The Victorian government’s financial troubles are widely documented.

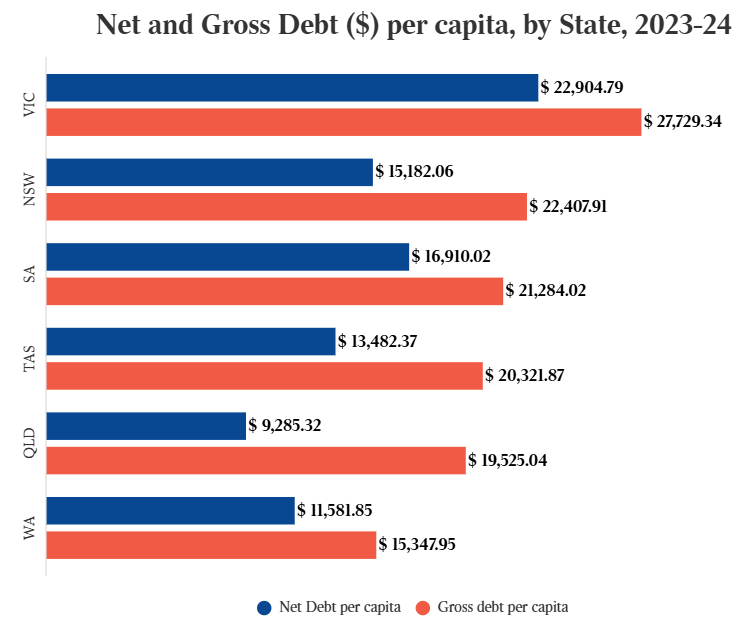

In 2023-24, the state had the nation’s highest per capita net debt and the lowest credit rating (AA).

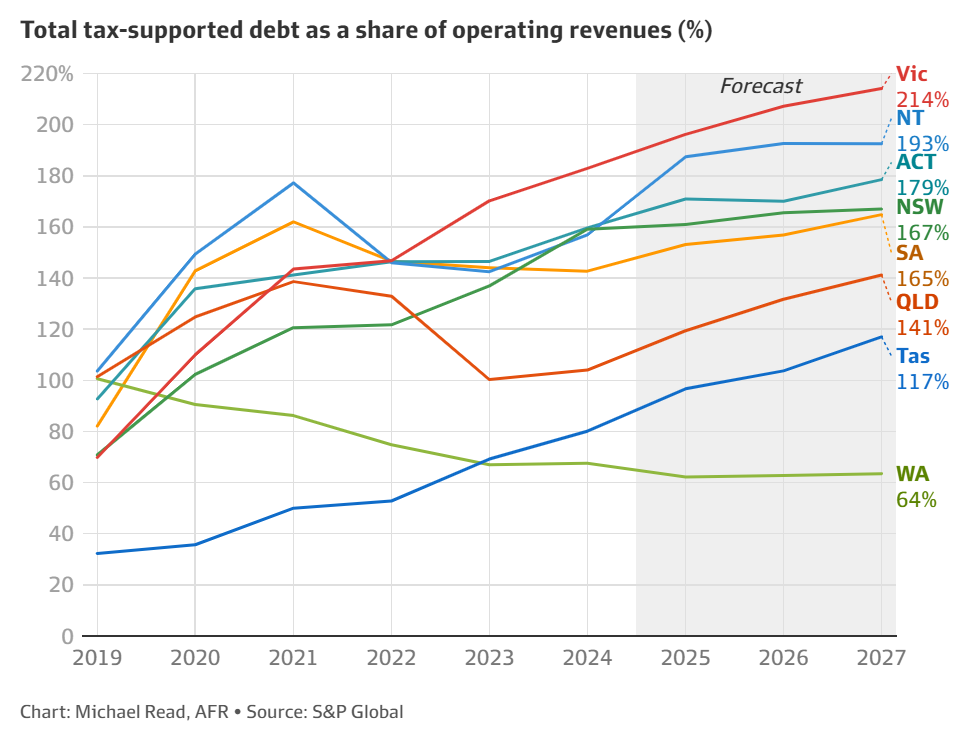

The trend growth in Victoria’s debt is equally alarming.

The two leading international rating agencies, S&P and Moody’s, warned that if debt levels are not managed, Victoria’s credit rating may be further downgraded.

