This is how catastrophic the East Coast gas cartel will become if left to its own devices.

Competition cop Gina Cass-Gottlieb has picked a fight with Australia’s top energy companies over data she says shows they are planning to increasingly use gas produced for domestic purposes to meet commitments to foreign buyers.

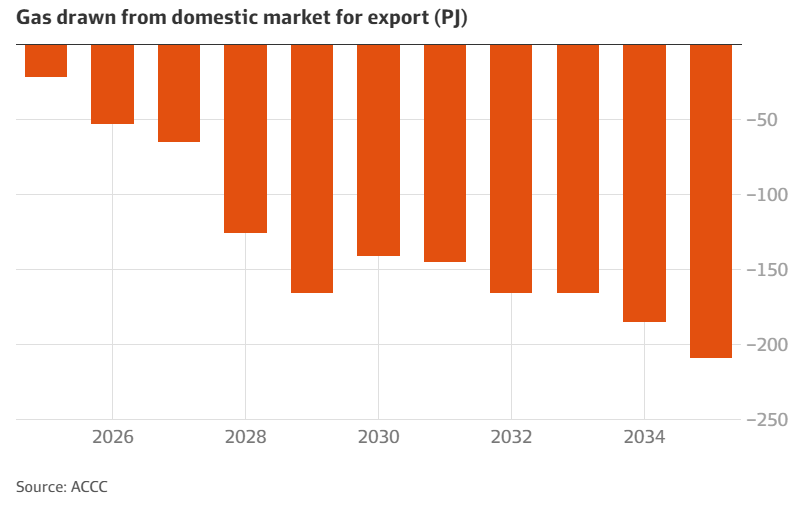

Queensland’s three major LNG exporters are forecast to collectively source 10 times more gas annually from the domestic market in 2035 than they will this year, according to previously unreported figures published by the Australian Competition and Consumer Commission.

According to the new ACCC figures, the exporters in 2025 plan to supply 156 petajoules of gas to the domestic market to meet commitments made to local consumers but will buy 178 petajoules from third-party sources, meaning on a net basis they will draw 22 petajoules from east coast supplies.

The companies expect the net shortfall to balloon to 209 petajoules by 2035. By contrast, in 2018 the Queensland producers made a combined net contribution to the east coast market of 90 petajoules.

What is perhaps most galling about this is that it will coincide with the runoff of export contracts.

That is, this gas will be sold into the Asian spot market. There are no broken contracts or “soverign risk” in stopping it.

There is no way known that Australia can allow these contracts to be renewed or for the volumes to be shipped as spot sales.

As well, this gives you an idea of how easy it will be for the export cartel to drive the price to import parity when LNG imports begin.

In this scenario, within ten years, we would need two LNG import terminals running at two-thirds capacity all day, every day.

The Australian gas market would be gone, substituted by the international gas market price, plus the currency adjustment, plus the importer margin.

That price is still about $20Gj today, despite the looming international glut. 50% higher than the local price. And it means we are exposed to every global gas or currency shock everywhere, every day.

This is national economic suicide.

The alternative is that the LNG export plants run at two-thirds capacity and Australia consumes its own gas for $7Gj.