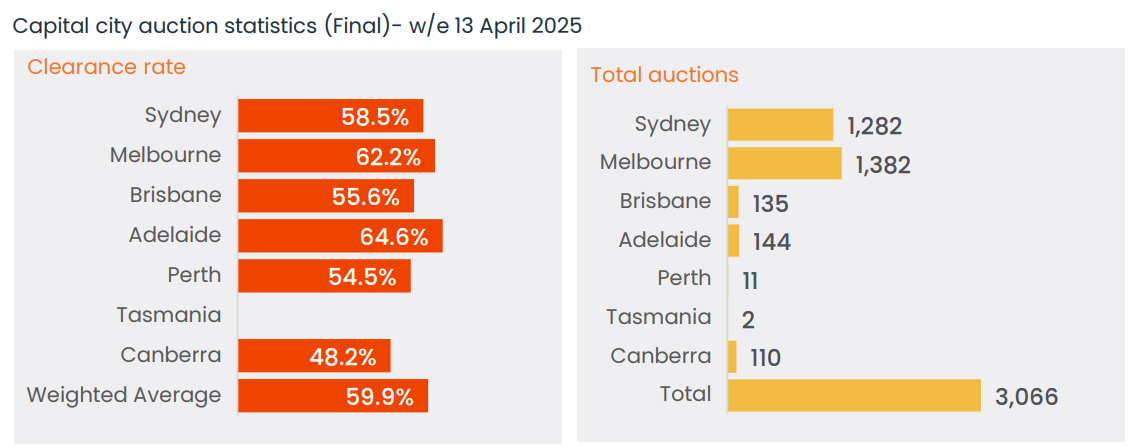

CoreLogic released its final auction results for last weekend. The clearance rate was just 59.9% nationally, the second time in three weeks it has been below 60%.

Source: CoreLogic

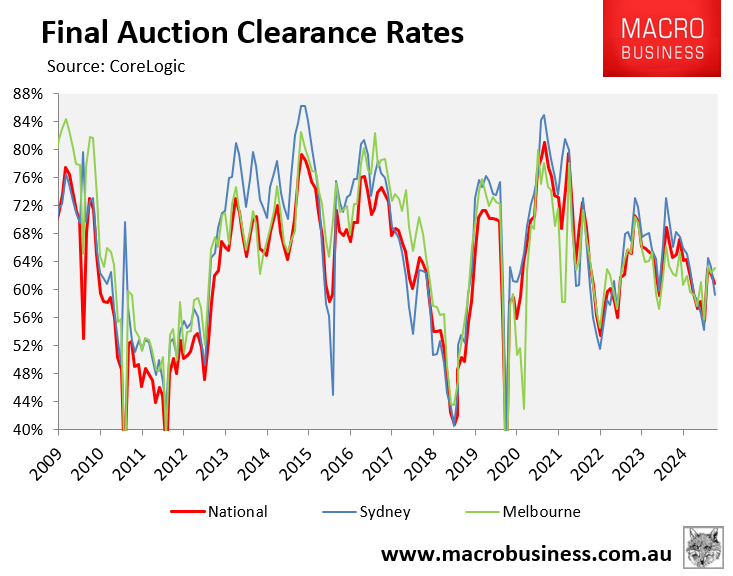

The following chart plots the monthly average final auction clearance rate across the major markets.

As you can see, the decline in the national final clearance rate has been driven by Sydney, with Melbourne’s falling by a smaller amount.

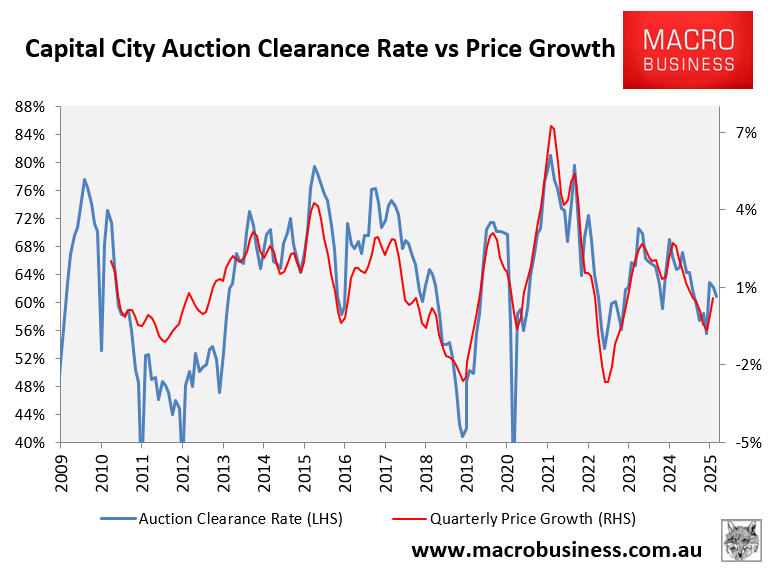

The final auction clearance rate has historically correlated strongly with the growth in dwelling values, as illustrated clearly below.

