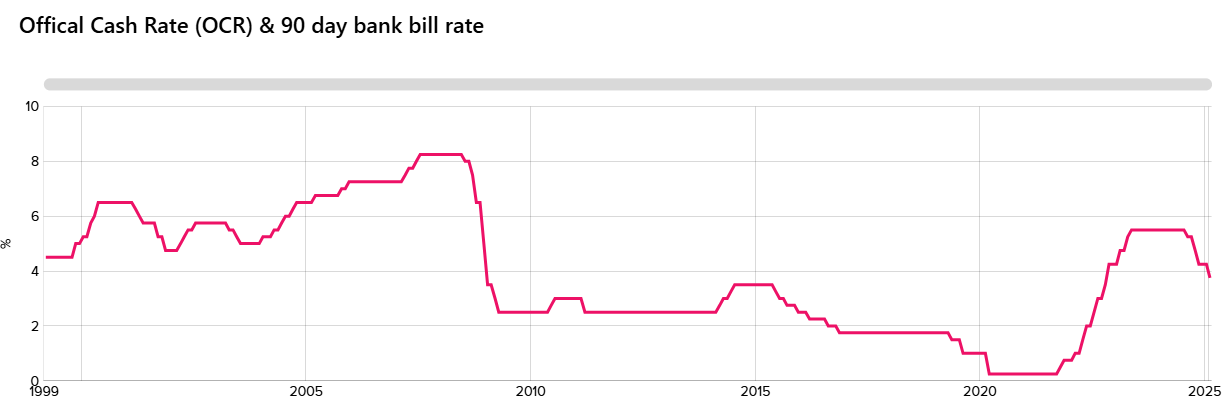

The Reserve Bank of New Zealand has cut the official cash rate by 1.75% to 3.75% over the past six months.

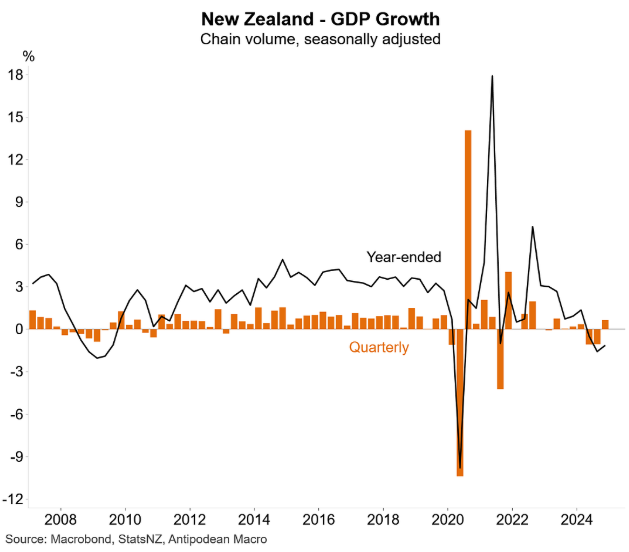

New Zealand’s gross domestic product (GDP) rose 0.7% in the Q4 2024 quarter, following a 1.1% decrease in the Q3 2024 quarter, according to figures released by Stats NZ on Tuesday.

The result was stronger than the Reserve Bank and economists had expected. The Reserve Bank and major bank ASB forecasted the economy to grow by only 0.3% over the quarter.

The result also ended the economy’s recession, which had been the worst (outside of the pandemic) since 1991.

Stats NZ noted that 11 of the 16 industries increased in Q4 2024.

The largest rises were from rental, hiring, and real estate services; retail trade and accommodation; and healthcare and social assistance.

The largest falls were in construction, information media and telecommunications.

