The Australian housing market is losing momentum following the stimulus bounce after the Reserve Bank of Australia’s (RBA) 0.25% interest rate cut in February.

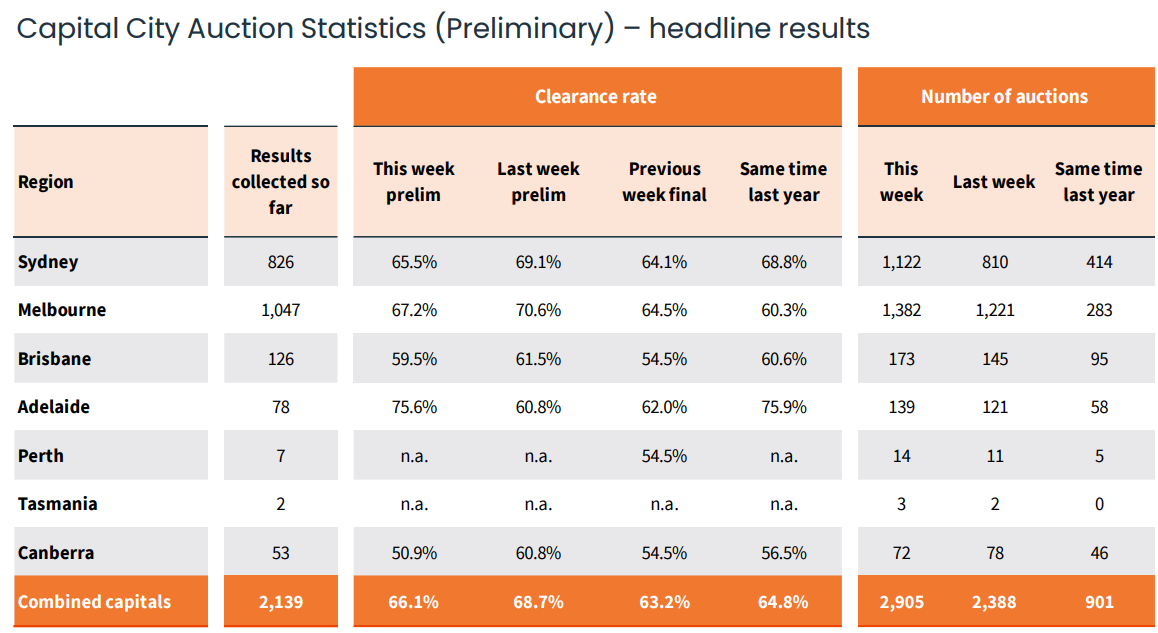

The weekend’s auction market recorded a preliminary clearance rate of 66.1%, which, according to CoreLogic, was the lowest outcome since the week prior to the rate cut (65.0% over the week ending 2 February 2025).

Source: CoreLogic

Despite the downtrend, auction clearance rates remain above the levels recorded late last year, when the preliminary clearance rate was stuck in the low 60% range.

After holding above 70% for the previous six weeks, Melbourne’s preliminary clearance rate declined to 67.2%, a 3.3-percentage-point decrease from the last week.

Sydney’s preliminary auction clearance rate dipped to 65.5%, following a trend of easing from the recent high of 76.6% reported during the week ending 16 February.

Although Sydney’s preliminary clearance rate remains above the December lows, which temporarily fell below 60%, this week’s preliminary auction clearance rate was the lowest since 15 December 2024 (63.0%).

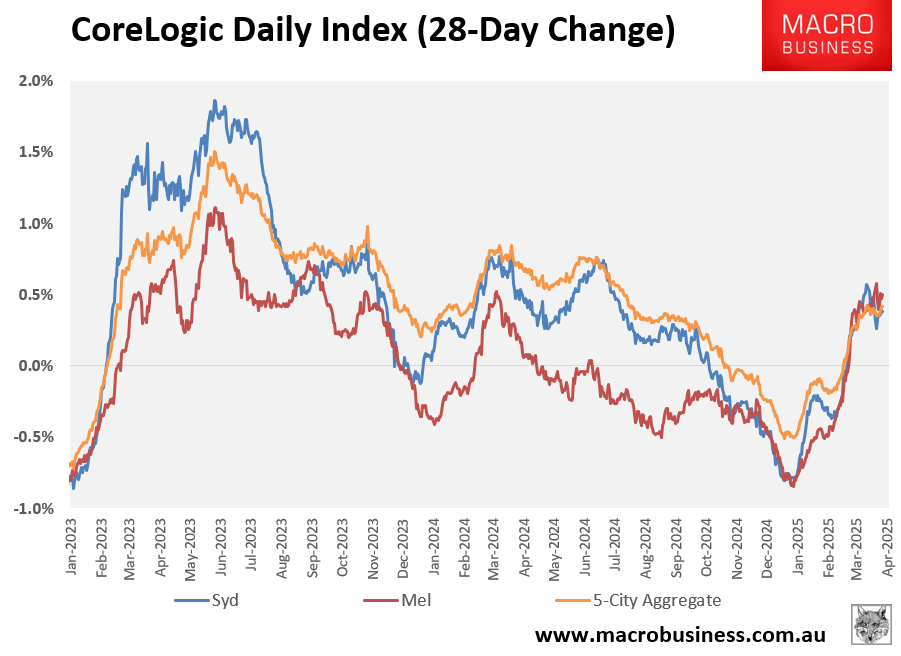

The downtrend in clearance rates is also reflected in price, with the rebound in CoreLogic’s daily dwelling values index stalling across Sydney, Melbourne, and the 5-city aggregate level.

The housing market needs another interest rate reduction to spur momentum.

Most economists expect the RBA to deliver its next 0.25% rate cut in mid-May, just after the federal election.

Expect the housing market to experience a post-election bounce.