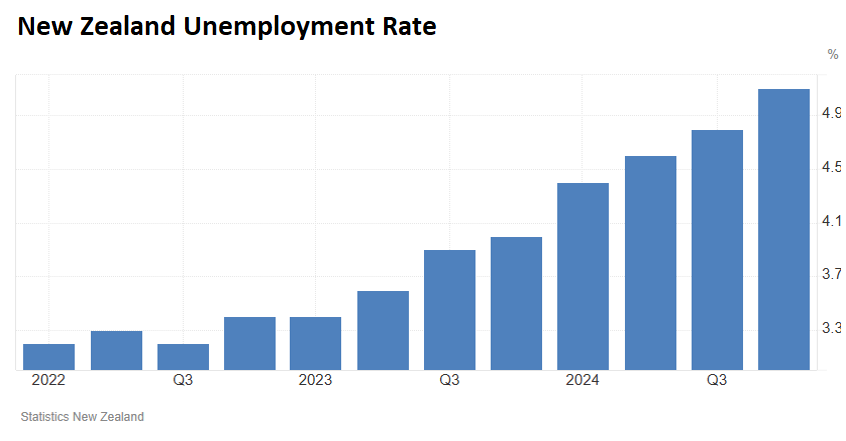

New Zealand’s unemployment rate increased to 5.1% in Q4 2024 from 4.8% in Q3 2024.

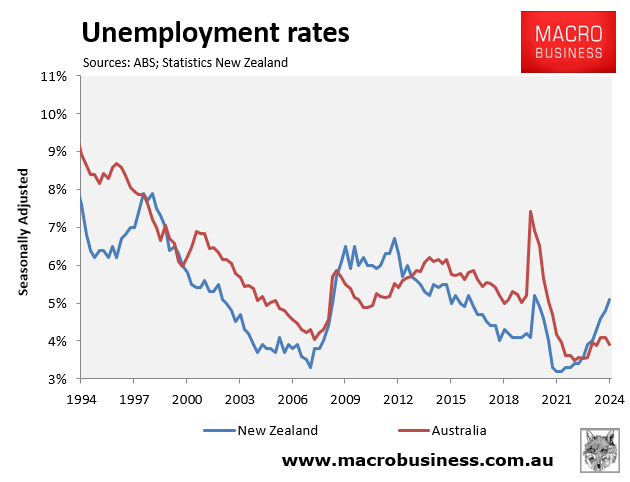

In comparison, Australia’s unemployment rate was 3.9% in the fourth quarter of 2024 (4.1% in January), the largest difference since Q3 2012.

