Justin Fabo from Antipodean Macro has published interesting charts showing how Australians continue to pay some of the highest mortgage rates in the world.

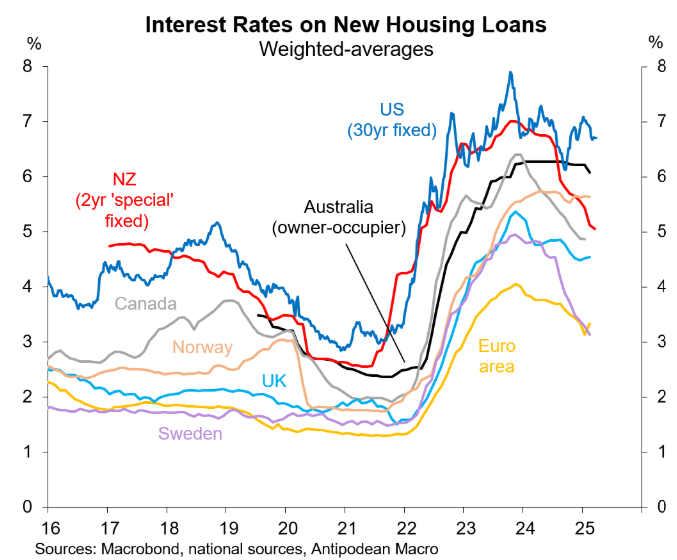

The first chart shows that Australian mortgage rates on new home loans are the second-highest in the advanced world, behind those of the United States.

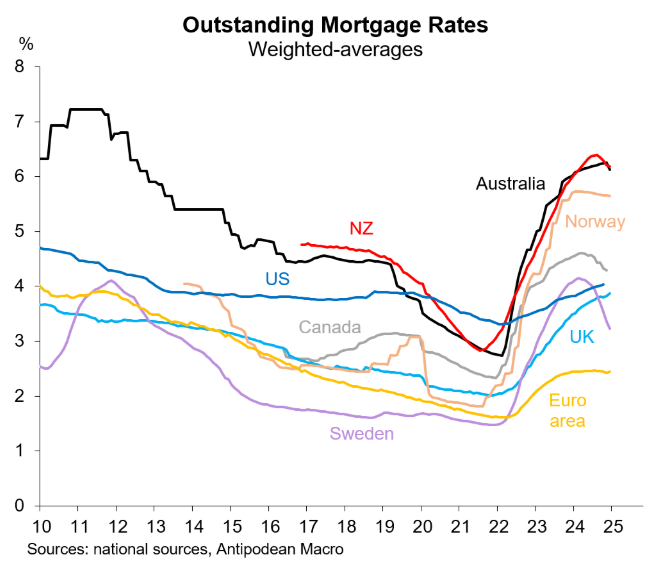

Australia also has the equal highest mortgage rates on existing home loans alongside New Zealand.

