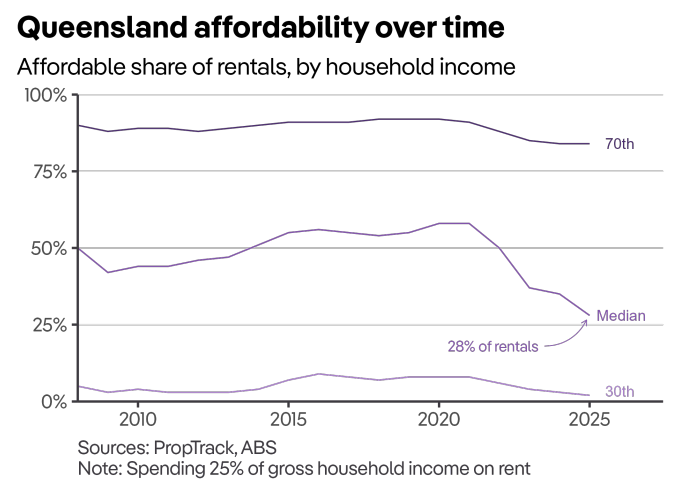

CoreLogic’s February housing market report contained the following graphic on dwelling value growth across Australia’s major capital cities.

Source: CoreLogic

As you can see, Brisbane dwelling values have soared by 69.7% over the past five years, whereas Melbourne’s have only risen by a comparatively modest 8.2%.

As a result, Brisbane’s median dwelling value was $894,425 as of 31 February 2025, $121,864 (16%) higher than Melbourne’s median dwelling value of $772,561.

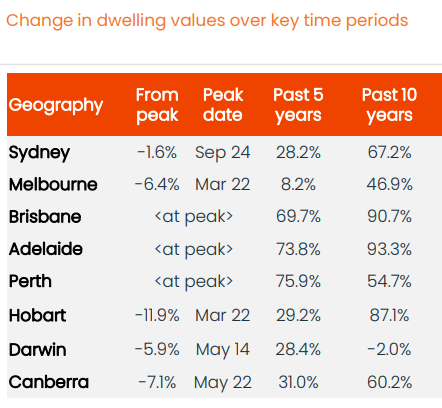

One reason Melbourne dwelling value growth has lagged is that investors have abandoned the state following increases in land taxes.

Data from mortgage broker Lendi, which also owns the Aussie Home Loans brand, shows that 95.1% of Victorian investor loans were used for purchases in the state in 2020, which fell to 90.7% by the end of 2024.

Over the same period, Victorian investors buying in Queensland grew from 1.7% to 4.2%.

The flood of investment dollars north has helped pump up Brisbane home prices.

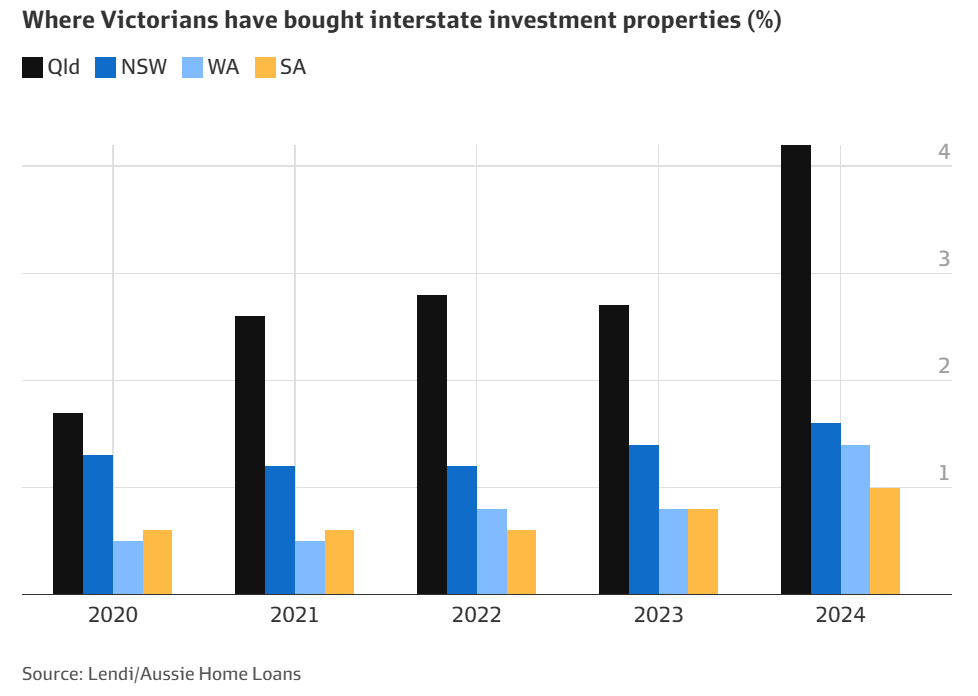

Queensland has also seen large numbers of Victorians migrate north since the beginning of the pandemic, which has driven up rents.

According to PropTrack, weekly rents in Brisbane and regional Queensland have increased by $230 and $240, respectively, since the start of the pandemic, equivalent to 50% and 54% growth, respectively.

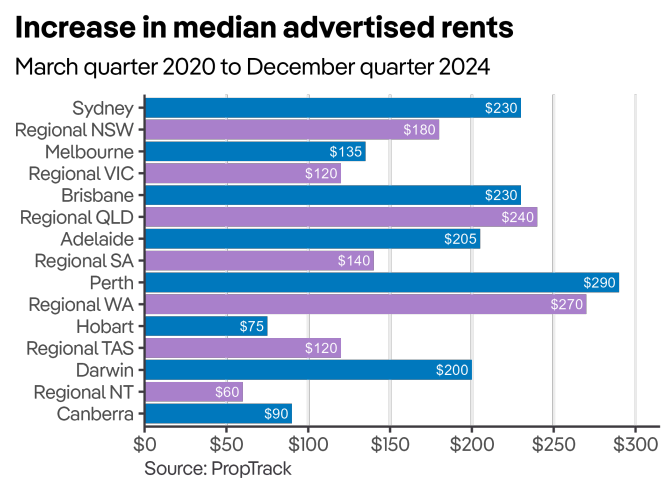

As a result, rental affordability has deteriorated sharply across Queensland.

A household in Queensland with a median income of $113,000 per year could rent only 28% of the properties advertised from July to December 2024. This declined from the already record-low in 2023-24 of 35%.