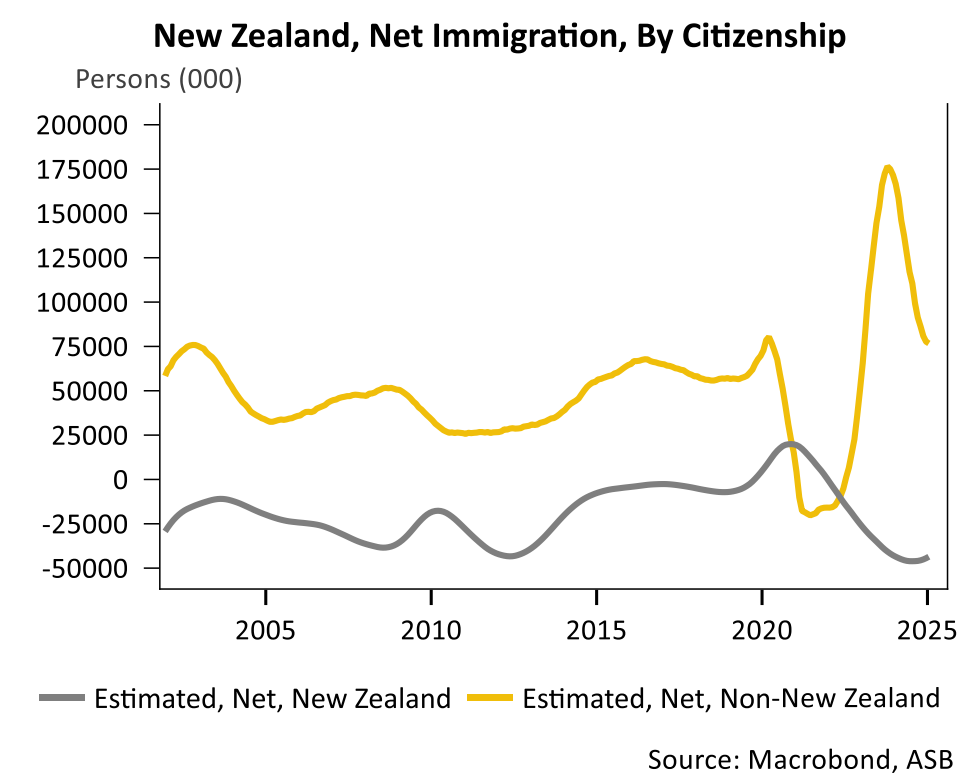

Statistics New Zealand released net migration data for January, showing that annual net permanent and long-term (PLT) migrant inflows declined to 32,471, continuing the declining annual trajectory.

This is just above the post-2000 historical averages (30,000) but is well below the 135,500 October 2023 year peak.

Annual arrivals have stabilised but annual departures hit record highs.

