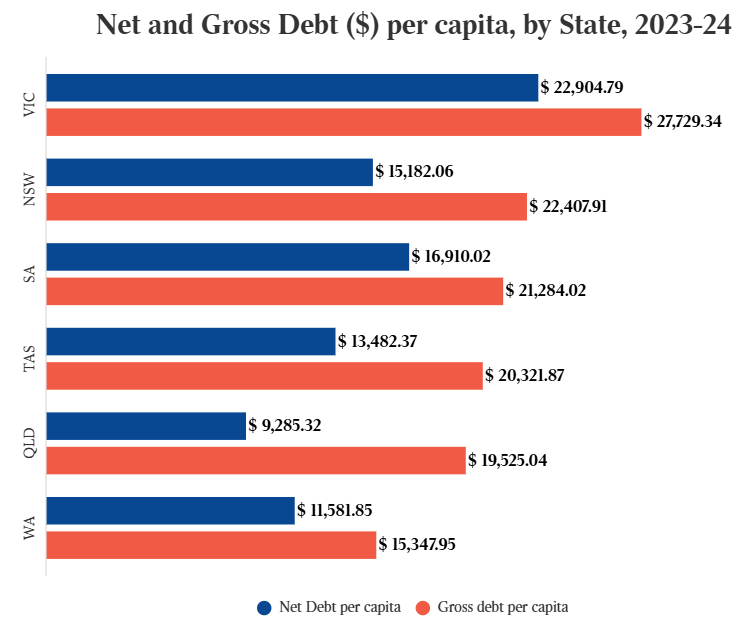

Last year, former federal Treasury official Stephen Anthony warned that Victoria could require a federal “bailout” amid soaring state debt, which hit $27,729 per person in 2023-24.

“Victoria is on a suicide mission to record borrowing, just as global interest rates are about to hit 5%”, Anthony warned.

“Potholes can’t get filled, emergency departments can’t afford clean linen, primary schools can’t fix heaters”.

“Things are about to get very ugly”, he said.

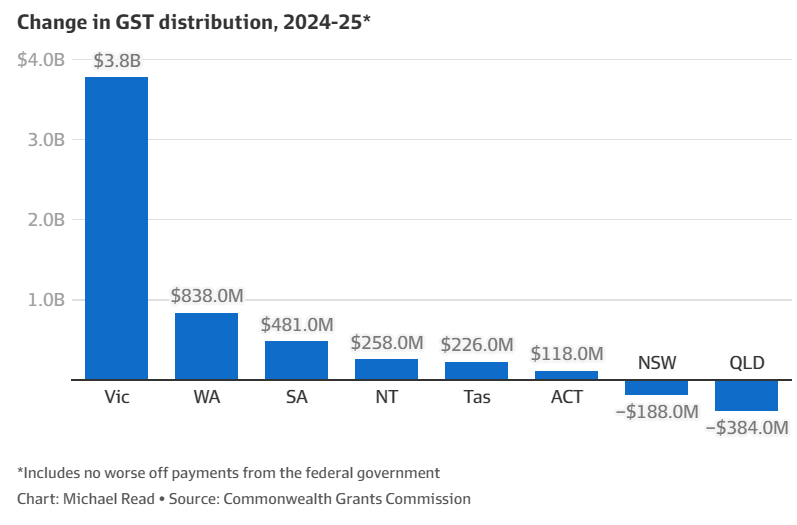

The federal government had already effectively bailed out Victoria by handing it $3.8 billion in additional GST revenue in 2024-25, whereas NSW lost $188 million.

Last year’s GST carve-up angered NSW Premier Chris Minns, who derided Victoria as a “welfare state”.

Victoria also received an additional $411 million in grants from the Commonwealth last year.

