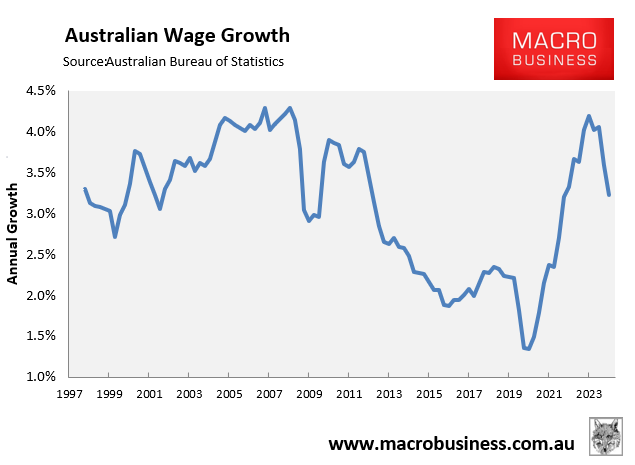

Last month, the Australian Bureau of Statistics (ABS) released the Q4 2024 wage price index, which increased 0.7% for the quarter and 3.2% year on year.

The 0.7% quarterly increase was the equal-lowest growth rate since Q1 2022, while the 3.2% annual increase was the lowest since Q3 2022.

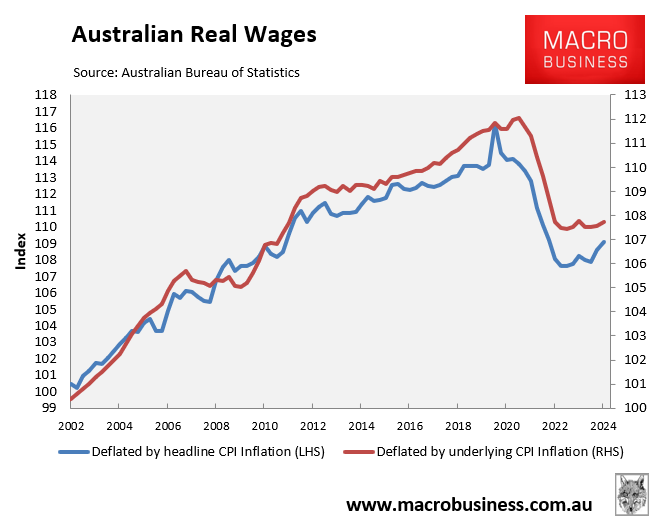

Real wages deflated by headline CPI were 6.2% lower than their peak in Q2 2020, but have recovered marginally as headline inflation has fallen due to energy and rent subsidies.

Real wages, deflated by underlying inflation, were 3.8% below their peak in Q2 2021 and have been stagnant for eight consecutive quarters.

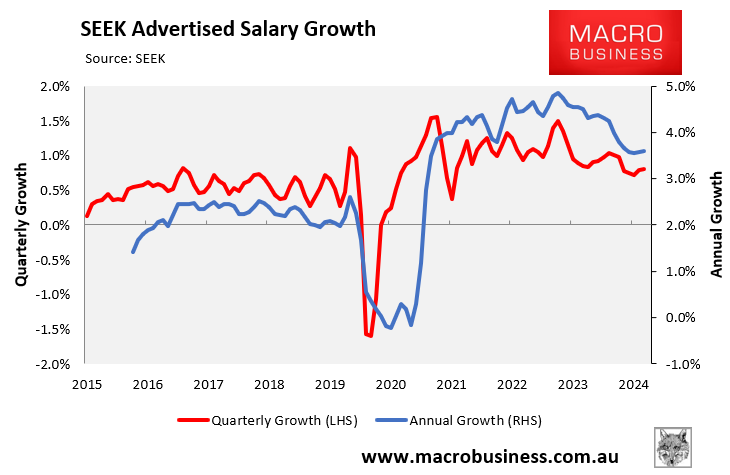

On Thursday, SEEK released its advertised salary index for February, which rose by only 0.3% over the month.

The quarterly increase was 0.8%, and annual growth was 3.6%, down from 4.5% a year earlier.

