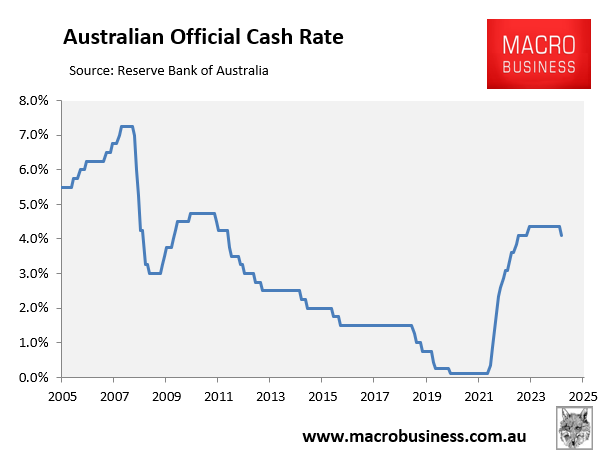

Last month’s interest rate cut from the Reserve Bank of Australia (RBA) was about as hawkish as possible.

The RBA’s statement explicitly noted that the decision to cut the official cash rate by 0.25% was ‘line-ball’ with upside risks to inflation remaining:

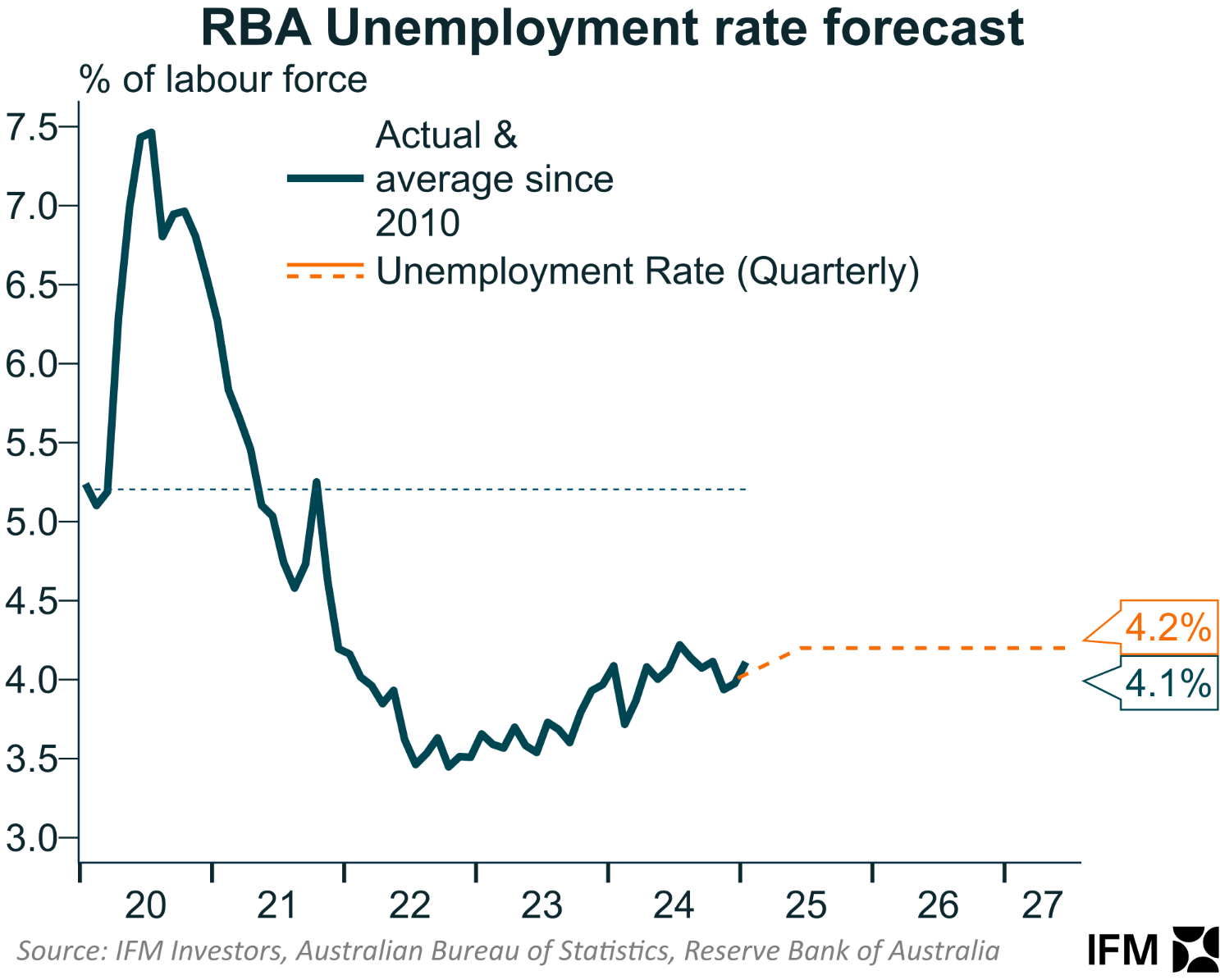

“However, upside risks remain. Some recent labour market data have been unexpectedly strong, suggesting that the labour market may be somewhat tighter than previously thought”.

