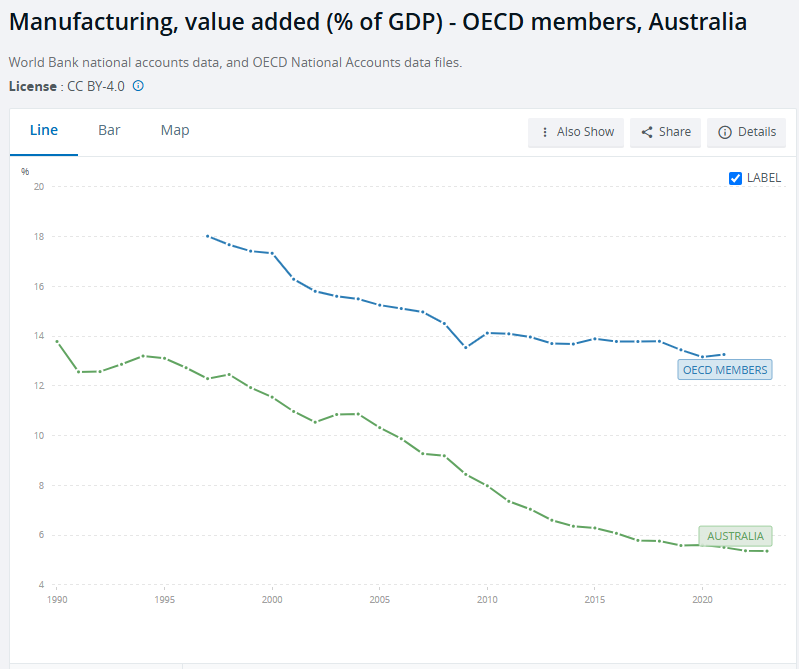

As we know, Australian industry has been dying for decades. So much so that we are leading the OCED into industrial oblivion.

Now, the death of Australian industry is at hand. Bloomberg.

Near the Indonesian city of Surakarta, a one-time royal capital on the island of Java that’s long been known for producing elaborate fabrics, dozens of once-bustling garment factories sit empty behind locked gates.

At a coffee shop not far from the plant where he was employed for more than three decades, 53-year-old Hariyanto blamed cheap imports from China for the economic devastation. One of about 1,500 employees furloughed at an apparel maker last year, the former low-level manager is now leading a legal fight to get back pay and severance from the company, which is financially stressed and looking to sell off assets.

“I’m worried China could pressure the government to accept the current conditions,” Hariyanto, who like many Indonesians goes by one name, said on a scorching day in February. “If a company goes down, it’s more than just those they employ who feel it,” he added. “It impacts every part of the community.”

…“This is China Shock 2.0 or China Shock 3.0,” says Gordon Hanson, a professor of urban policy at the Harvard Kennedy School and one of the authors of the research paper that coined the name of the phenomenon. “China has this immense manufacturing capacity, and the goods have to go somewhere.” The lesson from the US experience, he added, is that “there’s a political response to all this. People get mad.”

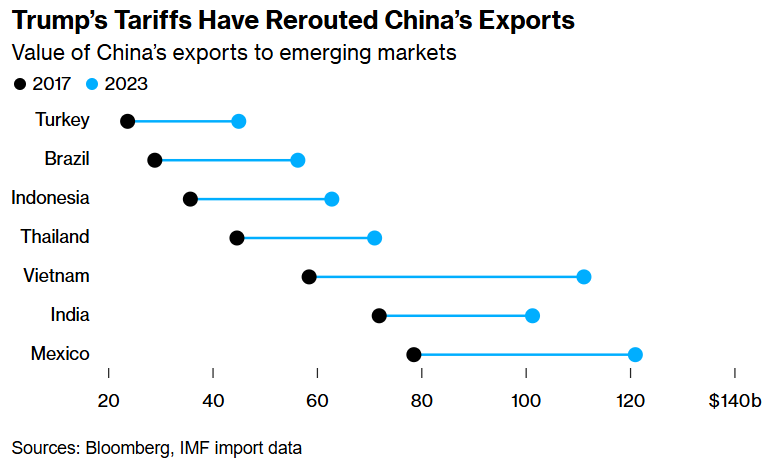

The hollowing out of local economies in the American heartland helped lead to the rise of Donald Trump as a political force. Seeking to rebalance US-China trade and bring manufacturing jobs home, Trump imposed tariffs on China during his first term that were kept in place by the Biden administration. Chinese manufacturers priced out of the US had to search for alternative markets, while some moved production to other countries to evade duties.