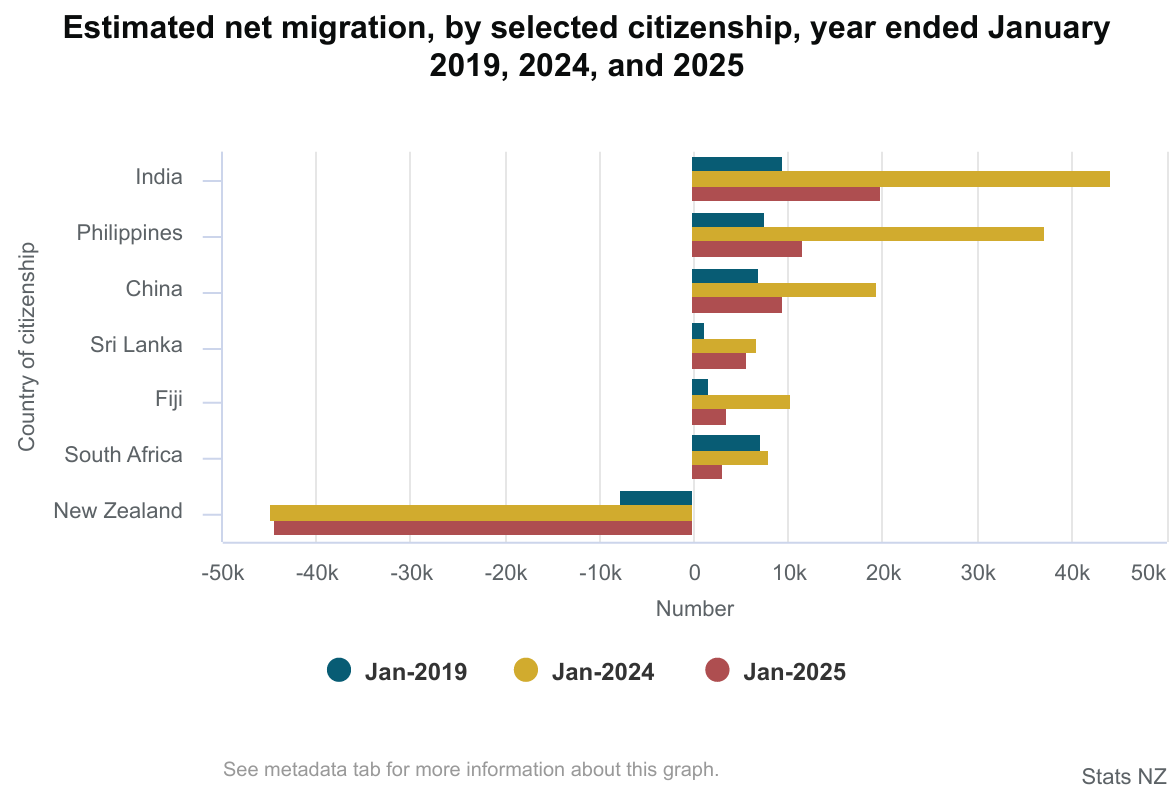

As a result, large volumes of Kiwis have left New Zealand for Australia.

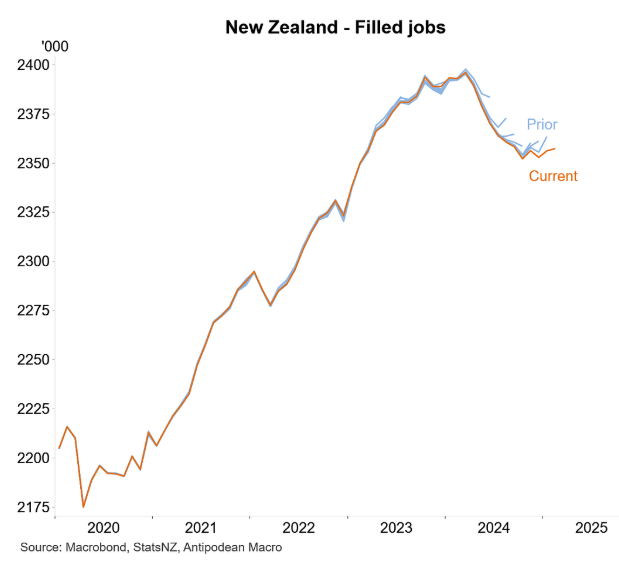

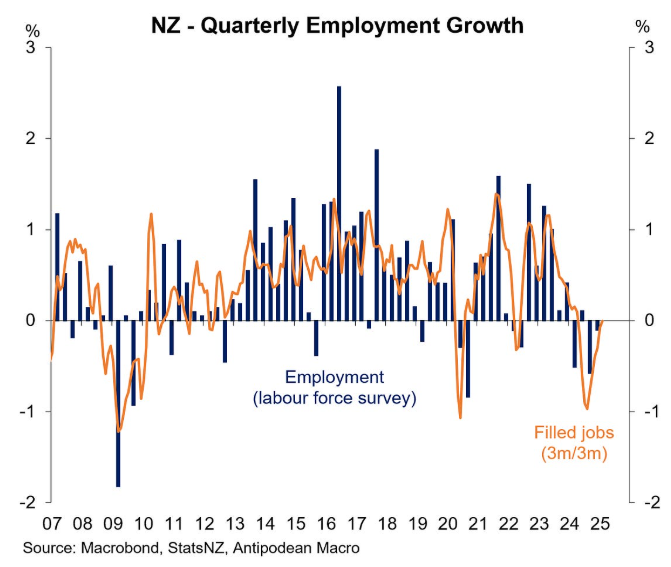

New data from Stats NZ, charted below by Justin Fabo from Antipodean Macro, shows that the number of payroll jobs, while having stabilised in recent months, was revised significantly lower in February.

The number of filled jobs has fallen significantly from its peak, down 1.5% from a year ago and 1.6% below its March 2024 peak.