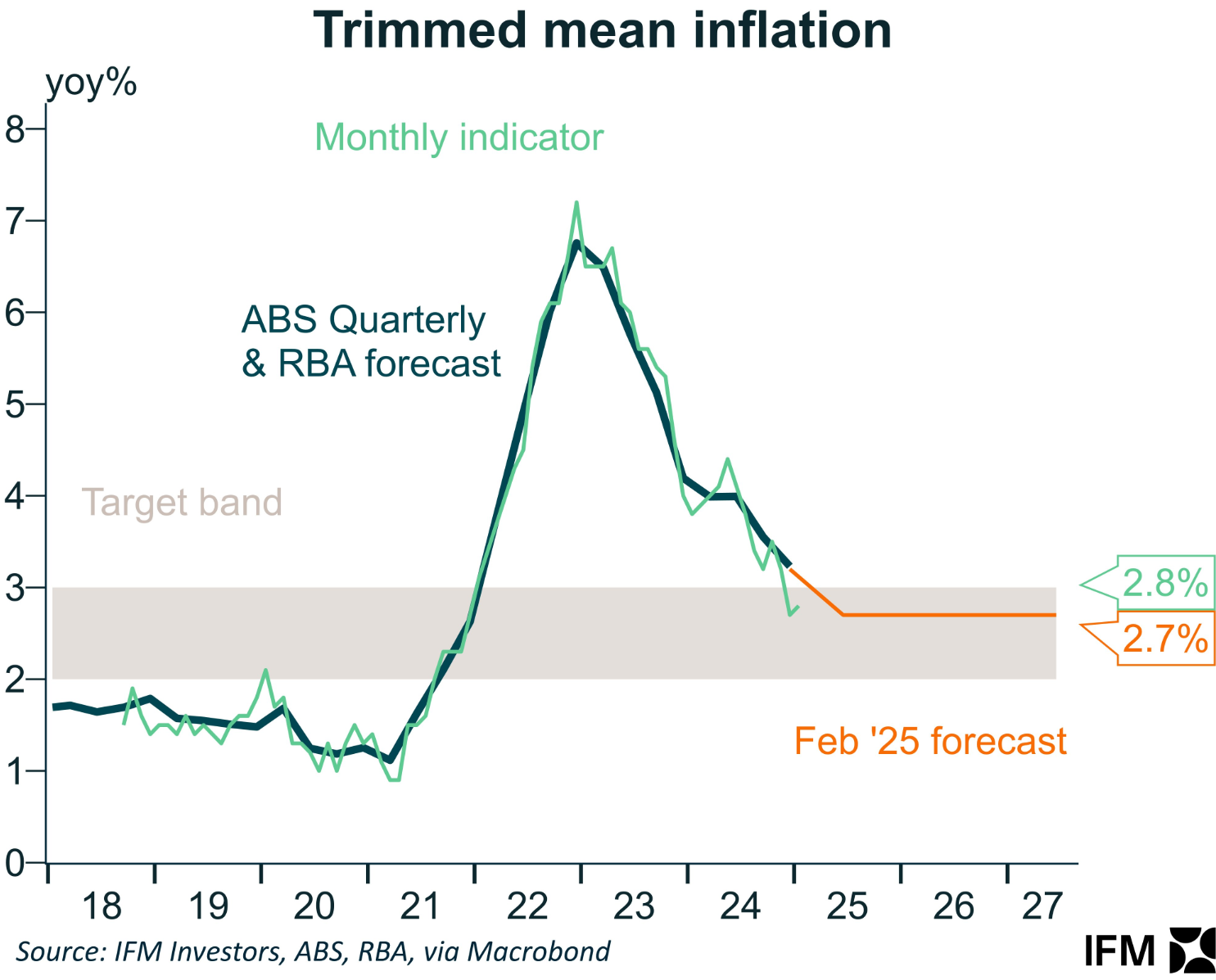

“The central forecast for underlying inflation, which is based on the cash rate path implied by financial markets, has been revised up a little over 2026”.

“So, while today’s policy decision recognises the welcome progress on inflation, the Board remains cautious on prospects for further policy easing”.

The minutes of the RBA’s meeting were released on Tuesday, and they contained the following statement playing down the prospects of another rate cut in April [my emphasis].

“In finalising the policy statement, members affirmed their commitment to returning inflation to the midpoint of the target range, consistent with the Board’s mandate set out in the Statement on the Conduct of Monetary Policy”.

“They emphasised that the decision at this meeting acknowledged the progress that had been made in reducing inflation while not committing the Board to ease policy further“.

“Members also agreed that future decisions would be guided by the incoming data and evolving assessment of risks. Returning inflation to target remains the Board’s highest priority and it will do what is necessary to achieve that outcome”.

Since the interest rate decision was handed down on 18 February, the data has been mixed on whether another rate cut is warranted.

