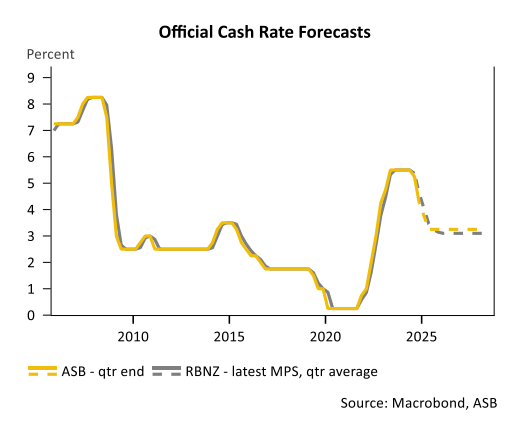

The Reserve Bank of New Zealand’s 1.75% reduction in the official cash rate has finally stimulated an upswing in New Zealand house prices.

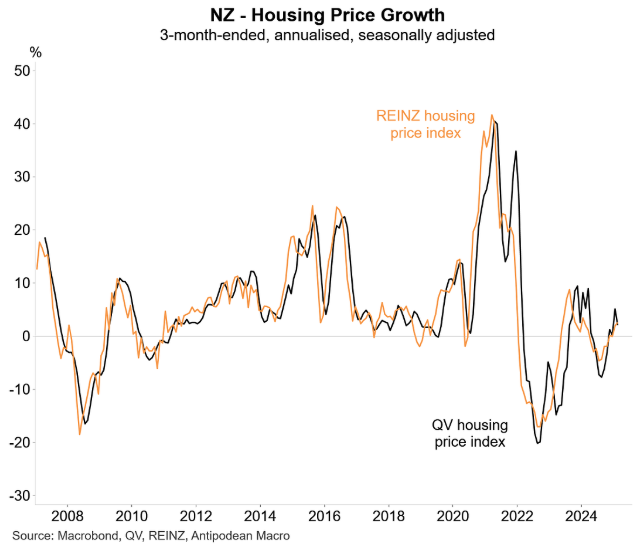

The Real Estate Institute of New Zealand’s (REINZ) House Price Index jumped by 1.4% in February to be 0.5% higher over the quarter. Over the year, New Zealand home prices were down by 1.2%.

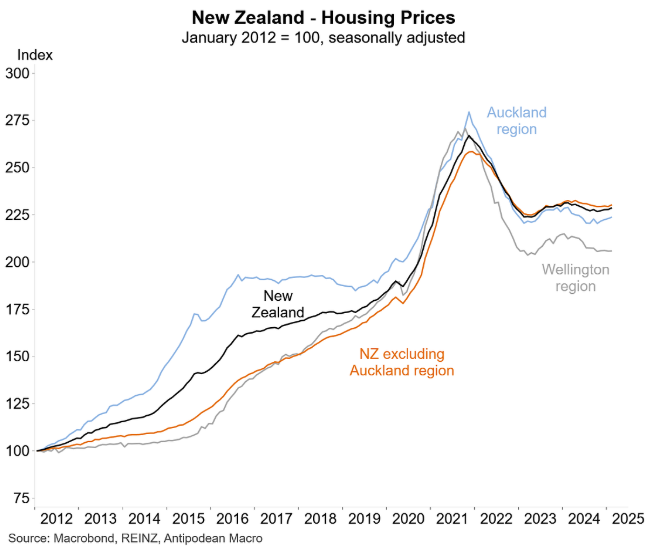

The following chart from Justin Fabo from Antipodean Macro shows the nascent rebound in the REINZ house price index across the major jurisdictions.

Quotable Values’ (QV) rival house price index has also rebounded.