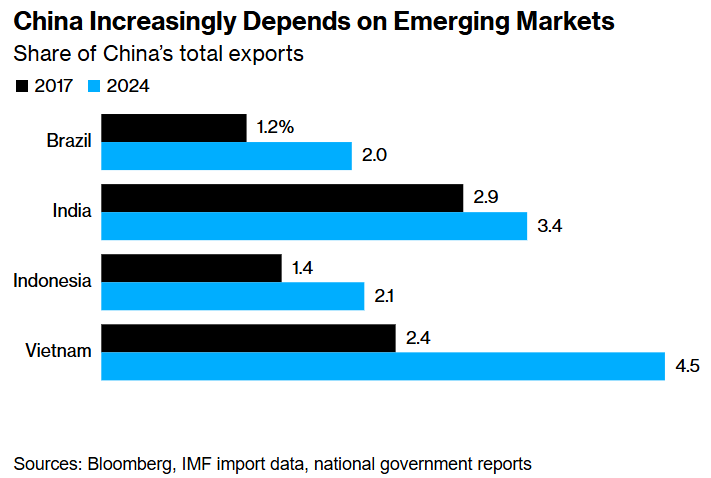

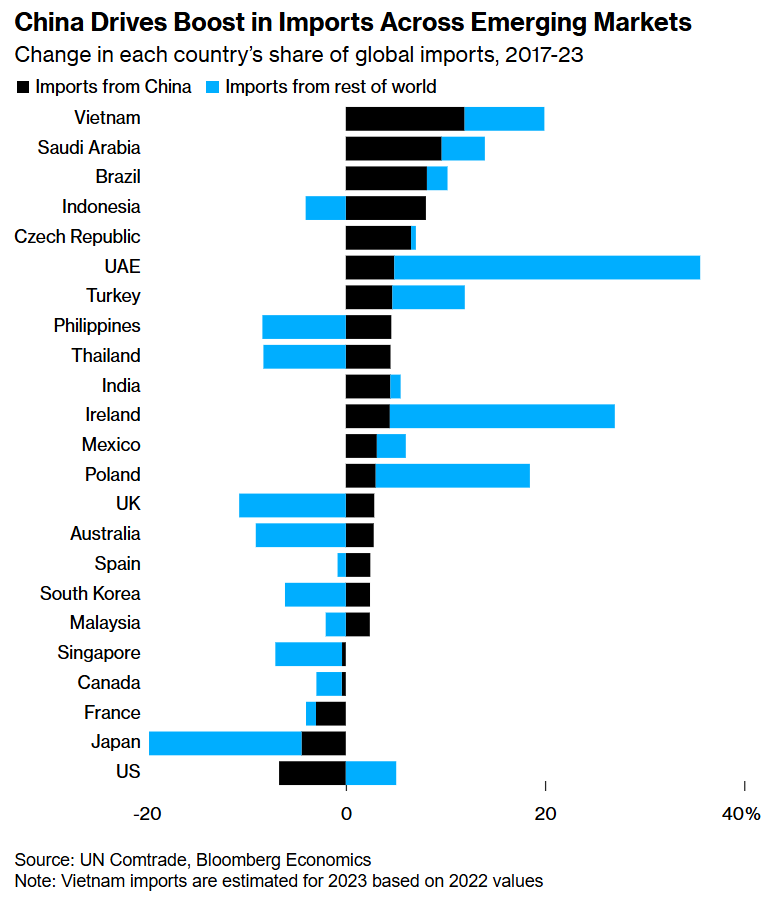

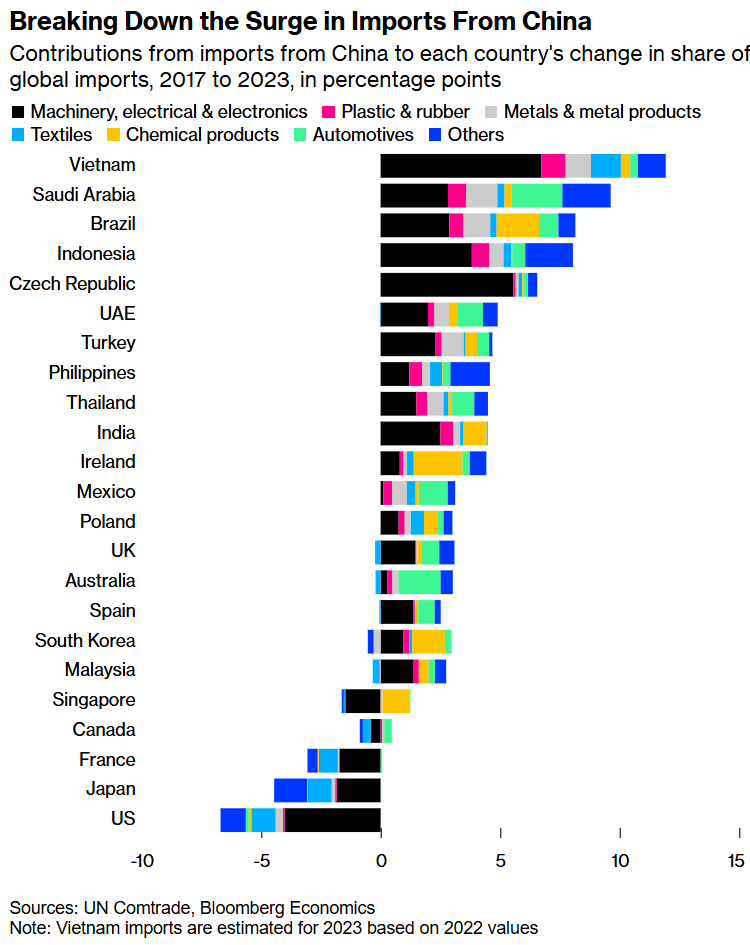

Research by Bloomberg Economics shows that China has roughly managed to maintain its share of global exports despite a big drop in its share of total US imports since Trump’s first term. Since 2017, many emerging economies have seen their purchases from China increase substantially, taking its manufactured goods trade surplus to historic heights.

…Pressure is mounting for governments to take action. Mexican President Claudia Sheinbaum this month said her country would review tariffs on Chinese shipments, linking growing violence in places such as central Guanajuato state to large-scale job losses in its shoe and textile industries.

…In Indonesia, officials are similarly reluctant to criticize China despite the mounting job losses in the garment sector. China accounts for more than a quarter of the nation’s overall trade—about three times as much as any other country. Xi’s government has also helped Indonesia build high-speed rails and is investing large sums in the country to process minerals, helping with the government’s strategy to move up the value chain.

So far, a lot of rerouted supply chains have been to get around Trump tariffs 1.0. Not this time, as Mexico and other transit nations are forced to hike tariffs as well.

That means this is going to be one hell of a goods price smash Downunder. Like Indonesia, Australia is far too cowardly to impose tariffs on China.

Any import-competing industry not bolted down will be swept offshore over the next few years, with the gas cartel adding the shove to China’s push.

It is hilarious that we are going to combat this with a government-sponsored program to assemble Chinese components into solar panels.

The only industry left standing in a few more years will be government-sponsored strategic operations, like Whyalla and defence.

More broadly, given the Chinese economy is collapsing inwardly at the same time with bulk commodity prices falling much further ahead, Australia will be hollowed out across the board.

How will Canberra respond?

Get ready for an immigration surge the likes of which we have never seen, no matter who is in power.