“Advertised salary growth has been slowing alongside a loosening labour market, with annual growth down 1.3% from its peak in September 2023”, noted Blair Chapman, Seek’s senior economist.

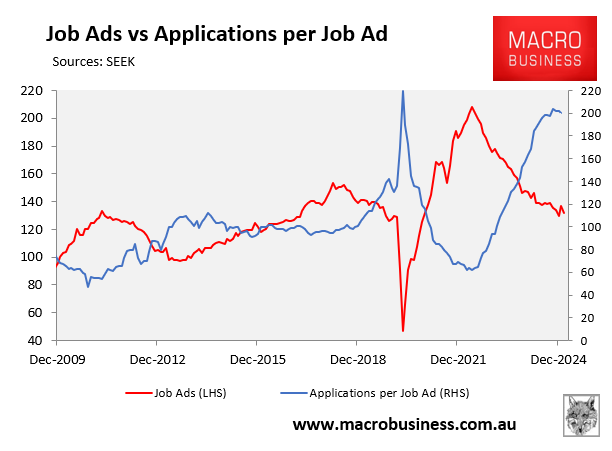

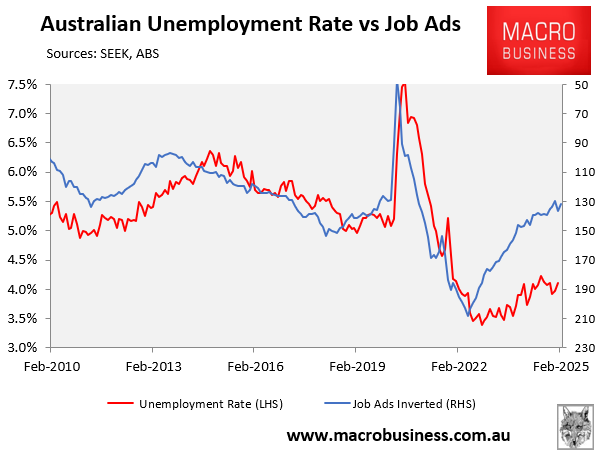

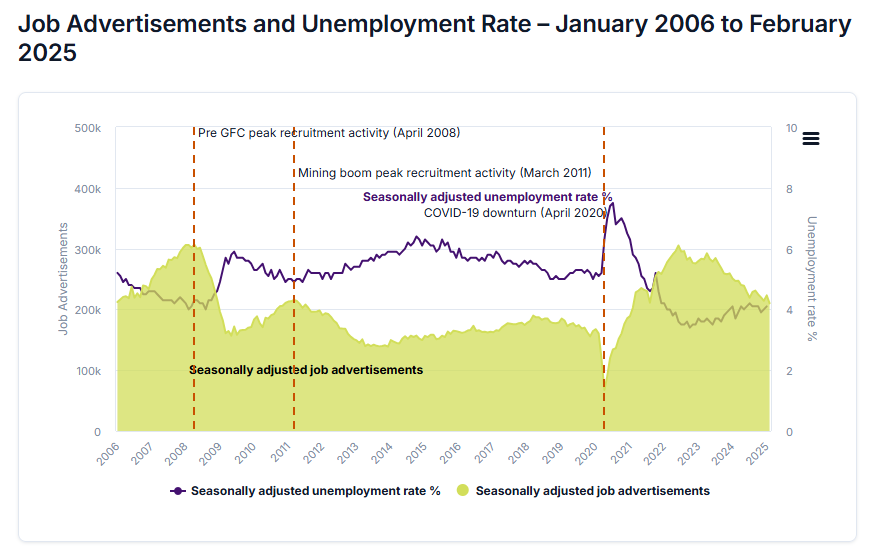

Separate Seek data on job ads and applications per job ad shows that the labour market’s tightness has eased.

This easing should result in a gradual rise in the unemployment rate and slower nominal wage growth.

Jobs & Skills Australia’s Internet Job Vacancies Index also declined by 5.9% (or 13,200 job advertisements) in February to a new cyclical low.