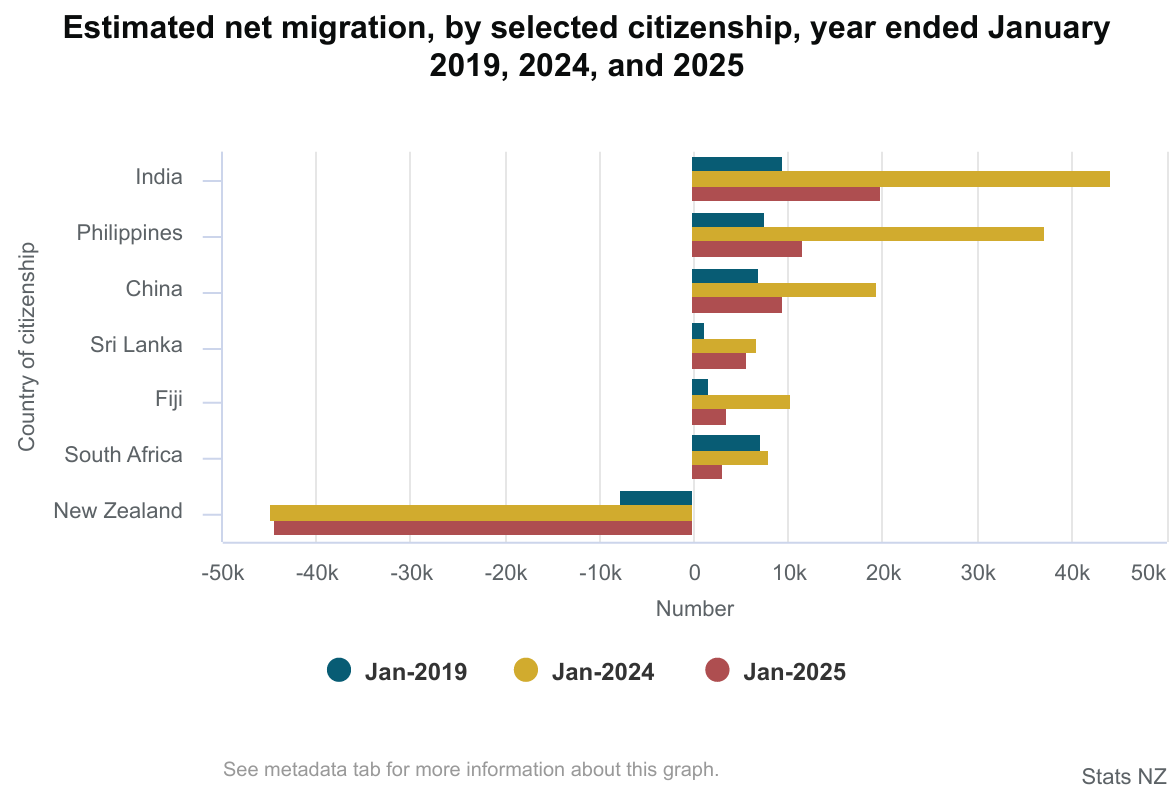

Non-New Zealand citizens’ yearly net PLT moderated to 76,700. While it remained above historical averages (47,500), it was far less than the net gain of 166,500 recorded in the year to Januaru 2023.

The outflow of New Zealand citizens was a near-record high 44,200, as Kiwis sought better pastures abroad.

There was an estimated annual net migration loss of 30,500 persons to Australia.

Historically, New Zealand has had net migration losses to Australia. This averaged roughly 30,000 from 2004 to 2013, and 3,000 per year from 2014 to 2019.

