It’s a triumph! Australia’s energy shortages have been resolved.

Except when you look at how. From the AEMO.

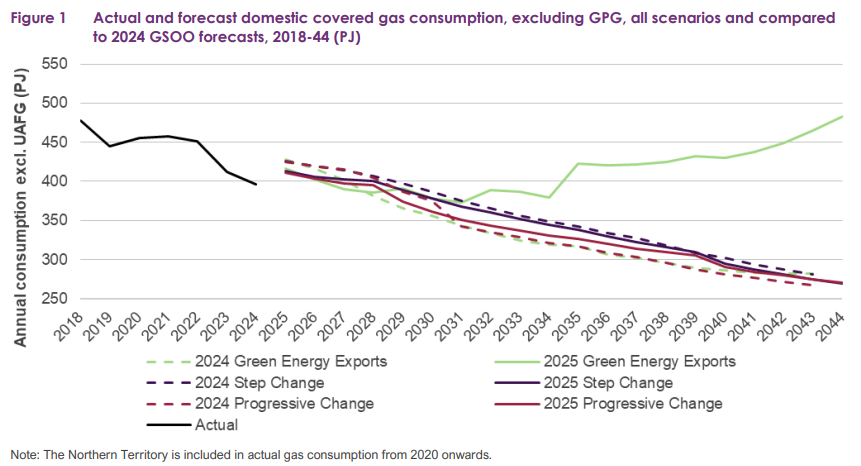

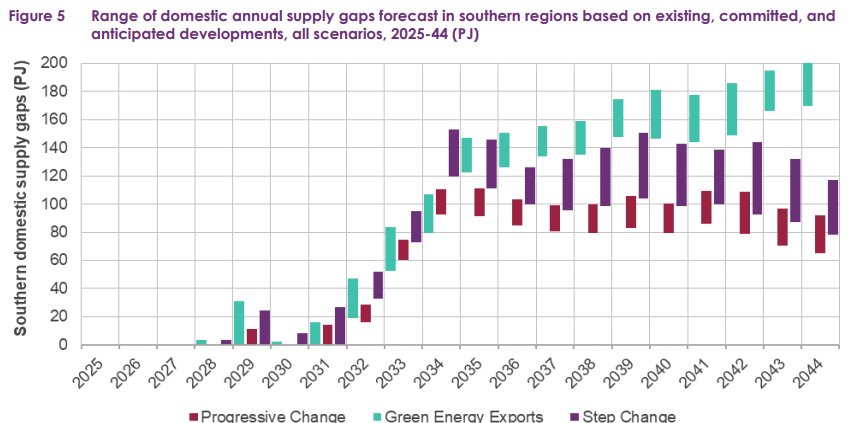

Shortfall risks under peak conditions are forecast in southern Australia from 2028, later than forecast in the 2024 GSOO due to expected falls in residential, commercial and industrial consumption of gas, and the delayed retirement of Eraring Power Station reducing forecast gas-powered generation (GPG) of electricity in the near term while it remains online. Seasonal supply gaps may emerge from 2028 if conditions lead to sustained high gas usage.

Depending on what MSM propaganda you read, the solution is misrepresented as a triumphal reduction in gas usage, a triumphal increase in gas cartel supply, or a triumphal Labor policy.

All of these are lies.

The truth is that the energy transition is succeeding by failing.

- Gas shortfalls have been here for years already, which is why prices have been so high for so long, and this has triggered demand destruction in all forms of gas usage.

- The extension of Eraring and, soon enough, Yallourn, via various forms of public subsidy (kept secret in communist VIC) is reducing future gas use by increasing future unprofitable coal use.

That’s it. That’s all there is in the slightly less horrifying AEMO annual gas update, which is out today and butchered by the MSM.

Beyond 2028, the same question remains. The shortfall is disastrous.

And:

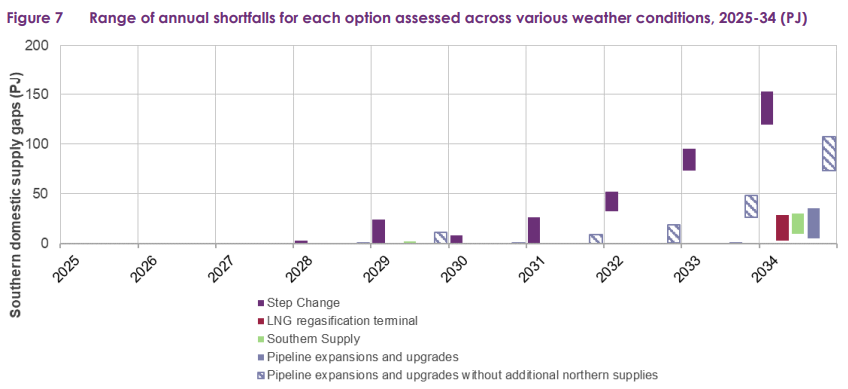

Various solutions are being considered by industry that may address these risks. In this GSOO, AEMO assesses several potential future supply, storage and transportation options, to provide additional information on potential investments and their impact on gas adequacy. All options assessed delay forecast annual supply gaps and help mitigate the risk of peak day shortfalls, to varying degrees.

The geniuses at AEMO have determined that more gas from any source will result in a diminished shortage. Thanks for that.

Why AEMO didn’t test the economic viability of each is beyond me. This is a total failure of a quivering market regulator.

I can do it in about five minutes.

- If you import LNG, then the local gas price will immediately rise to $25Gj as the gas export cartel reduces available supply. This is a doubling in the gas price, 40% increase in electricity prices, and a roughly 5% shock to CPI.

- If you force the gas export cartel to supply the south with domestic reservation, then it will need an export levy to guarantee lower prices. $7Gj would be fine. This would halve the gas price, decrease electricity prices by 40% and reduce inflation by 5%.

- If you informally pressure the gas cartel to supply the south, then the local gas price will continue to hollow everything out at a (barely) politically manageable pace, and unprofitable coal power will be publicly subsidised for decades.

- If you do nothing, then gas prices will go so high that demand destruction decimates the entire economy, and unprofitable coal-fired power will grow via public subsidy to keep the lights on that you can no longer afford.

My guess is the Canberra cowards will opt for option three, given it is the path of the poltroon, sprinkled with a barely viable option one so as not to upset Twiggy. This will lift gas prices further without delivering a visible catastrophe.

So, to determine where Aussie energy prices go next, we need to look elsewhere than Australia. Goldman.

In the absence of incremental Russian gas, TTF needs to remain high enough to attract LNG.

European gas markets remain stuck between a tight prompt physical market, with NW European storage at 25% full currently, less than half the fill a year ago, and the possibility of increased Russian gas supplies from a potential Ukraine peace deal.

In our view, end-Mar25 gas storage levels are simply too low for European inventories to reach 90% full by end-Sum 25.

We think storage can still reach over 80% full, which will likely be enough to go through next winter given the ongoing ramp in global LNG supply, if European prices stay high enough to continue to attract high LNG imports.

This means staying at least above 40 EUR/MWh ($12.80/mmBtu), though moving higher to 45-50 EUR/MWh would increase our conviction on European LNG imports remaining robust.

Our base case for Bal2025/2026 TTF remains 49/36 EUR/MWh($14.90/$10.80/mmBtu).

In short, as things stand, only Donald Trump can save Australians from a terrible energy future.

You’re not going to read that inconvenient truth in the MSM.