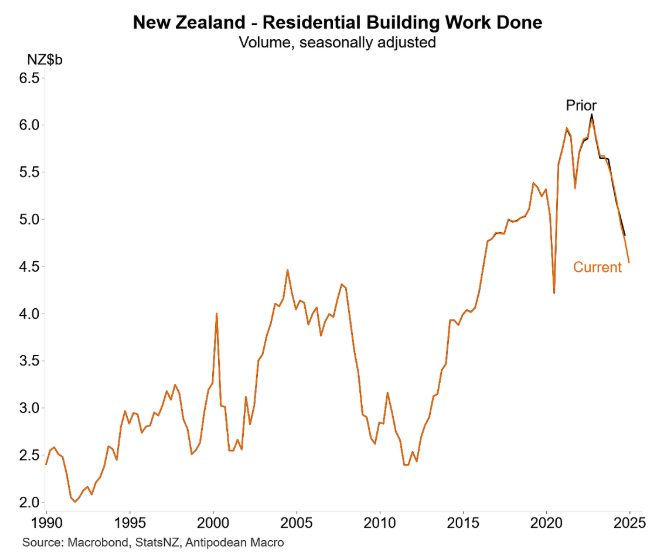

On Thursday, Statistics New Zealand released data on Building Work Put in Place, which showed that residential construction plunged by 4.9% in Q4 2024, to be 25% down from its previous peak in Q3 2022.

The following chart from Justin Fabo from Antipodean Macro also shows that the level of building was revised down in Q3 2024.

The result was weaker than economists’ expectations, pointing to another contraction for construction GDP in the December 2024 quarter.

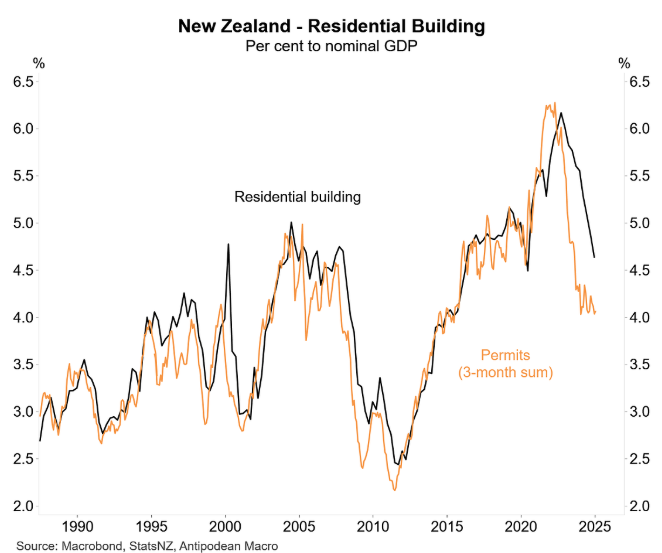

The relatively low level of residential building approvals also suggests further declines in residential home building in New Zealand.

“Restrictive financial conditions and elevated building costs have weighed on homebuilding activity by both occupiers and developers in recent history”, noted major bank ASB.

“Activity has continued to retrace from stimulus driven highs in 2021/22. Still sizeable Q4 declines paint a grim sectoral picture despite lower interest rates”.

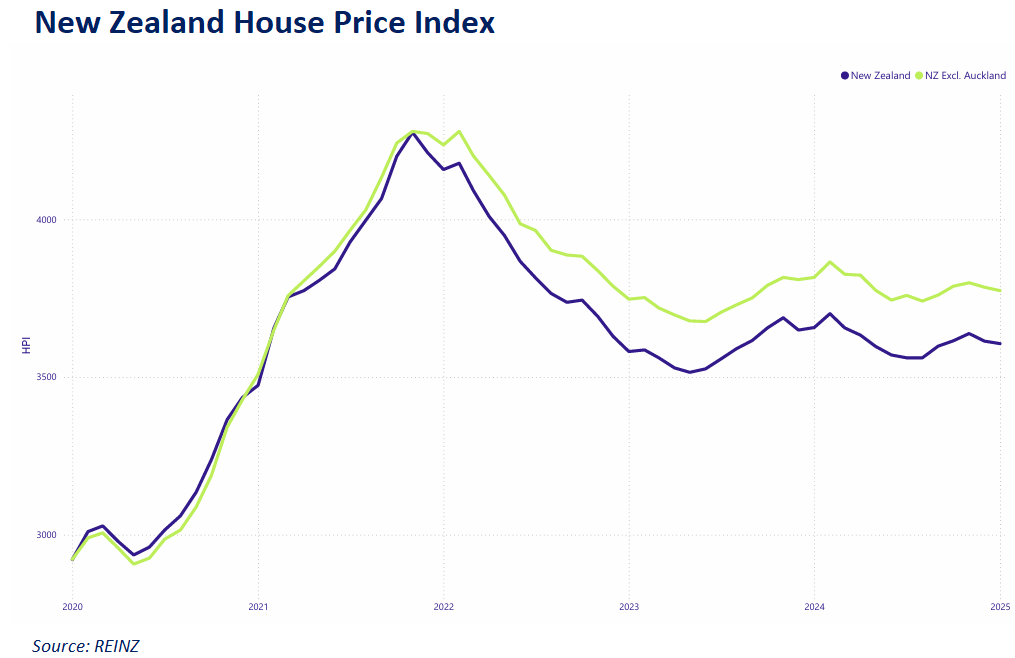

The Real Estate Institute of New Zealand’s (REINZ) house price index (HPI) for January was released at the end of last month.