The only positive is that the number of filled jobs has stopped falling.

Major bank ASB noted that “the trend level of filled jobs was flat on a 3-monthly average basis”. Moreover, “forward employment indicators—job advertising, hiring intentions from business surveys—have been portraying mixed signals, suggesting little prospect of a sustained jump in hiring just yet”.

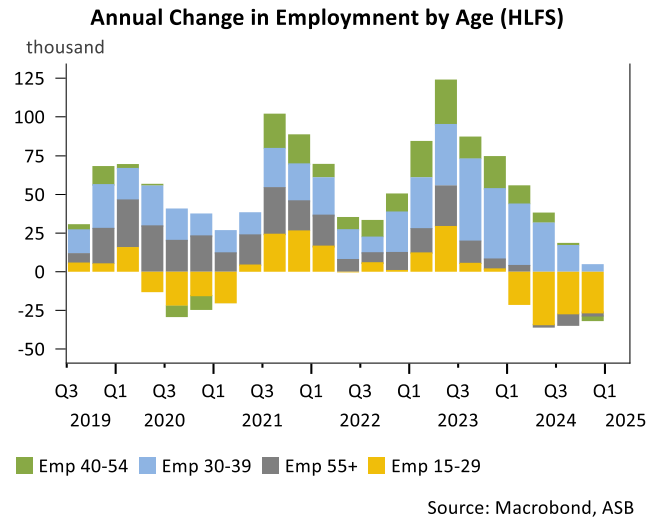

Young Kiwis continued to bear the brunt of job losses. Heavy annual falls were evident for the 15-19 age bracket (-9.9% YoY), with hiring down 3.2% YoY for those aged 20-24 and down 4.6% YoY for the 25-29 age group.

Indeed, ASB noted that more than 80% of the net jobs lost over 2024 were for employees aged under 30 and close to 40% of the net job losses being for those aged 15-19. This was despite the 15-29 age group constituting less than 30% of the working age population and just over one quarter of the labour force aged 15-64.

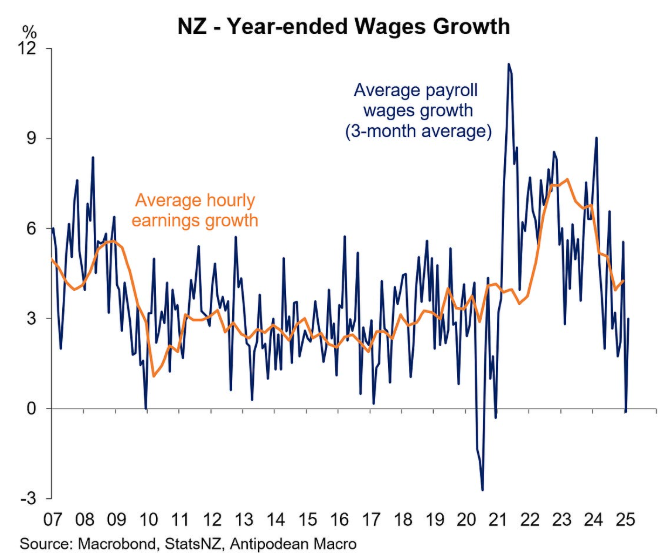

The decline in payroll jobs is reflected in wage growth, which has fallen heavily.

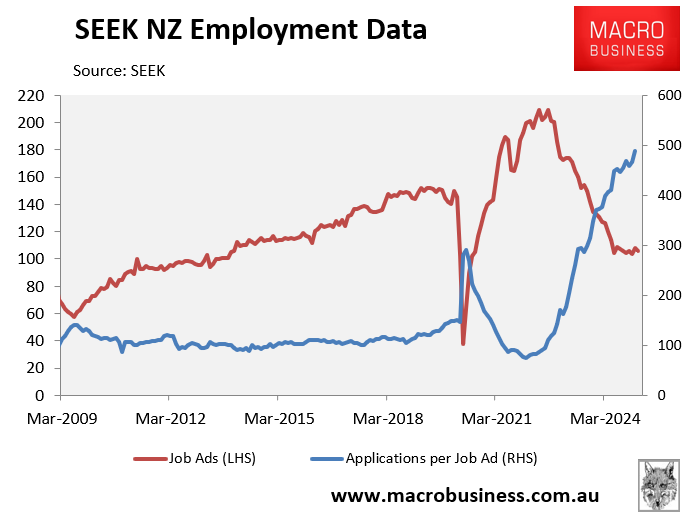

The latest SEEK employment data tells a similar story. The number of job ads has fallen heavily from the peak but has stabilised in recent months, whereas the number of applications per job ad hit a fresh high.