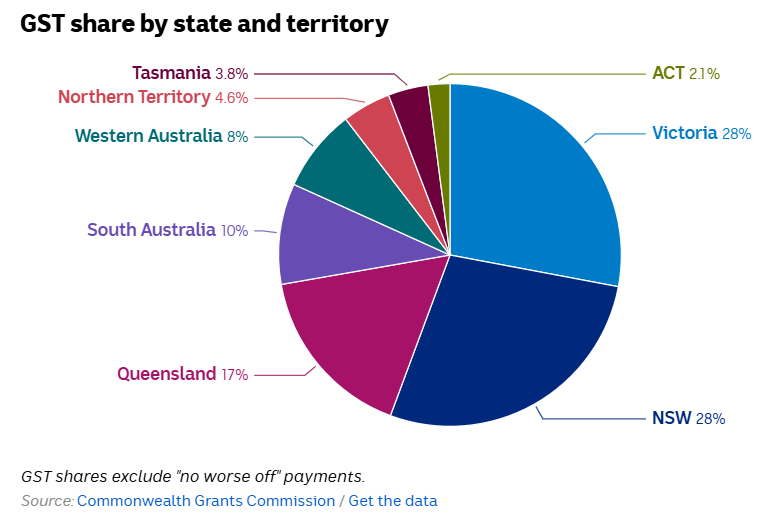

An update to the GST carve-up has shifted Victoria from being a “lifter” to a “leaner”, driven by strong population growth and an underperfoming economy.

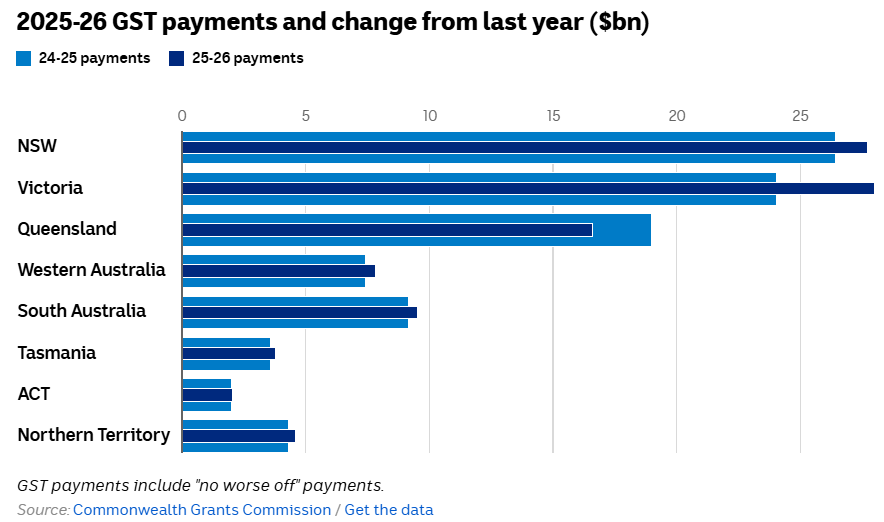

Victoria’s GST revenue will rise by $3.7 billion from last year, increasing its portion from 24.8% to 27.5% of the entire GST pool.

“Victoria’s GST distribution is estimated to increase significantly from last year”, the Commonwealth Grants Commission confirmed.

“This is largely driven by its lower capacity to raise mining revenue relative to the main mining states and its higher relative state population growth”.

“Victoria’s assessed GST needs also increased substantially because of the change in the method for assessing COVID-19 health and business support expenses”.

When the GST was implemented in 2000, Victoria earned 85 cents for each dollar raised.

Last year, Victoria’s share increased to 97 cents for every dollar.

This latest carve-up will see Victoria tip to the opposite side of the ledger, collecting $1.07 for every $1 raised.

The 2023-24 Victorian Budget stated that it expects the federal government to provide “a matching contribution” to the first stage of its Suburban Rail Loop (SRL) boondoggle, which it inked contracts to build against the explicit advice of infrastructure experts.

Source: Victorian Budget 2023-24

Therefore, it appears that all Australian taxpayers are responsible for the Victorian government’s financial incompetence.

The Victorian government is probably aware of this, which is why it is willing to pursue wasteful projects and spending knowing full well that the expenses would be borne, at least in part, by the federal government.

Economists and actuaries call this type of behaviour “moral hazard”.

That is, an economic actor (in this case, the Victorian government) has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong.