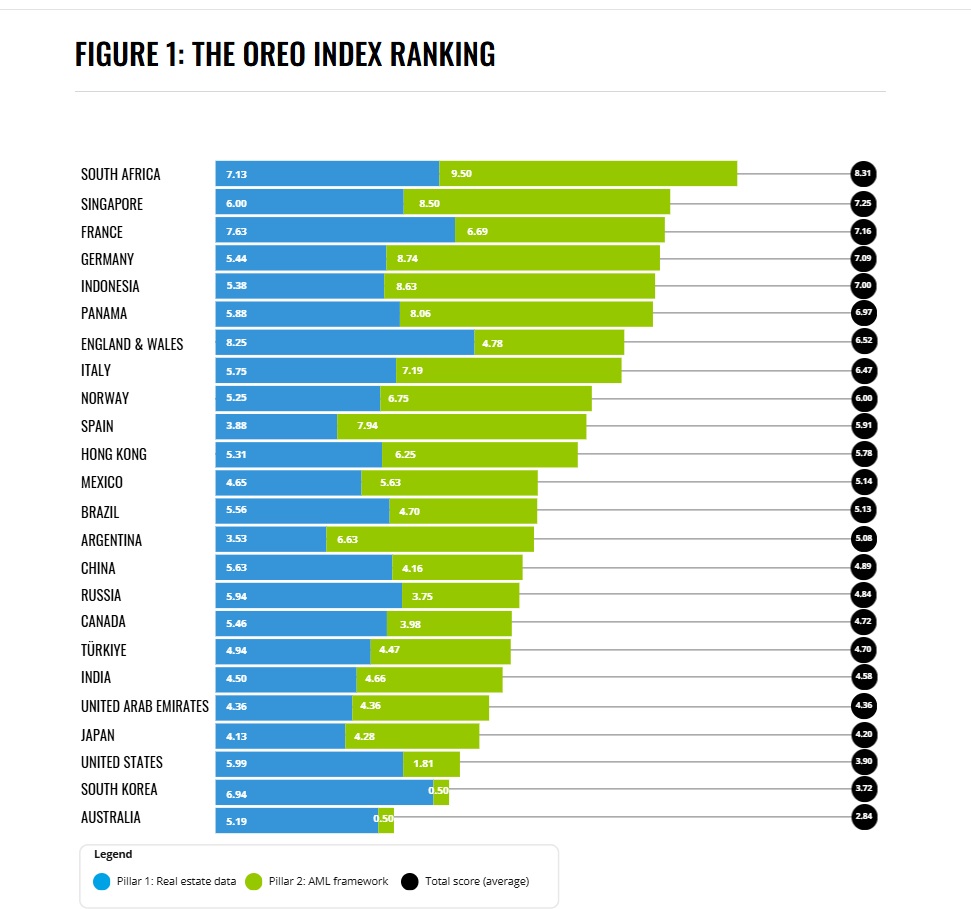

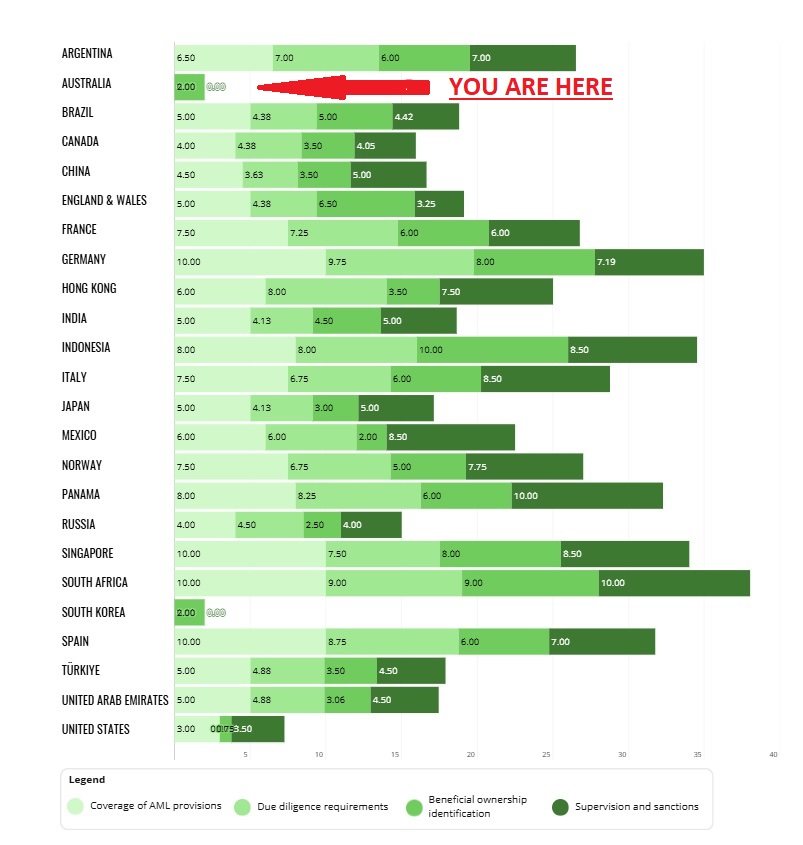

The inaugural Opacity in Real Estate Ownership (OREO) Index, published this week by the Anti-Corruption Data Collective (ACDC) in partnership with Transparency International, has ranked Australia last in the world.

The report, released on 26 March, ranks major developed nations on two key criteria: 1) scope and accessibility of real estate ownership data and 2) the strength of domestic anti-money laundering frameworks governing property transactions.

Each pillar is composed of three and four components, respectively, each receiving a score from 0 to 10.

A weighted average was used to calculate the two pillars, which contributed equally to the final score. The overall OREO Index score was determined by averaging these pillars.

Australia, currently going to the polls with the cost of housing a central issue and generally the primary concern for anyone under the age of about 50, ranked last.

Transparency International announced:

Crooks, corrupt officials and professional enablers with scant regard for the law are able to exploit yawning gaps in real-estate regulation across many of the world’s major economies, allowing them to launder illicit funds through property purchases with minimal risk of detection, according to the inaugural published today (26 March).

The report paints a troubling picture of global property markets, revealing that real estate remains a favoured vehicle for money laundering owing to widespread legal loopholes, a lack of transparency and, in some cases, woefully poor oversight. In particular, the report highlights the ease with which individuals can anonymously buy and sell property – often through opaque corporate structures – without triggering anti-money laundering (AML) controls.

The report noted that Australian anti-money laundering laws, which Macrobusiness has championed for more than a decade, will not come into effect until mid-2026.

It also highlighted weak laws and woeful data on property transactions as key contributors to corruption, allowing beneficiaries, criminals, and persons closely tied to despotic regimes to not only launder criminally gained proceeds but also establish domicile in jurisdictions where they could utilise legal protections to avoid disclosure. It highlighted property developers globally as being able to flout legal processes with impunity.

