The past year has seen plenty of propaganda from the property industry warning that the decline in property investment in Victoria arising from the government’s land tax hikes will harm renters.

Indeed, rental bond data from the Victorian Government showed a record decline of 24,726 rental properties (3.6% of total stock) in the year to Q3 2024.

Melbourne lost 23,108 rental properties (4.2% of its stock) over the same period.

Ray White Group’s chief economist Nerida Conisbee warned that Victoria holds the “unenviable title of having the highest property taxes in Australia”.

“The consequences of this high-tax environment are far-reaching”, she said.

“The backbone of the rental market – individual investors – are shying away and limiting the number of rental properties”.

However, the latest Rental Affordability Report from REA Group suggests that Victorian renters have been big winners from the government’s land tax hikes.

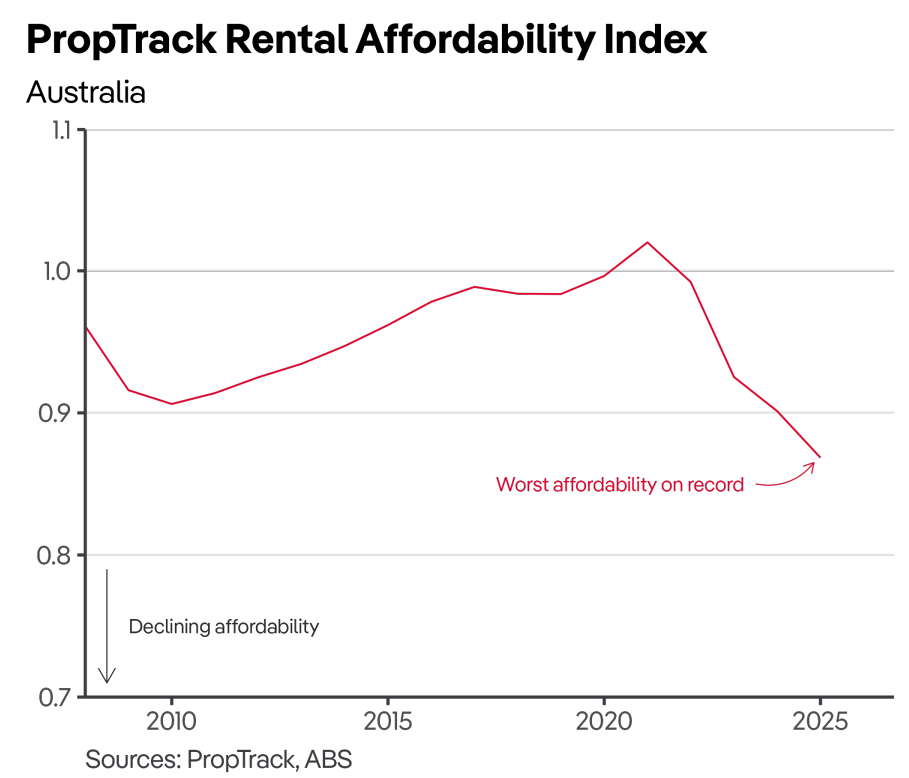

In Q4 2024, PropTrack’s rental affordability hit the lowest level since at least 2008, when records began.

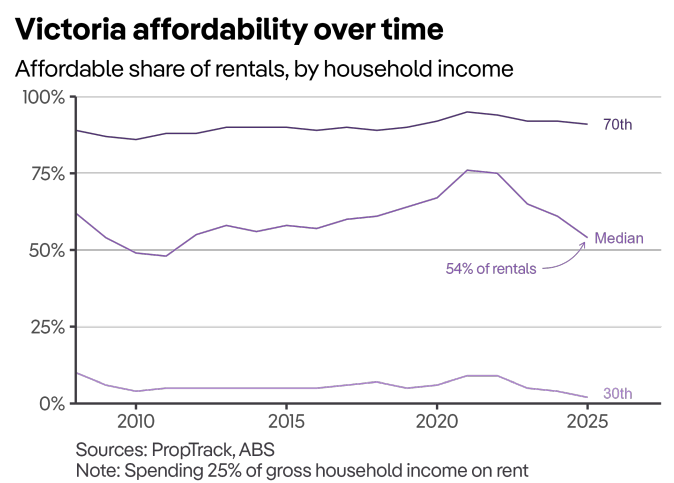

However, Victoria is the big exception and is Australia’s most affordable state for renters. Victoria is currently the most affordable state to rent in, by a wide margin.

While Victorian rental affordability has worsened significantly since 2021-22, it has not deteriorated as sharply as in other states.