It showed that national home values declined by 0.2% in January to be 1.4% lower year-on-year.

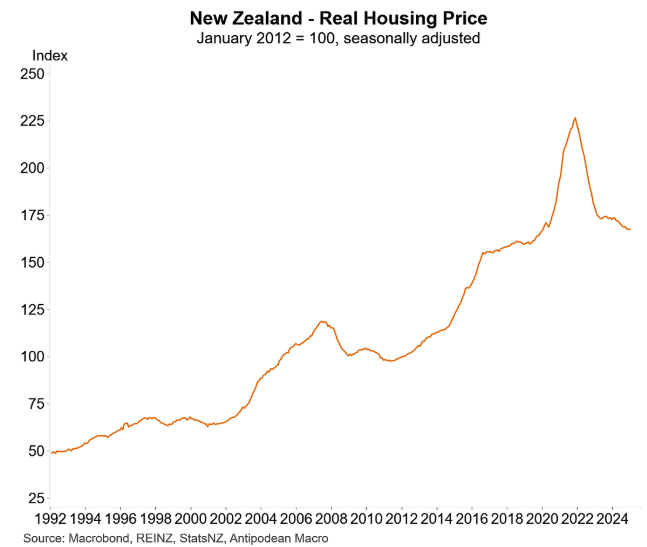

After recording one of the world’s largest price booms over the pandemic, New Zealand dwelling values have crashed back to pre-pandemic levels when adjusted for inflation.

However, New Zealand house prices are showing signs of improvement following the Reserve Bank of New Zealand’s 1.75% interest rate cuts.

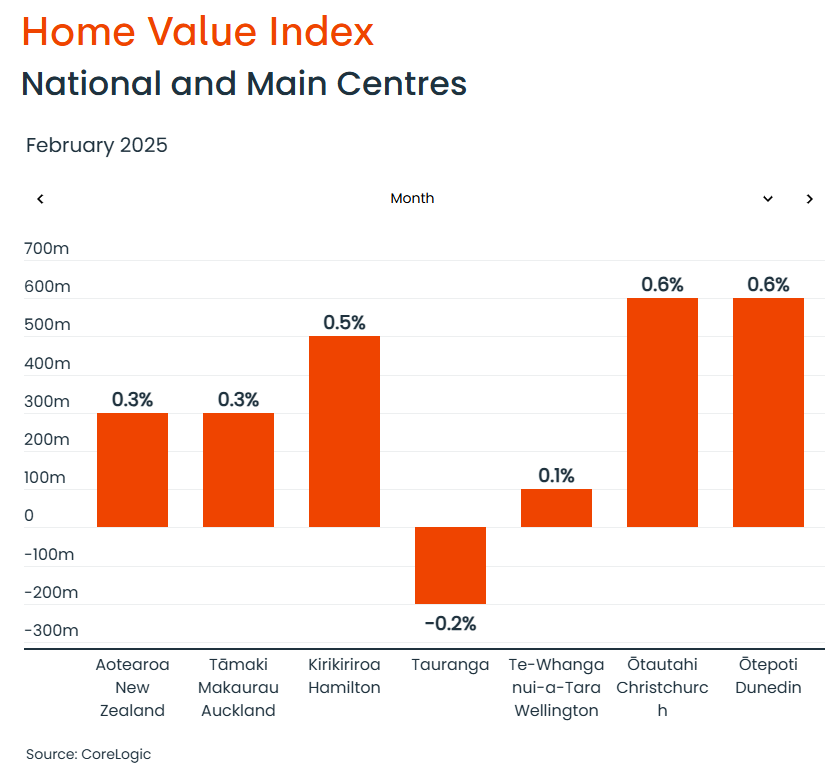

CoreLogic recorded a 0.3% rise in average dwelling values in February, representing the first meaningful increase in more than a year.

“The rise of 0.3% in the national median property value is fairly modest by past standards but nevertheless represents the first meaningful increase for more than a year”, noted CoreLogic NZ Chief Property Economist Kelvin Davidson.

“It was always likely that the property value falls in 2024 would come to an end at some stage in early 2025, given the extent of interest rate cuts since July or August last year”.

ASB forecasts a further 50bps of official cash rate cuts over the next few months, which will support the housing market.

That said, realestate.co.nz reported that the total number of homes listed for sale in New Zealand rose in February to a new cyclical high.

The flood of supply should keep a lid on any price rebound.