The following chart from Justin Fabo from Antipodean Macro shows the quarterly change in New Zealand’s GDP:

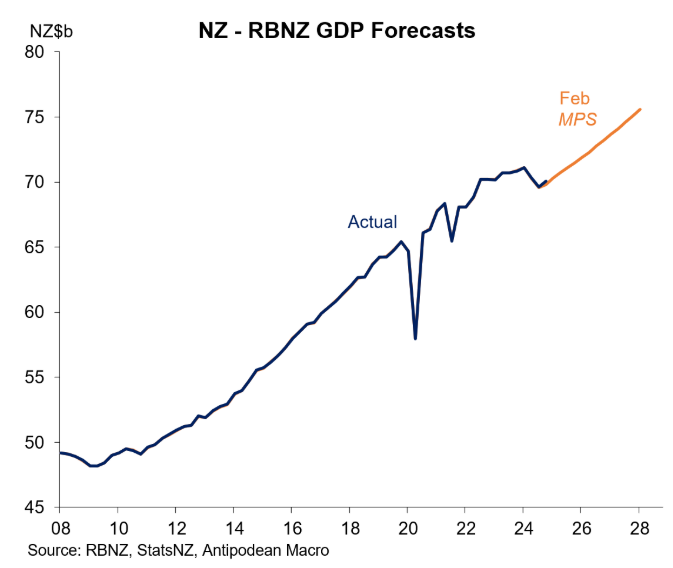

Here is how New Zealand’s GDP growth looks as a time series and against the Reserve Bank’s forecast:

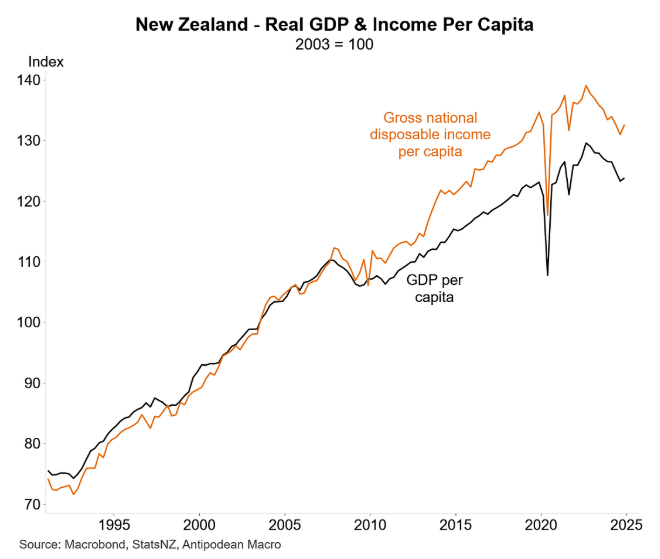

New Zealand’s GDP per capita also rose by 0.4% in Q4 2024, the first increase since Q3 2022. However, it remains well below the peak.

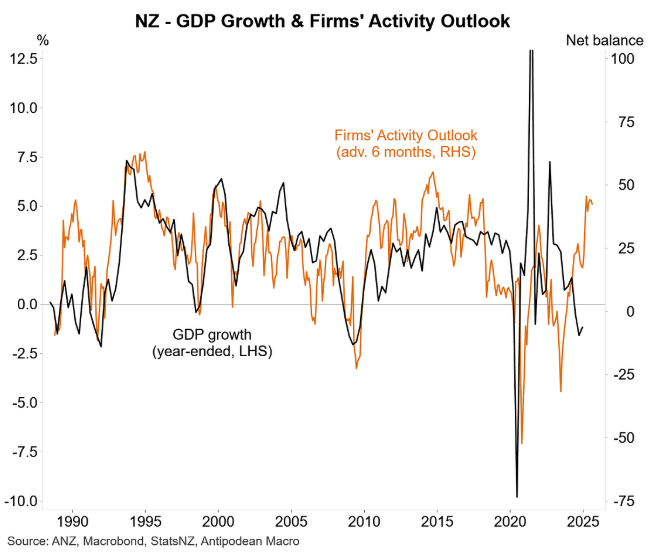

According to Justin Fabo, activity indicators suggest that the New Zealand economy will continue to improve in the upcoming quarters, provided that unfavourable global developments remain stable.

Before these results, major bank ASB forecasted that the Reserve Bank would cut the official cash rate (OCR) by 0.25% at the April and May meetings, lowering the OCR to 3.25%.

Such monetary easing would further stimulate New Zealand’s economic recovery.