While Australia’s two major parties are busy blowing the world’s largest house price bubble, New Zealand’s politicians are letting their house prices slowly deflate, restoring affordability.

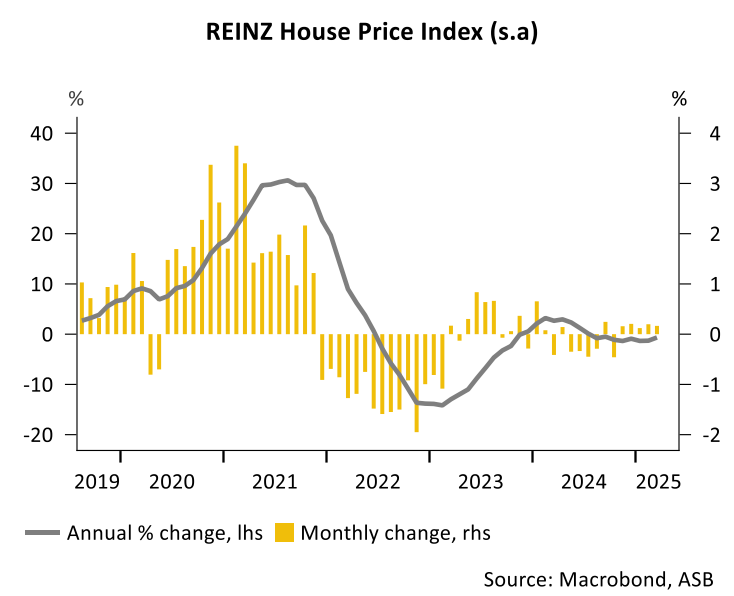

The REINZ house price index remained muted in March, rising 0.2% over the month to be 0.4% lower than a year ago.

Major bank ASB noted that New Zealand remains well supplied with homes amid softer demand, driven in part by lower immigration.

“The high supply and cooling demand have shifted the market balance back towards buyers, and it has remained there”, ASB wrote. “Since July 2023, supply has been steadily increasing”.

“This shift has been a crucial factor in turning the market around. The latest data from realestate.co.nz (March) shows that the number of unsold homes listed in New Zealand has more than doubled since the last peak of late 2021, reaching about 33.8k (seasonally adjusted)”.

“The primary reason for the subdued market is the imbalance between demand and supply. Supply levels continue to rise, while demand remains weak due to the softer labour market and easing (but stabilising) migration”, ABS wrote.

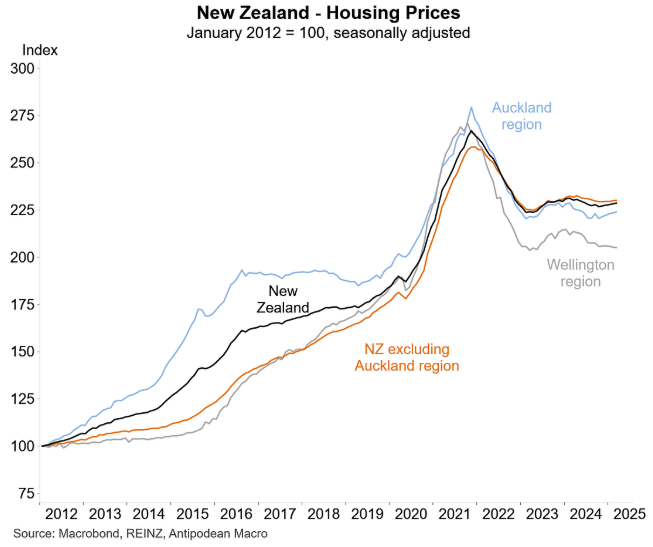

The following chart from Justin Fabo from Antipodean Macro shows that house prices have fallen heavily from their peak across New Zealand.