After two years of steady and significant decline in job ad volumes, the past eight months have been broadly flat”, noted Rob Clark, SEEK NZ Country Manager.

“While we may not be out of the woods yet, the days of significant, broad-based drops in worker demand should be behind us”.

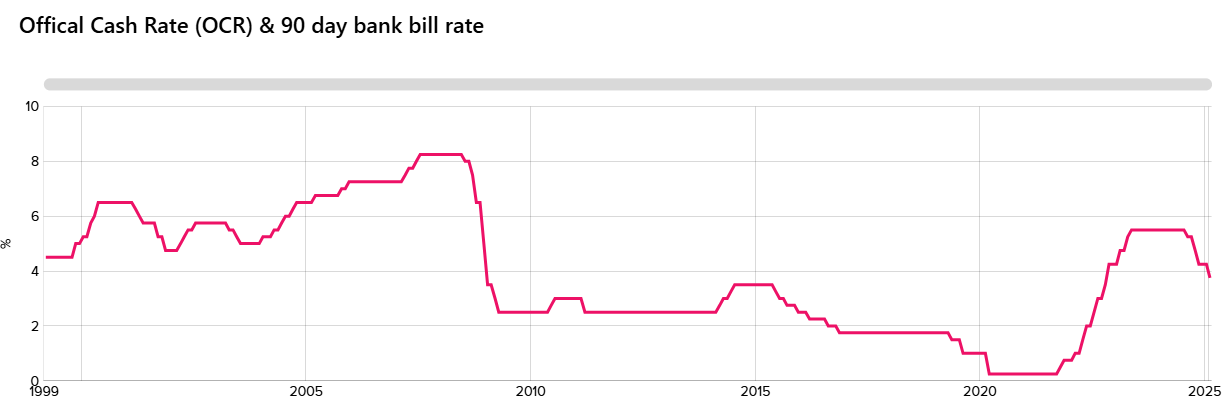

The Reserve Bank of New Zealand has reduced the official cash rate by 1.75% to 3.75% over the past six months.

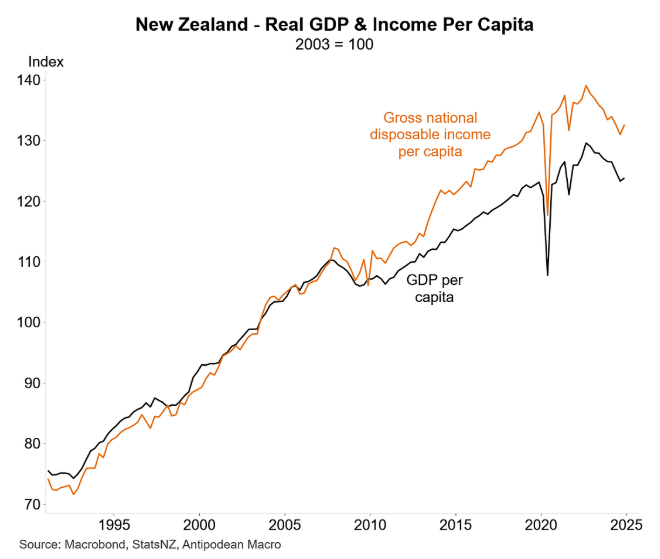

These interest rate cuts ended the economy’s recession, which was the worst (outside of the pandemic) since 1991.

Major bank ASB expects the Reserve Bank to cut the official cash rate (OCR) by 0.25% at the April and May meetings, lowering the OCR to 3.25%.

ASB argued that further rate cuts are a distinct possibility as the Reserve Bank “may have to shift from the policy brake to the accelerator if the economy fails to gain traction and the long-awaited turnaround in hiring later in 2025 fails to appear”.

Such monetary easing is necessary to stimulate New Zealand’s economic recovery and bolster employment.