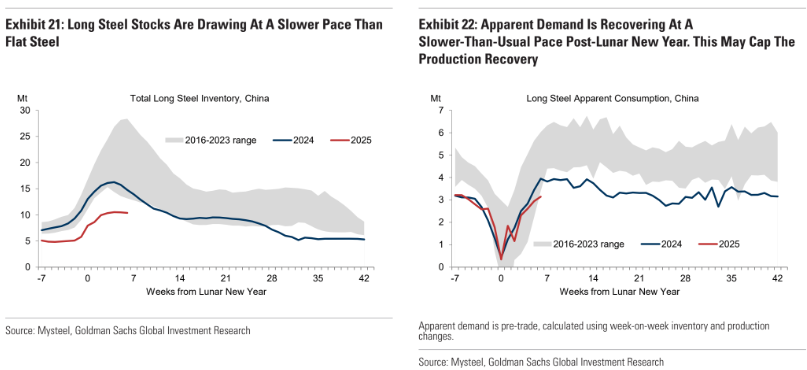

Apparent demand is a little better that 2024 for flat.

And a little worse for long.

Advertisement

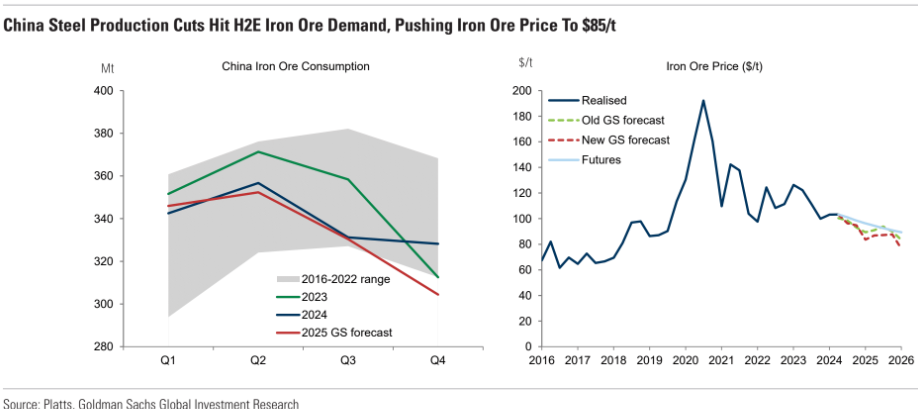

Ahead are cuts, cuts, cuts!

But the market is long.

Not a bad set-up for a short through H2.

Advertisement

Goldman says $85 by Q4.