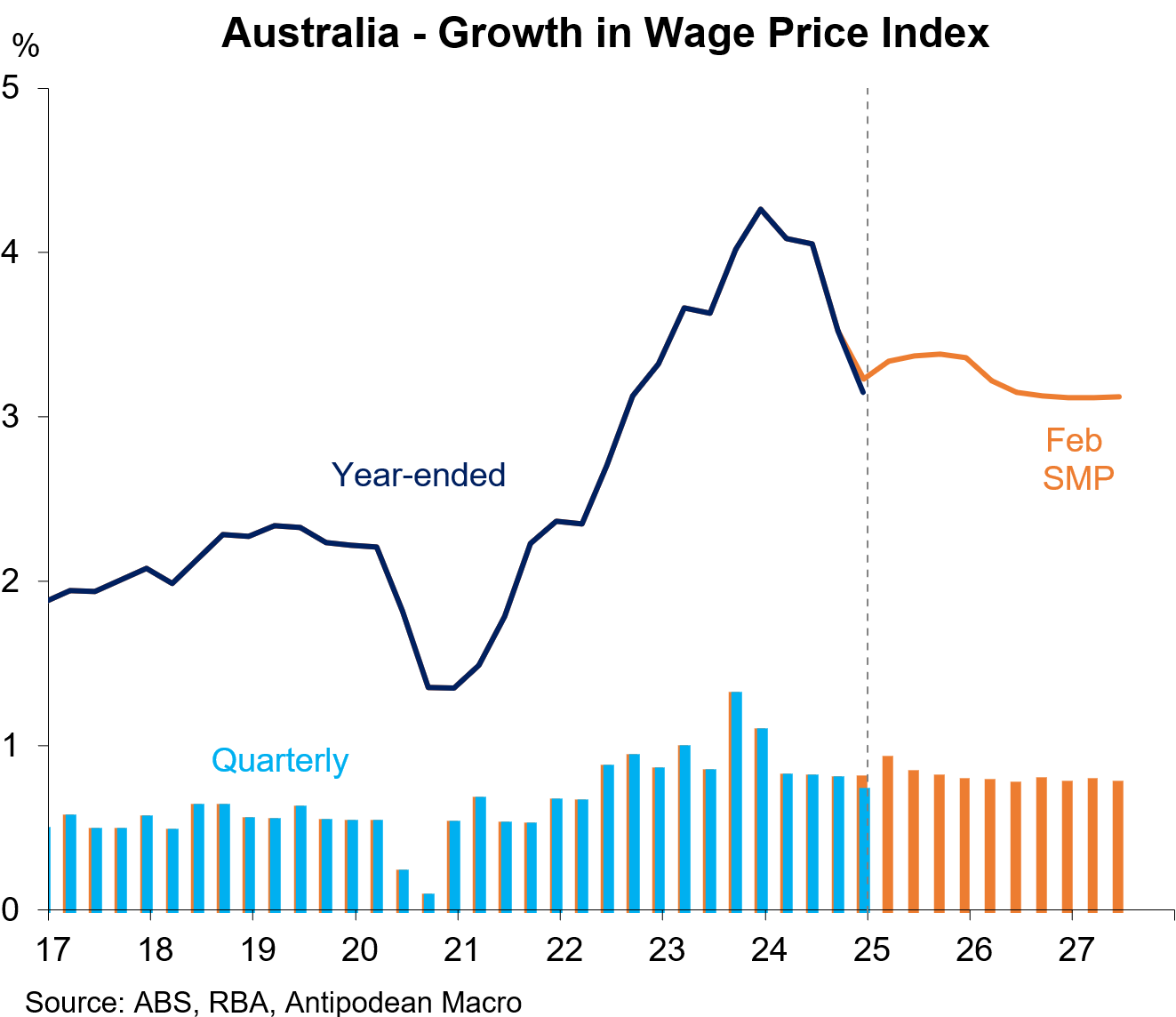

On the positive side, Australia’s Q4 wage growth was soft, coming in below the RBA’s expectations.

Monthly trimmed mean inflation also came in below the RBA’s expectations, although the monthly indicator is goods-heavy compared to the official quarterly CPI measure.

On the negative side, Australia’s unemployment rate remained lower than the RBA’s forecast.