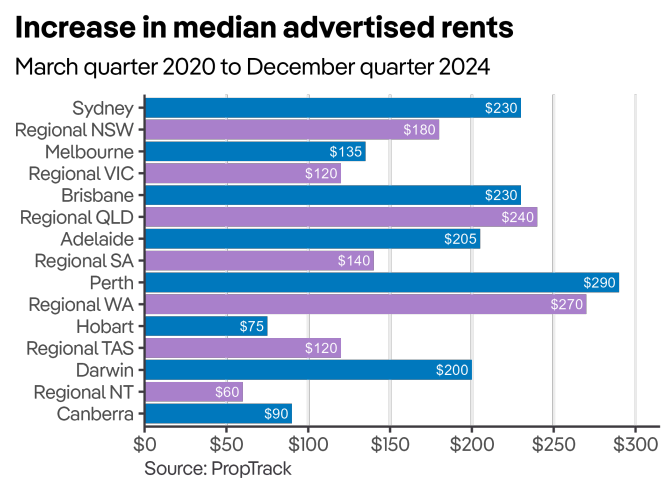

Victoria has not seen as strong rent growth over the past few years as other states. As a result, rents are lower than in other states, particularly given Melbourne’s large population and relatively high incomes.

For perspective, median advertised rents in Melbourne, at $570 per week, are $10 per week cheaper than Adelaide—despite typical household incomes in Victoria being 24% higher—and $60 per week cheaper than Brisbane and regional Queensland.

As a result, Victorian rental affordability is still around the levels it was in the mid-2010s and remains more favourable than other states.

A median-income Victorian household can afford a little more than half of all rentals advertised over July-December 2024.

This remains high compared with much of the country, but has fallen from the historically favourable conditions in 2019-20 to 2021-22 when a median-income household could afford to rent three-quarters of homes advertised.

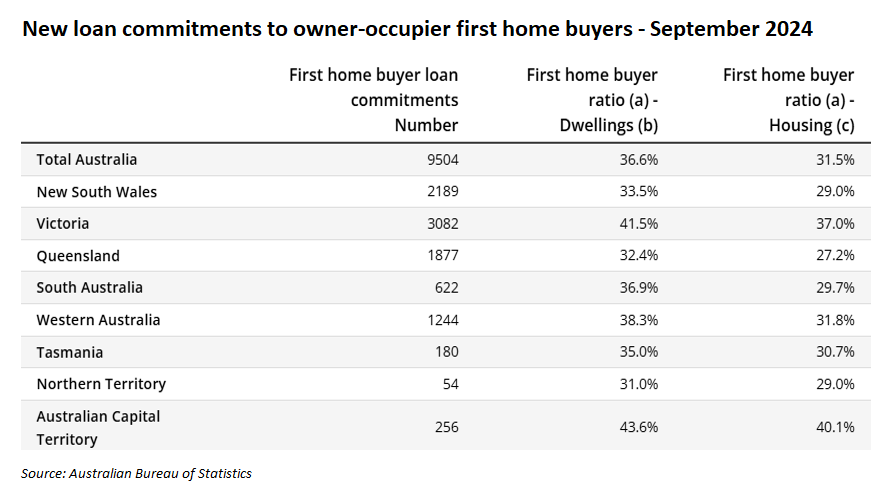

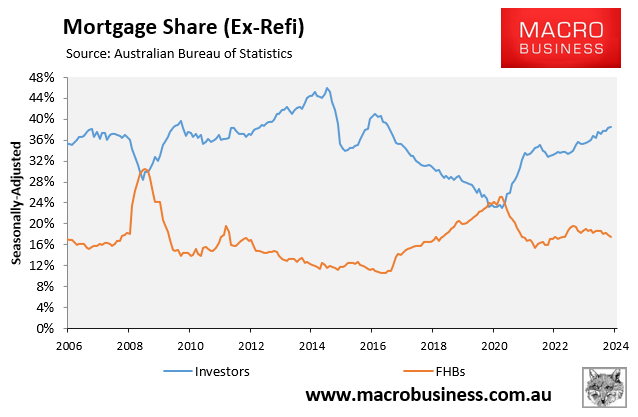

The decline in investor demand also meant that Victoria has the highest share of first-time home buyers of any state in Australia.

This reflects the historical inverse relationship between investor mortgage demand and first-home buyer mortgage demand.

The above data suggests that if policymakers genuinely want to alleviate the rental crisis and boost the homeownership rate, they should limit the number of investors in the market.

They should encourage investors to sell to first-time homebuyers, like Victoria does.