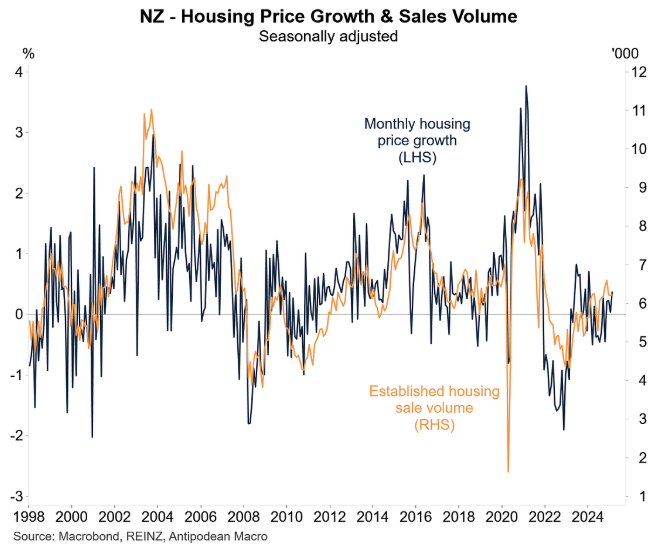

Home buyer demand has also picked up, as illustrated by the bounce in sales volumes.

However, the rebound in New Zealand house prices has been muted by the strong rise in for-sale listings.

The number of residential properties listed for sale on Trade Me Property was up 12% in February on the same time last year.

The number of residential properties listed for sale is now the highest it has been in more than a decade. This means that buyers still have plenty to choose from at the end of the summer selling season.

“We continue to see supply outpacing demand, however the gap is narrowing with demand hitting a three year high and up 8% on February 2024”, Trade Me Property Customer Director Gavin Lloyd said.

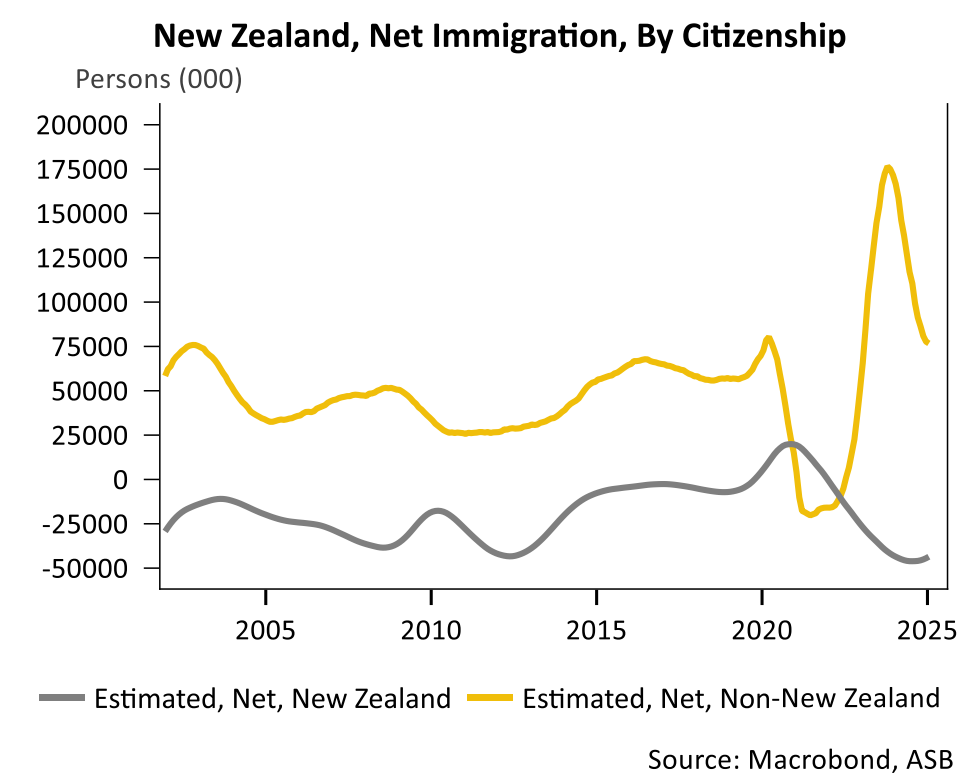

The housing market is also being subdued by slowing net overseas migration.

The outflow of New Zealand citizens remained near-record high 44,200, as Kiwis sought better pastures abroad.

The upshot is that lower interest rates are stimulating buyer demand and home prices. But the stimulatory impact is being partly offset by elevated for-sale listings and slower net overseas migration.