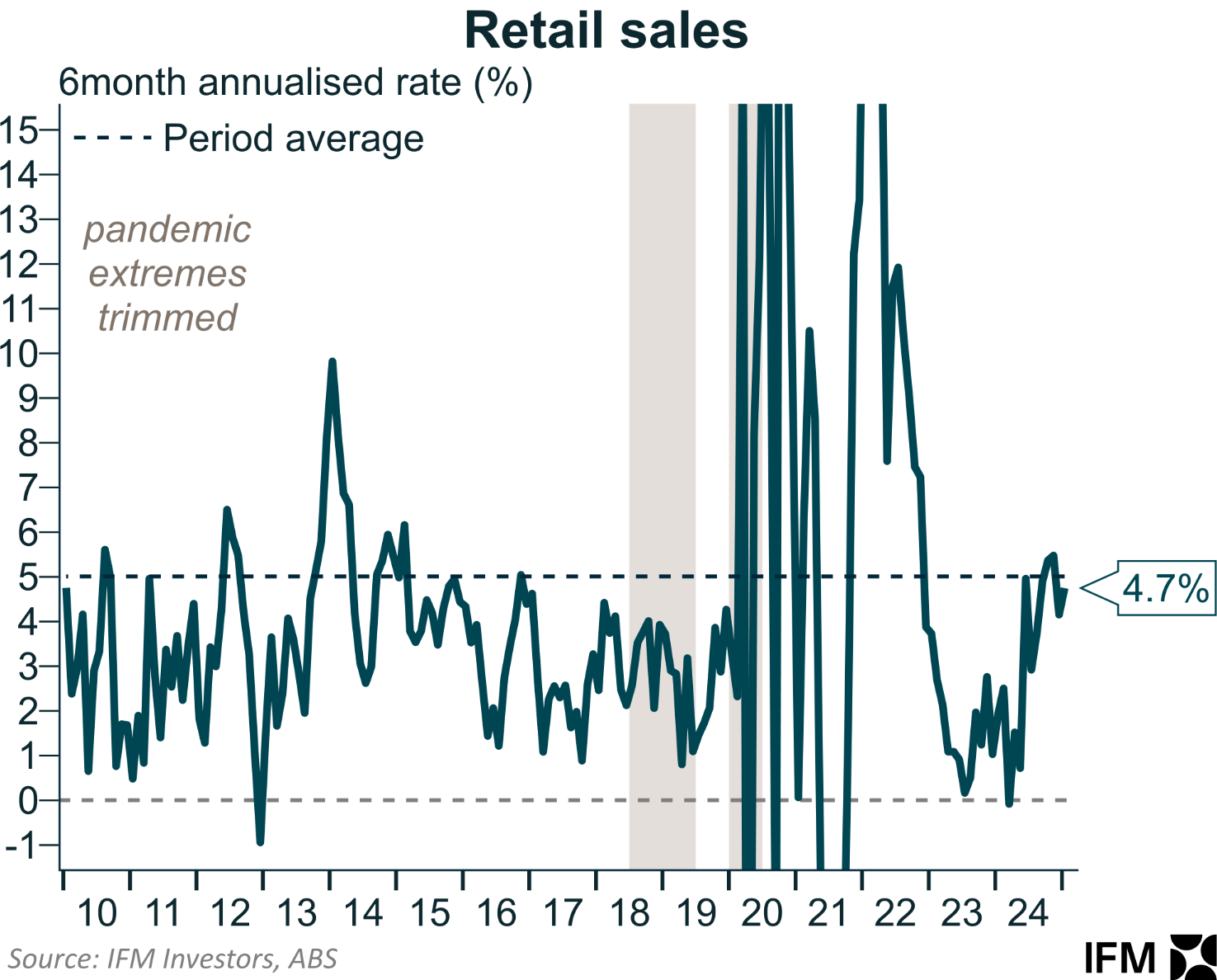

Retail sales rebounded solidly over the six months to January 2025.

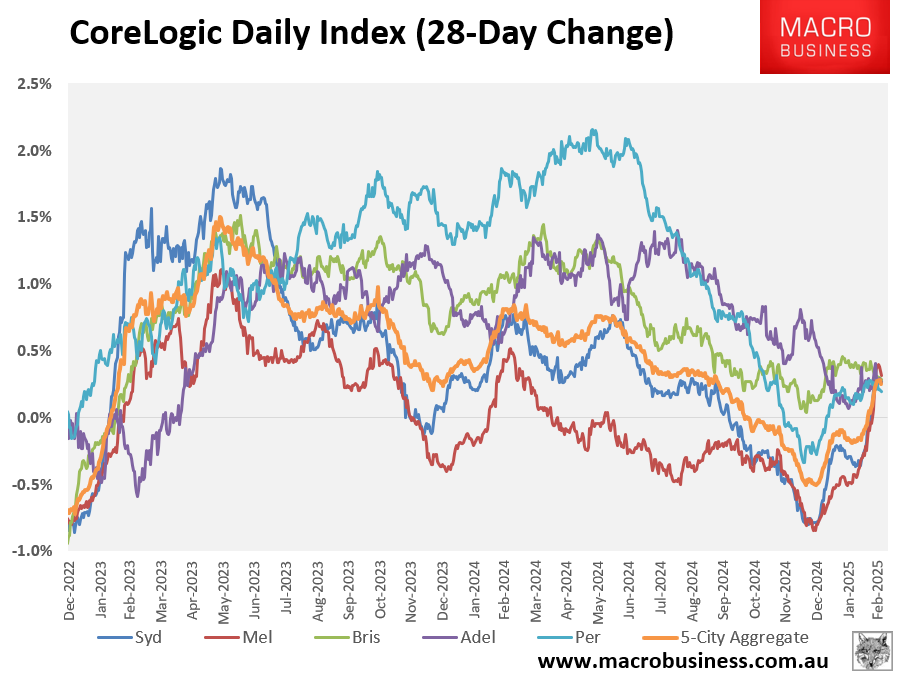

Australian house prices have also rebounded.

Before the RBA hands down its next interest rate decision on April 1, the ABS will release the Q4 national accounts (5 March), dwelling approvals (6 March), the Monthly Household Spending Indicator (7 March), the February labour force survey (20 March), and the monthly CPI indicator (26 March).

The outcome of this data will determine whether the RBA lowers the cash rate in April.

It will also be the last interest rate decision before the federal election. The Albanese government is praying that the RBA cuts again.