CoreLogic’s preliminary auction results reported a clearance rate of 71.4% for Sydney. This was the sixth consecutive week that the preliminary clearance rate was above 70%.

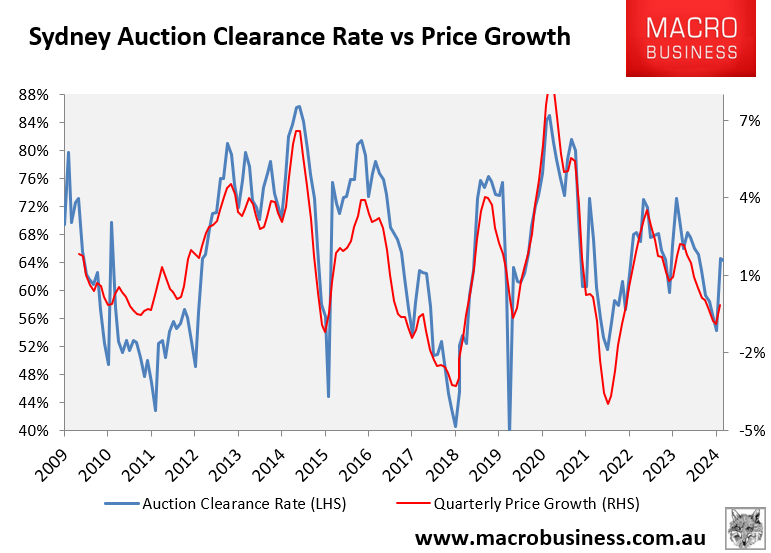

The following chart shows the strong rebound in final Sydney clearance rates since the beginning of the year.

Sydney’s final auction clearance rate has rebounded from an average of 57% in December to 64% in March.

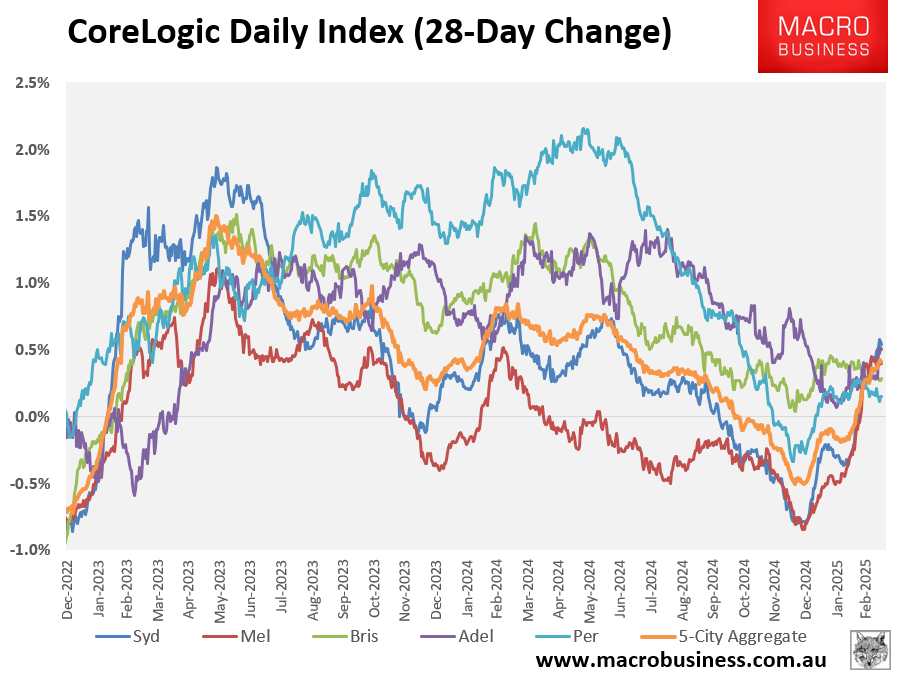

The rebound in the auction market has been reflected in CoreLogic’s daily dwelling values index.

Sydney has led the nation’s price rebound, recording growth of 0.5% over the past 28 days, the strongest growth of the major capital city markets.

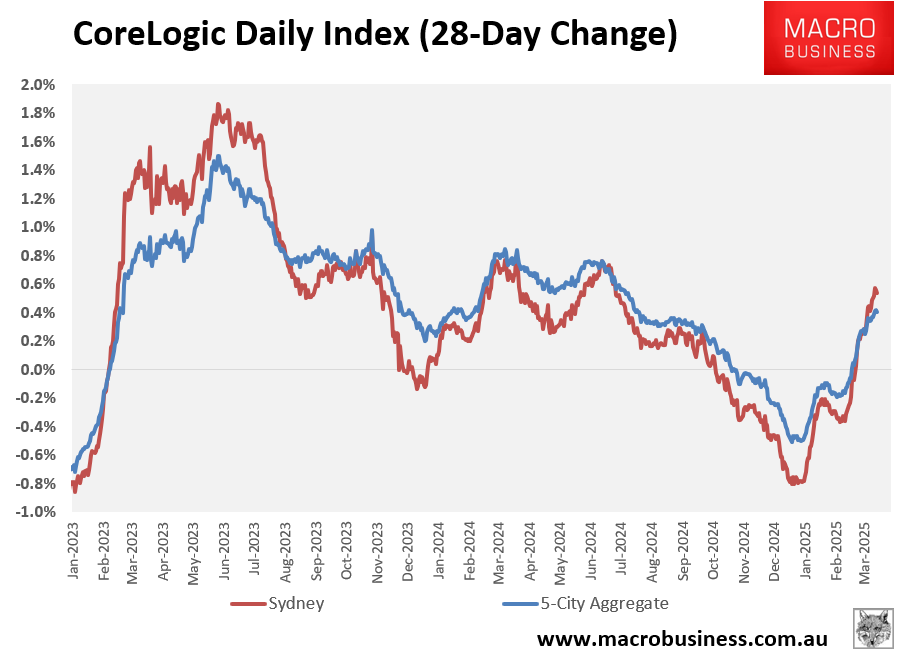

The following chart shows Sydney’s price rebound more clearly against the 5-city aggregate.

CoreLogic’s Tim Lawless commented over the weekend that buyers have “clearly responded positively post rate hike, moving from below average levels to about average levels”.

“There has been a real changing of the guard”, Lawless said. “Now, mid-sized capitals like Brisbane and Perth are sitting at the bottom of the list, while Sydney and Melbourne seem to be leading a mild recovery trend, which is a real turnaround from where those markets were pre-rate cut”.

Sydney is the nation’s most expensive market and should benefit the most from the three additional rate cuts expected this calendar year.