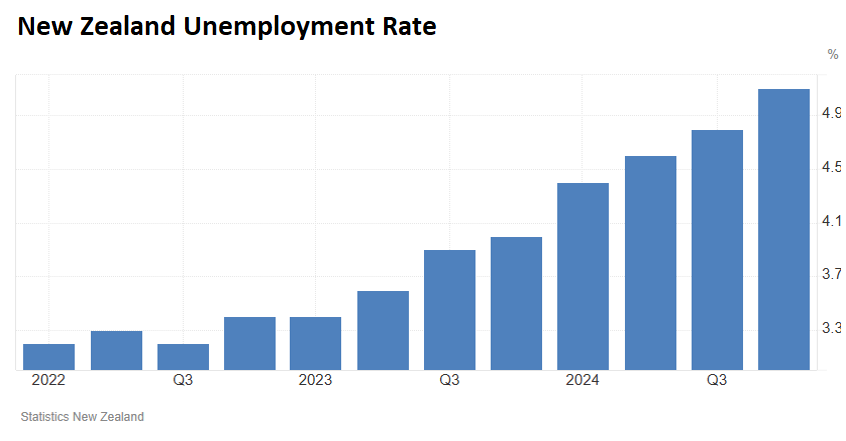

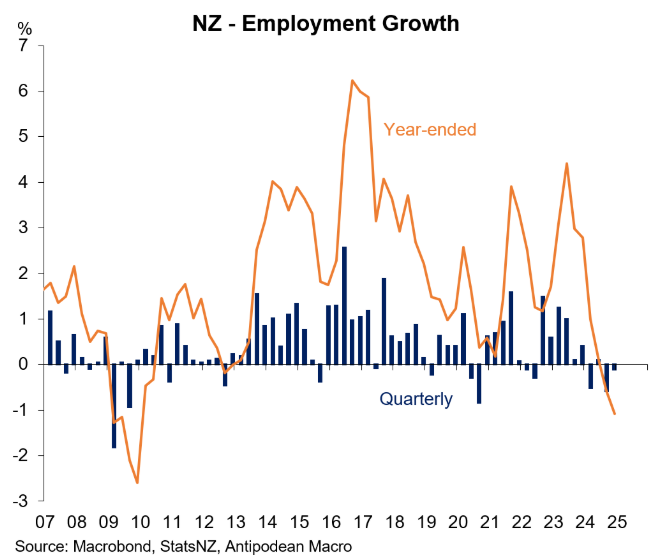

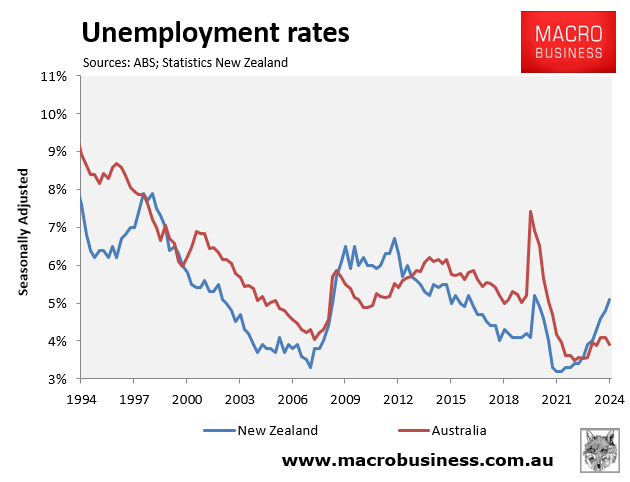

It’s easy to understand why. New Zealand’s unemployment rate increased to 5.1% in Q4 2024, from 4.8% in Q3 2024.

The number of jobs in New Zealand has also decreased for three of the last four quarters.

In comparison, Australia’s unemployment rate was 3.9% in the fourth quarter of 2024 (4.1% in January).

The difference has not been this large in favour of Australia since Q3 2012, when there was a similar substantial outflow of Kiwis to Australia.

Clearly, Kiwis are pursuing the more favourable employment opportunities in Australia.

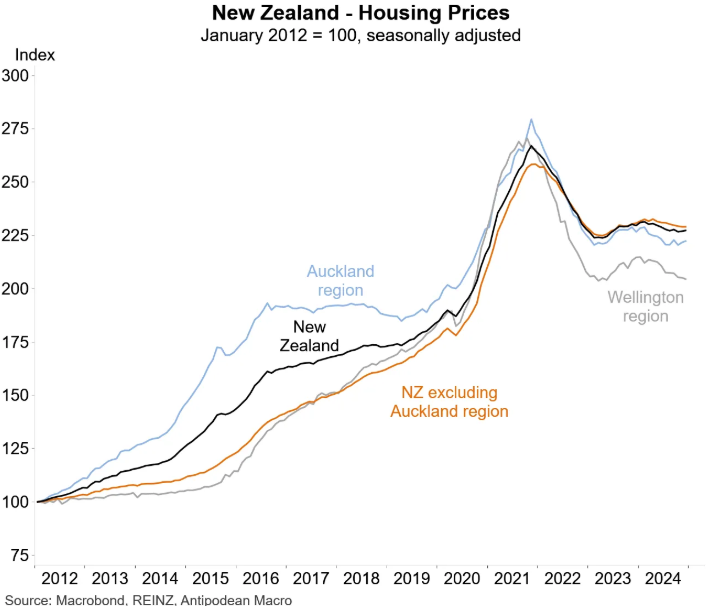

The news isn’t all negative for New Zealanders. The steep slowdown in net migration has significantly increased house affordability.

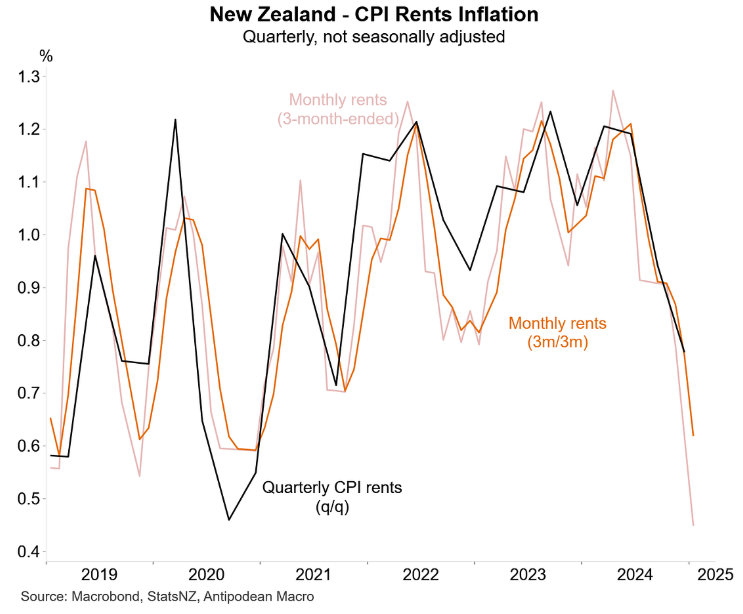

New Zealand rental inflation has plummeted.

Decreasing migration has also contributed to lower housing prices.

That is great news for Kiwi first home buyers and tenants.