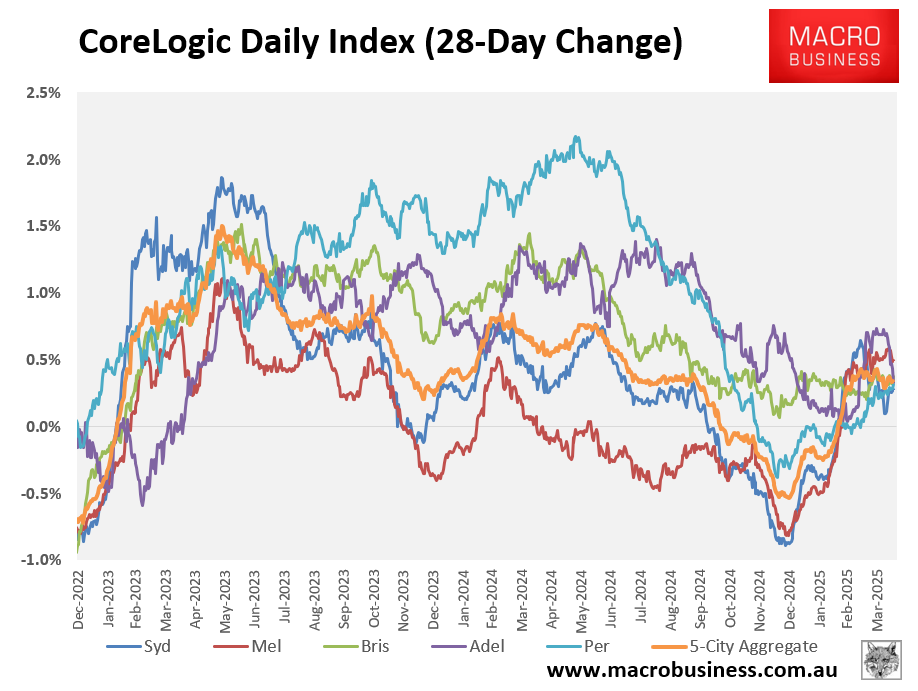

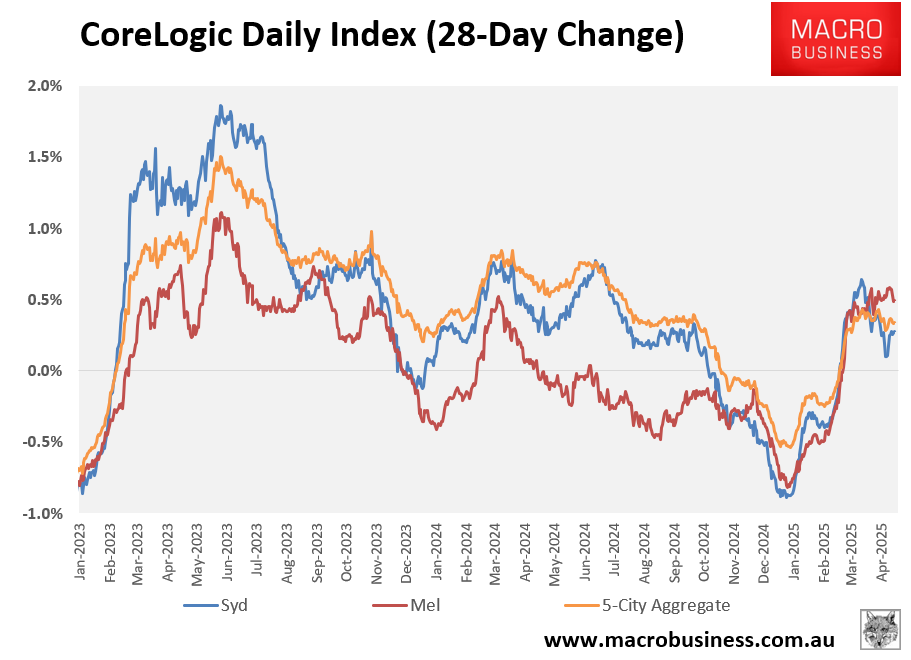

Not surprisingly, then, growth in CoreLogic’s daily dwelling values index has stalled across all major capital city markets.

