Treasurer Jim Chalmers reportedly held an emergency meeting with Reserve Bank of Australia (RBA) governor Michele Bullock, suggesting deep interest rate cuts are likely.

Some economists now expect the RBA to deliver the most aggressive interest rate cuts since the Global Financial Crisis in 2008.

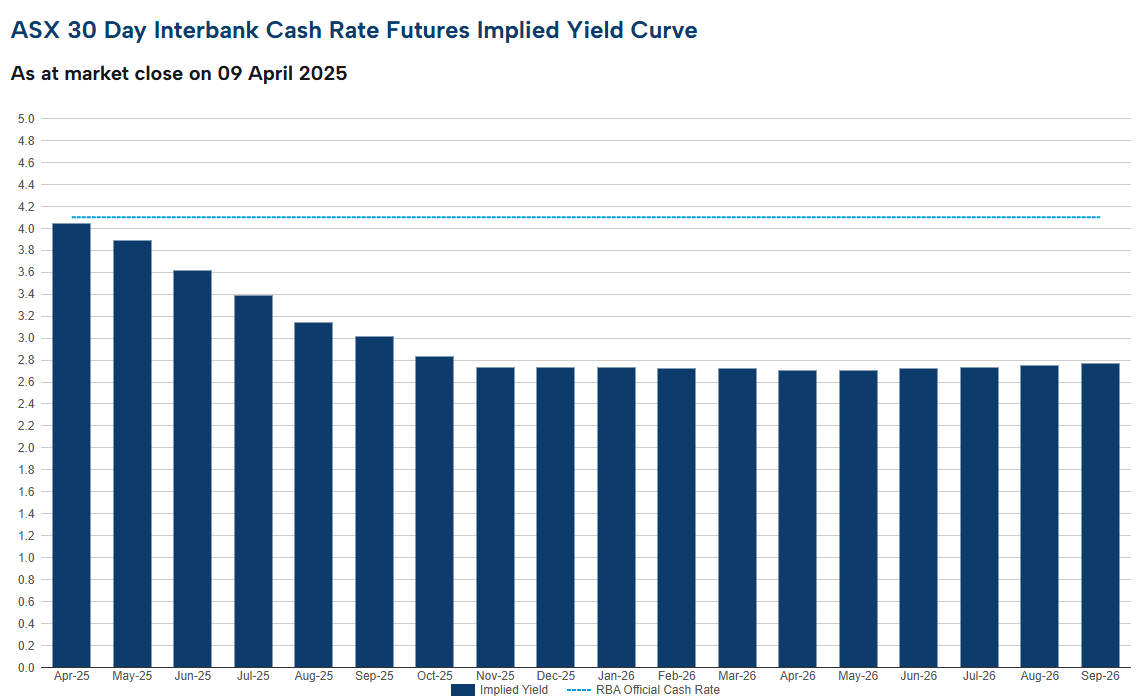

Futures markets are now tipping five rate cuts over the remainder of 2025, which would take the official cash rate to only 2.85% at year’s end.

Markets have also priced a 30% chance of a rate cut of 50 basis points at the next monetary policy meeting in May.

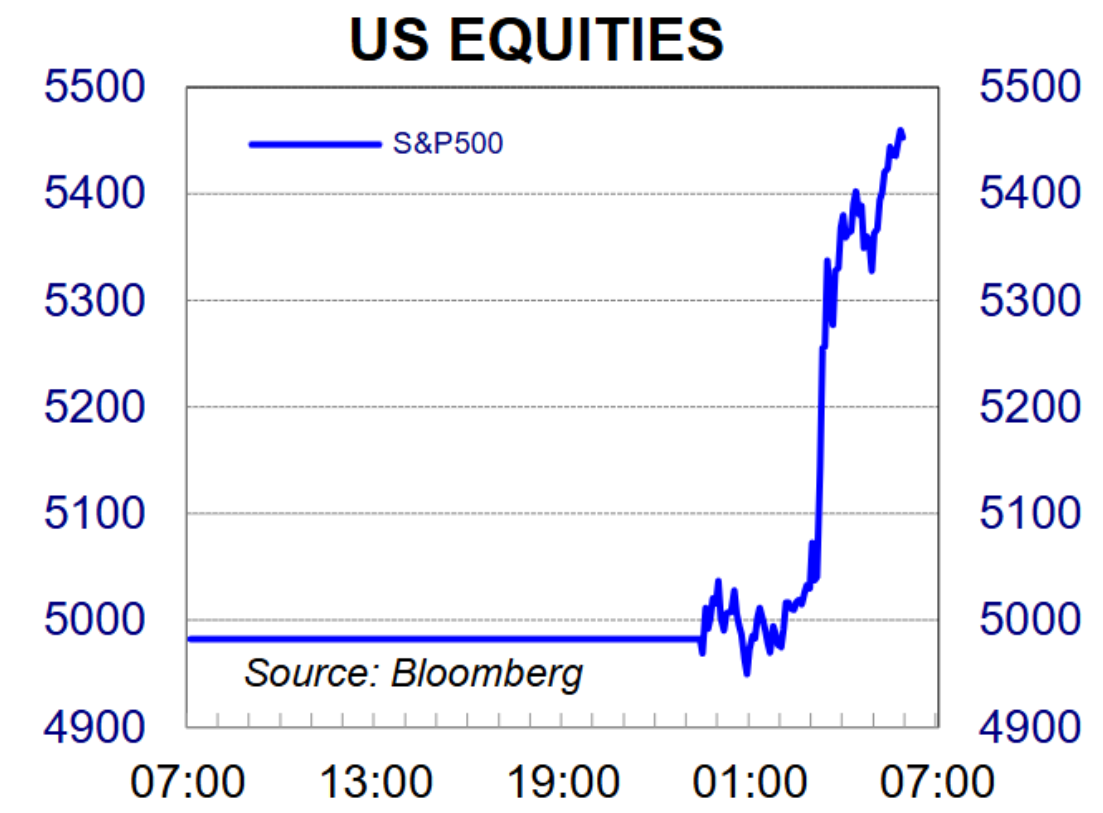

Overnight, US share markets ripped higher, with the S&P 500 closing up 9.5%, the biggest one-day gain since 2008.

This surge was in response to President Trump announcing a 90-day reprieve on reciprocal tariffs for most trading partners.

Countries that faced higher reciprocal tariffs, which went into effect yesterday (2pm Sydney time), will now face the baseline 10% rate applied to all other countries (including Australia).

However, tariffs on Chinese imports to the US have been ratcheted up to 125% in response to China’s retaliatory 84% tariff rate on US goods, set to begin later today.

While markets are looking through China’s tariffs for now, they have important implications for Australia.

China is easily Australia’s largest export market, accounting for roughly one-third of merchandise exports.

Source: DFAT

Therefore, any slowing of Chinese exports into the USA will likely result in China buying less iron ore, coal, and other commodities from Australia.

These are the types of indirect impacts that are most concerning for the Australian economy.