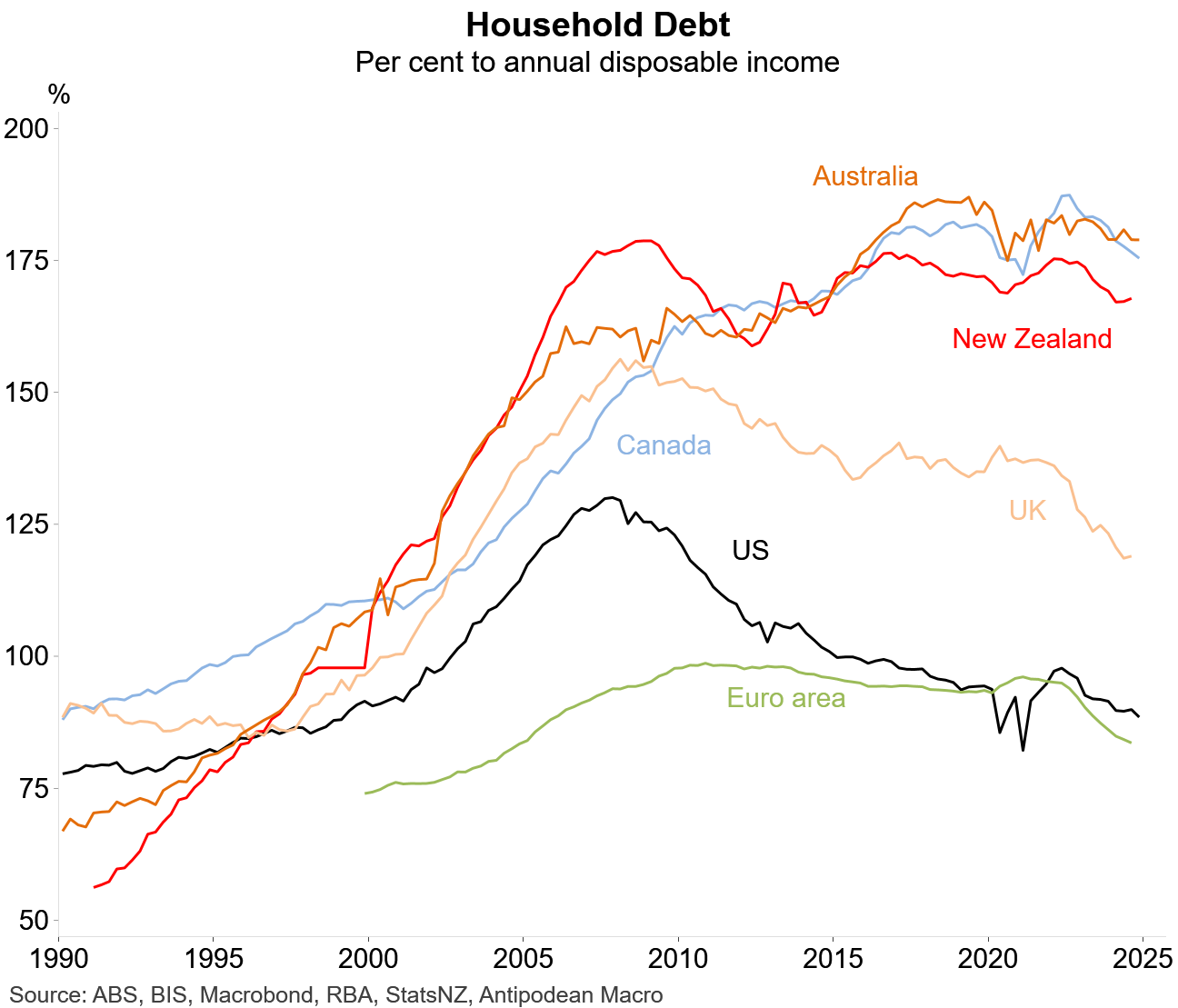

Australians are also likely to be spending the highest share of household incomes on mortgages, given that Australia has the highest household debt load.