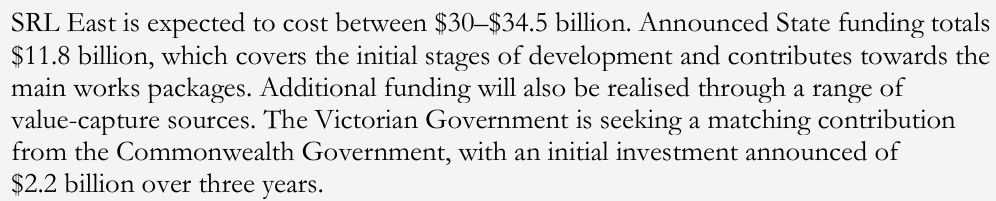

Further downgrades seem inevitable given that the Victorian Budget for 2023-24 specifically stated that it expects the federal government to provide “a matching contribution” to the first stage of its Suburban Rail Loop (SRL) project, which the federal government has declined to fund beyond the already committed $2.2 billion.

Source: Victorian Budget 2023-24

As a result, the Victorian government’s funding shortfall for the SRL is $9.3 billion.

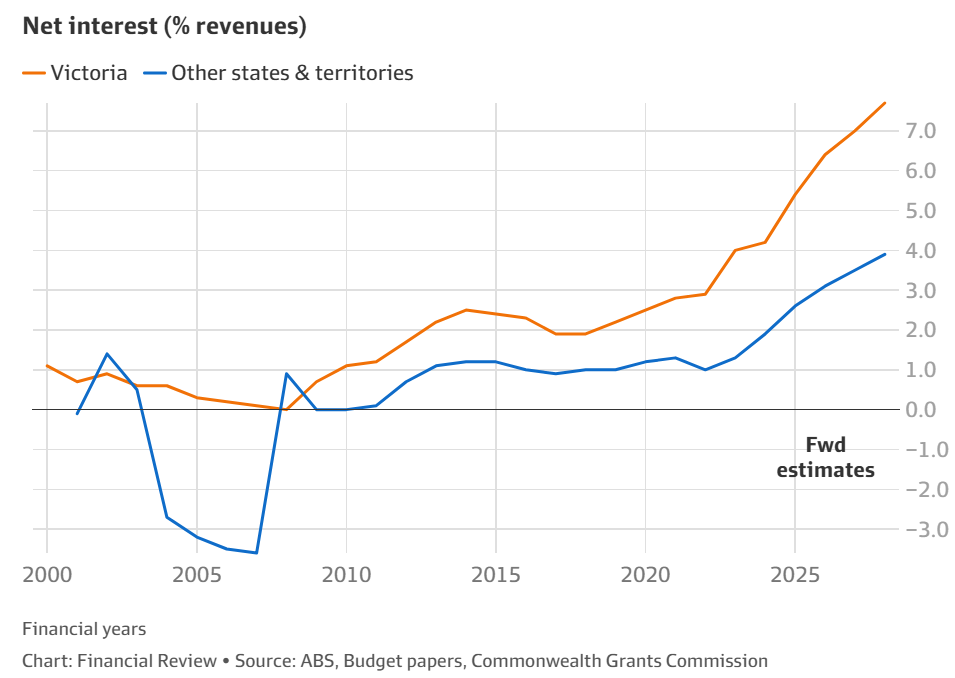

Once Victoria’s credit rating is cut, interest payments on its massive debt will rise even further, necessitating additional tax increases and/or budget cuts to compensate.

The Victorian government’s financial troubles have spread to businesses throughout the state.

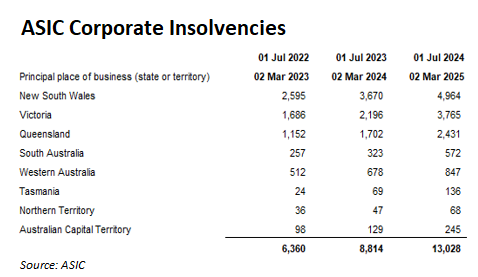

The Australian Securities and Investments Commission (ASIC) has reported that Victoria posted the most substantial growth in insolvencies among the larger states.

As illustrated above, Victorian corporate insolvencies rose 71% annually in the year to 2 March 2025, well above the 35% increase recorded in NSW and the 43% increase in QLD.