One concern highlighted in the index is the ability to conduct property transactions without third-party involvement.

In jurisdictions including Australia, China, England and Wales, Japan, Türkiye and the UAE, buyers can purchase property without the need for an estate agent or legal representation, increasing the risk of illicit activity going undetected.

Furthermore, some countries, including Russia and the UAE, permit property purchases to be made in cash, bypassing the scrutiny of the banking system entirely.

While many nations have imposed AML regulations on professional intermediaries, property developers—who often sell directly to buyers—are frequently exempt from such obligations and are not required to report suspicious transactions.

The Albanese government has announced a temporary ban on foreign nationals purchasing existing Australian homes, effective from next week. To its credit, it also legislated “Tranche 2” anti-money laundering rules for real estate gatekeepers, which come into effect in mid-2026.

However, Labor has said nothing about a longer-term ban, only that there would be a ‘review’. Liberal leader Peter Dutton is also planning to ban foreign buyers for two years.

Australians wondering about the role of foreign buyers in Australia’s real estate market may be perplexed by the fact that it has taken more than a decade for either side of mainstream Australian politics to take meaningful action.

The last review by the Abbott Government in 2015, headed by then-Assistant Treasurer Kelly O’Dwyer, had no effect, and proposals to review property transactions by the ATO came to nothing.

That review arose in the wake of the ‘Chodley Wontok’ revelations, as reported by Macrobusiness (FIRB’s foreign property failure – March 2013), which exposed the system for regulating foreign purchases of Australian real estate as a sham.

As Australian politicians ask for your vote in the coming weeks, this is a subject they should be asked about.

Even if they say the gate is closing, ask what they propose to do about more than a decade’s worth of home purchases where foreign buyers, money launderers, and buyers enabled by Australian student visas are a discernible factor in real estate prices.