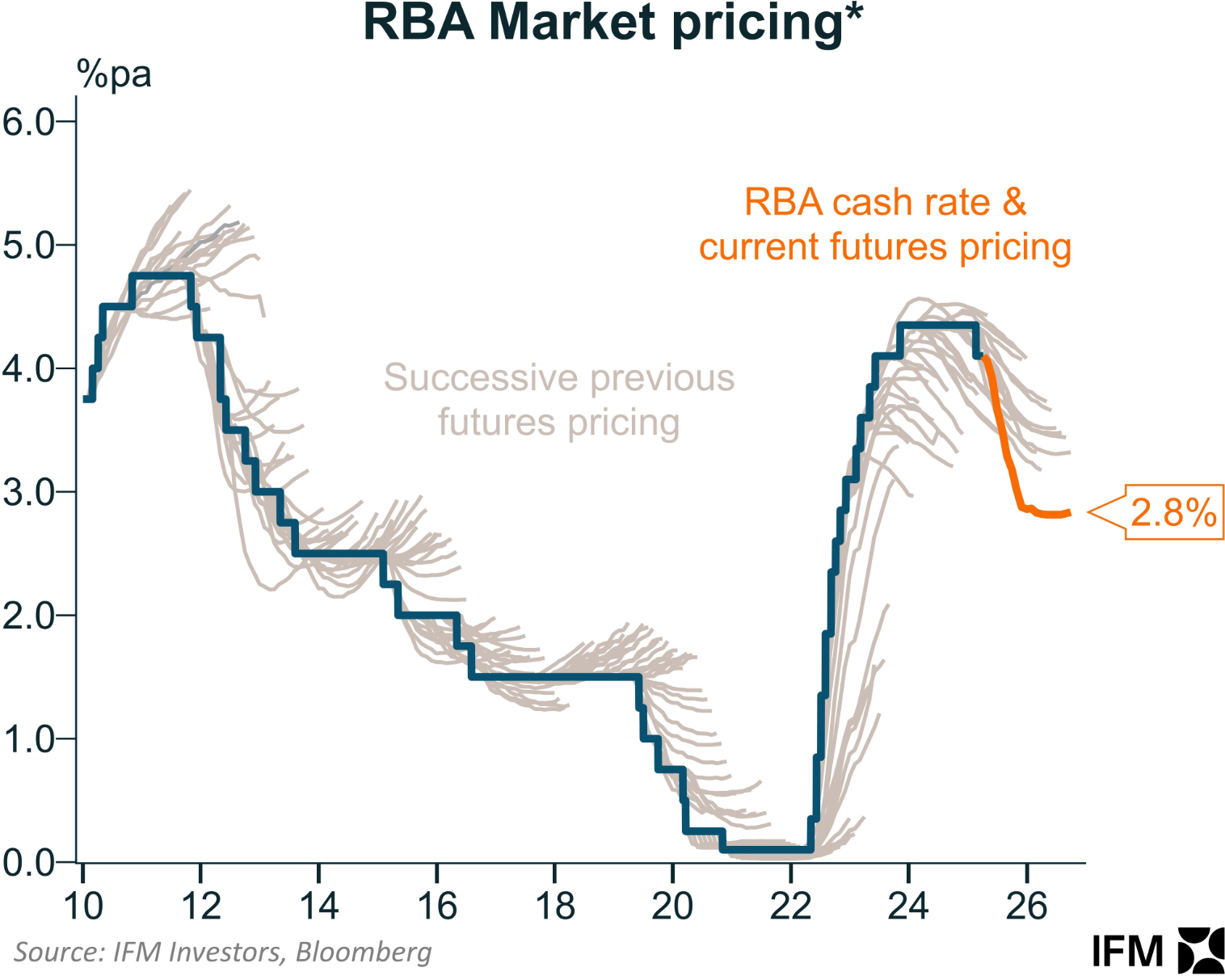

The good news for Australian mortgage holders is that financial markets are tipping the Reserve Bank of Australia (RBA) to cut the official cash rate by another 100 basis points this calendar year, with a terminal low of 2.8% (versus 4.1% currently).

However, there is the risk that the RBA could cut harder if global economic and financial conditions continue to weaken amid the Trump administration’s trade war.

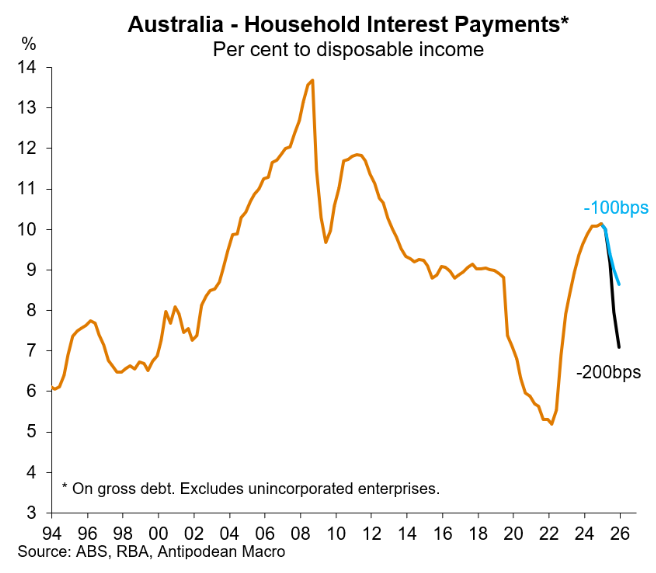

Justin Fabo created the following chart showing how rate cuts would impact Australian mortgage borrowers.

“A 100bp reduction this year in the average interest rate paid on household loans in Australia would reduce the gross interest burden by ~1.5% of household disposable income”, estimated Fabo.

“A 200bp reduction would be a ~3ppt fall in the gross household interest burden”.

Such deep interest rate cuts, alongside a flight to ‘bricks and mortar’ by investors, would also likely deliver a house price boom.

While such an outcome would be great for owners of investment property, it would be a disaster for structural housing affordability.

Australian housing is already too expensive. The nation does not need additional price inflation.