The release of the figures follows contractor Roberts Co. closing its Victorian doors and construction company John Hollands posting a $55.5 million loss for the year to 31 December on the back of cost blowouts on two Victorian infrastructure projects.

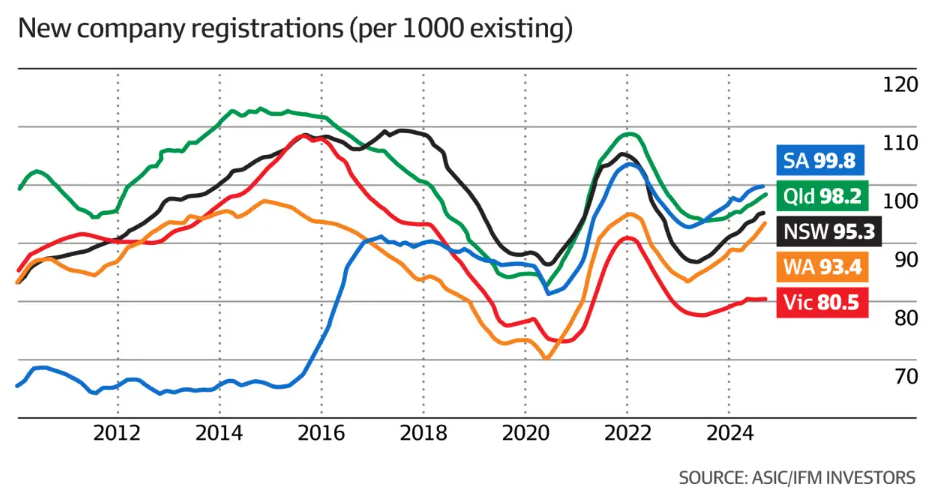

Separate ASIC data also showed that the average number of new businesses registered per 1,000 existing firms was 80.5 in Victoria in the year to Q3 2024.

This compared poorly to 99.8 in South Australia, 98.2 in Queensland, 95.3 in NSW, and 93.4 in Western Australia.

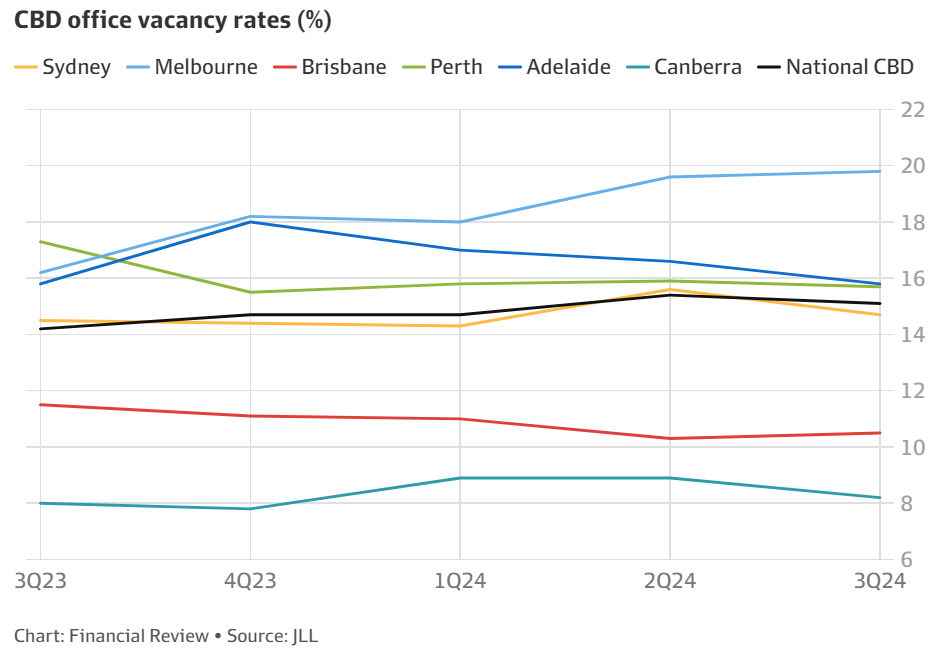

Melbourne’s CBD office vacancy rate also rose to nearly 20% in Q3 2024, well above the other capitals that recorded falling office vacancy rates.