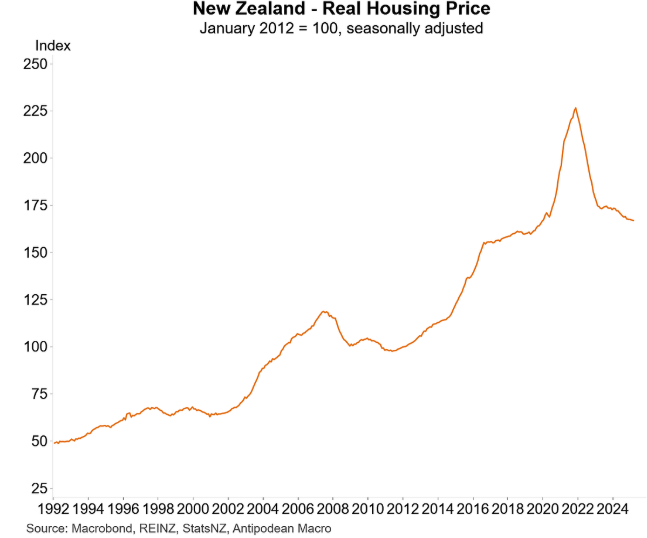

New Zealand’s real inflation-adjusted house price has now fallen to levels not seen since late 2019, just prior to the pandemic.

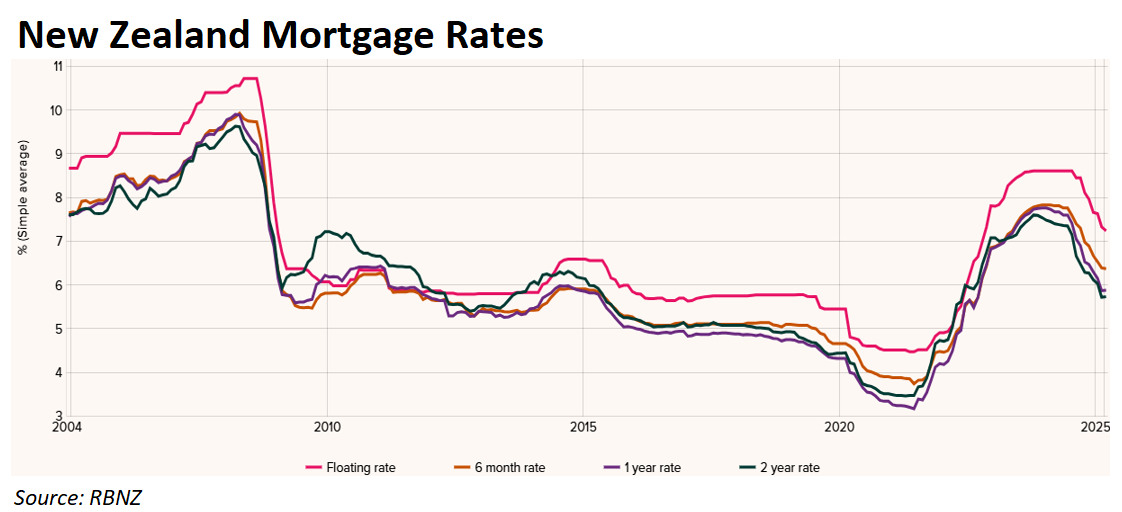

New Zealand mortgage rates have also fallen significantly following 2.0% of monetary easing by the Reserve Bank.

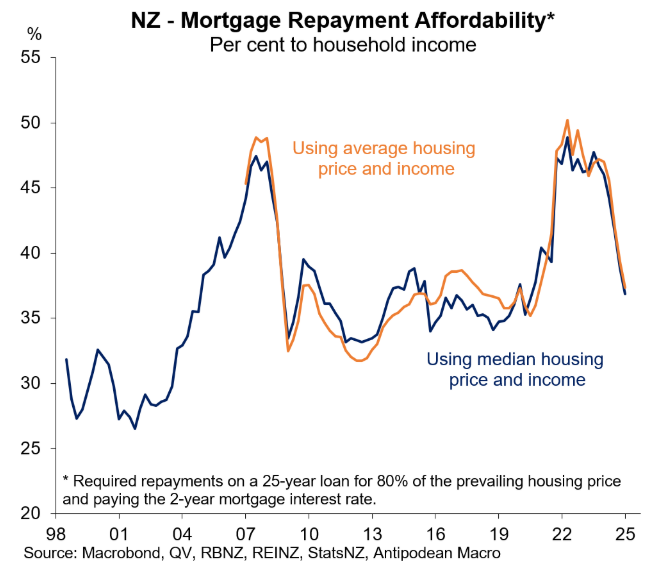

The combination of significantly lower home prices and lower interest rates has dramatically improved mortgage affordability.

Mortgage repayments as a share of household income have fallen from a peak of around 50% to just above 35%.

It is a shame that Australia’s politicians won’t take a similar approach to housing.

To improve housing affordability, lower prices are necessary.