The growth in Sydney dwelling values has eased the most, reflecting the sharp decline in its final auction clearance rate.

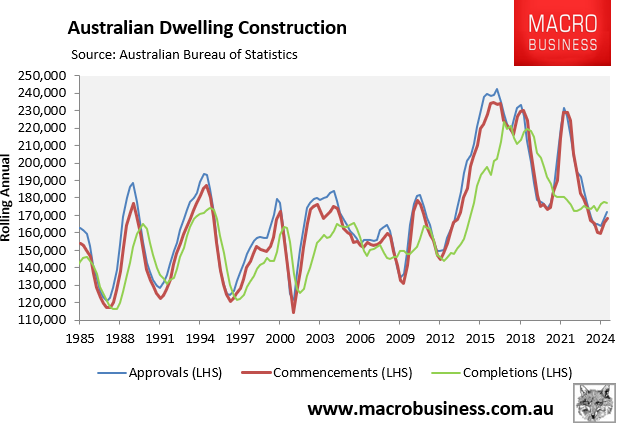

Meanwhile, the latest construction data from the Australian Bureau of Statistics (ABS) shows that approvals, commencements, and completions continue to track near decade lows.

Clearly, the housing market is stuck in a holding pattern as it awaits further interest rate relief from the Reserve Bank of Australia (RBA).

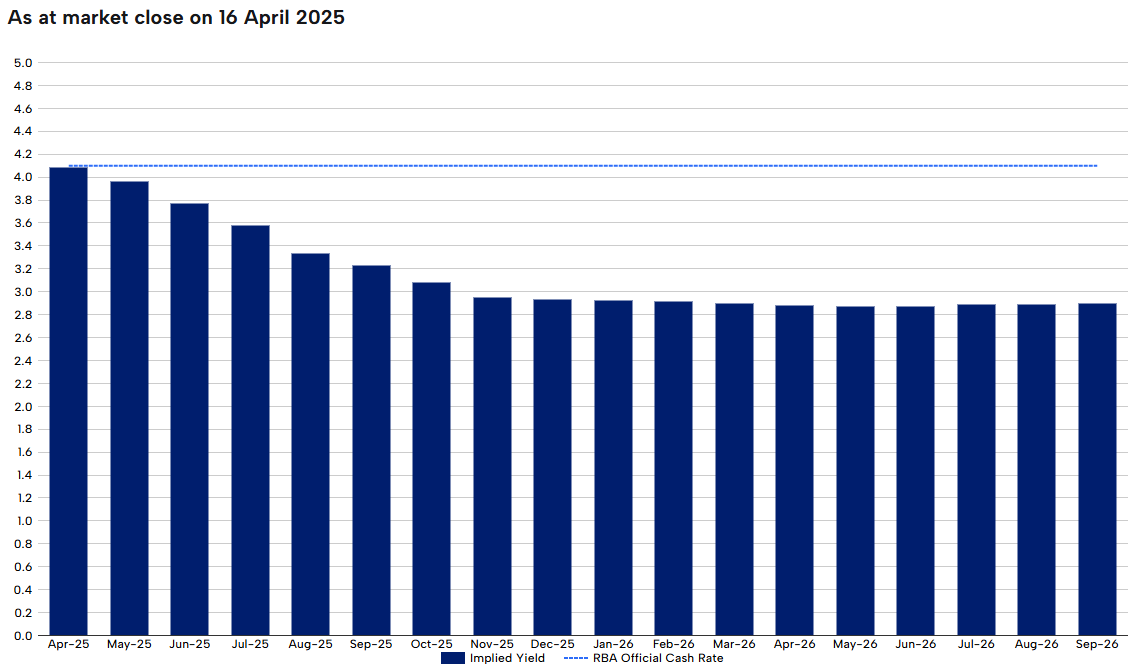

The latest projections from the interest rate futures market suggest that the official cash rate will be cut a further four times this year, ending the year at around 3.0%.

Such interest rate cuts will obviously provide significant stimulus to the housing market.

The Albanese government, which is heavily favoured to win the upcoming federal election, has also promised to allow all first home buyers to purchase a home with only a 5% deposit, with taxpayers guaranteeing 15% of all first home buyer mortgages.

The combination of heavy interest rate cuts and 5% deposits is likely to engineer a large house price boom in 2026.