“You just need to walk around the City of Melbourne to see how far we have declined. Every lease sign and vacant shopfront is a story of heartache and despair for the business owner who used to have a shop there”, said independent mayoral candidate Arron Wood.

“Over the last 20 years, Victoria has gone from being one of the country’s richest states to being down there with South Australia and Tasmania, as one of its poorest”, Saul Eslake added.

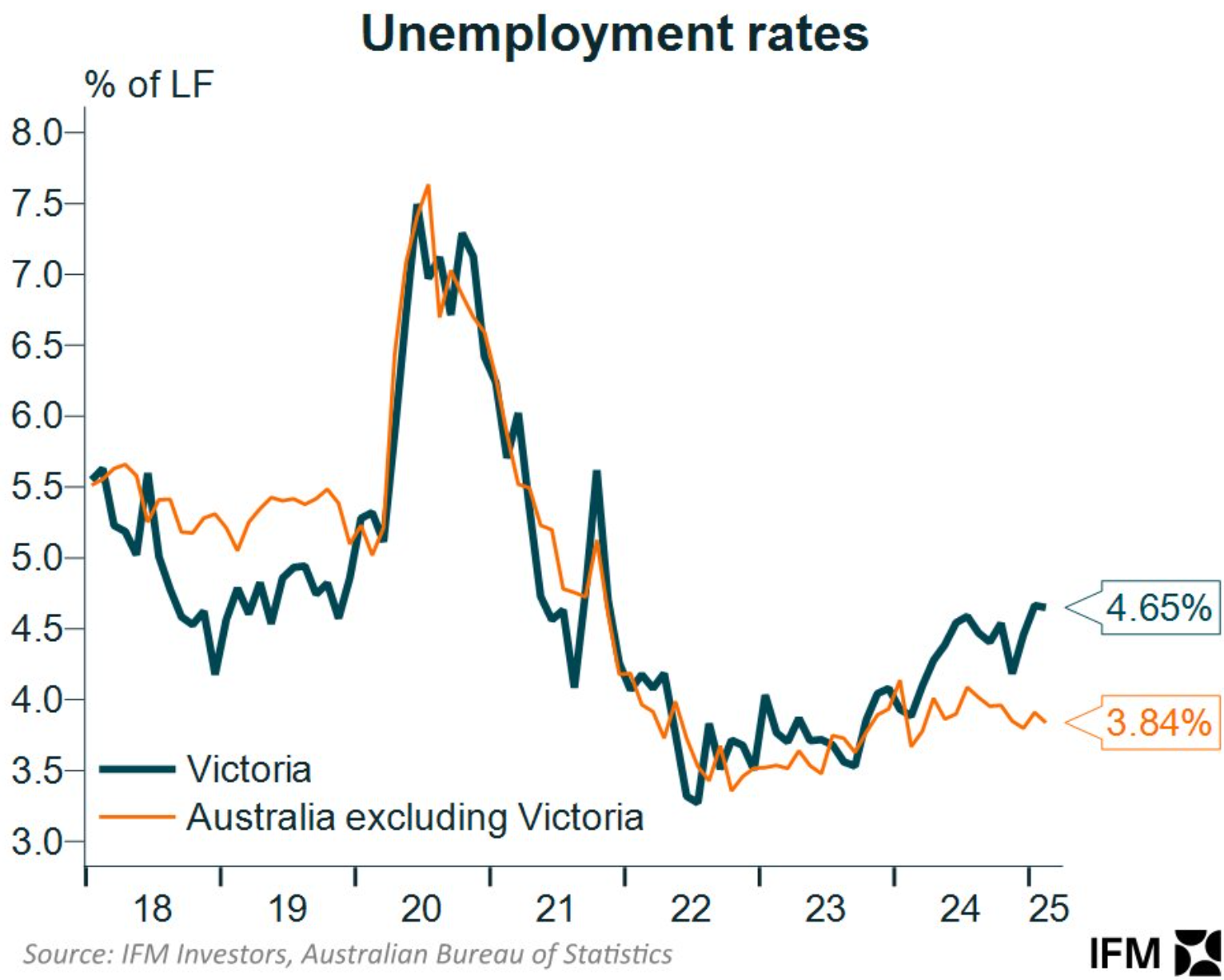

Finally, Victoria’s unemployment rate is the worst in the nation.

In summary, Victoria has transformed into Australia’s bankruptcy capital.