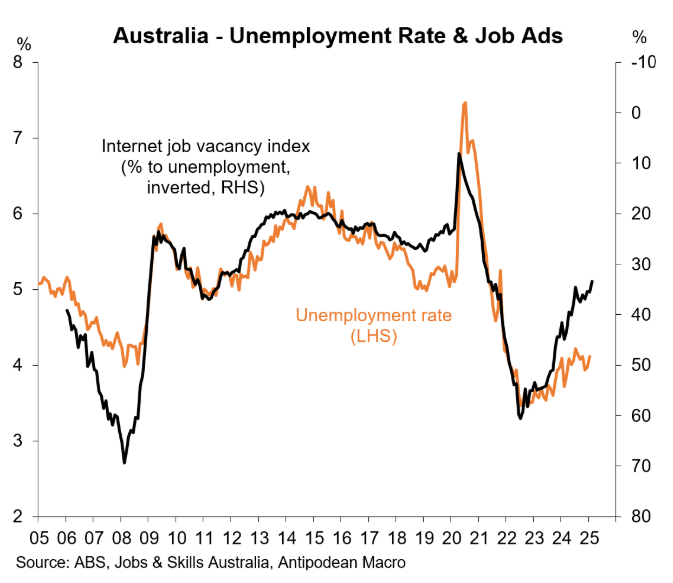

As shown below by Justin Fabo from Antipodean Macro, the decline in the Internet Job Vacancies Index is also pointing to rising unemployment.

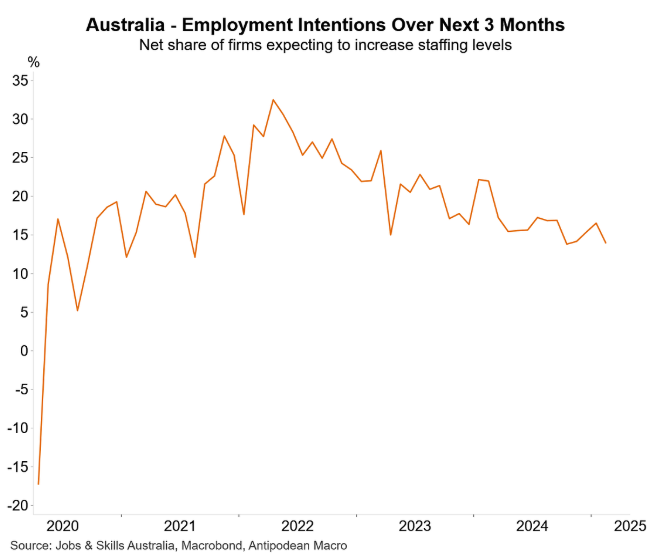

Fabo also showed that the net share of Australian firms surveyed in February expecting to increase staffing levels was around recent lows.

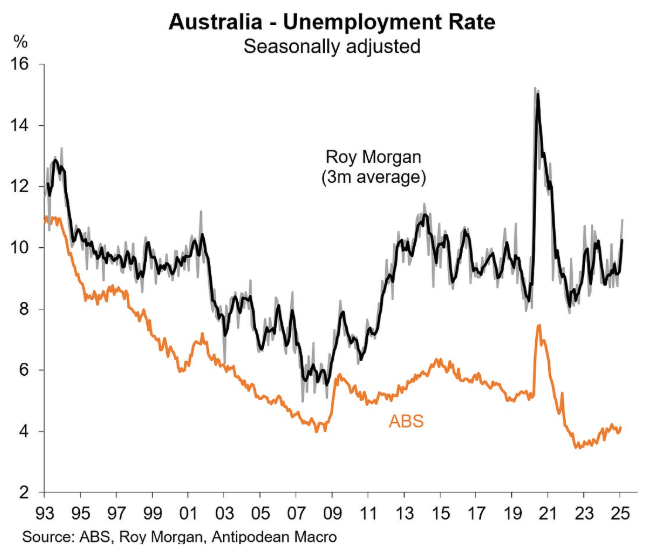

Finally, as noted yesterday, Roy Morgan’s unemployment indicator has also trended higher.

This data should please the RBA as it suggests that wage inflation pressures are likely to ease.