DXY is back and EUR soft.

AUD lol.

Lead boots are OK.

Gold margin call is a measure of market extremity. Oil to the rescue.

Copper oh dear.

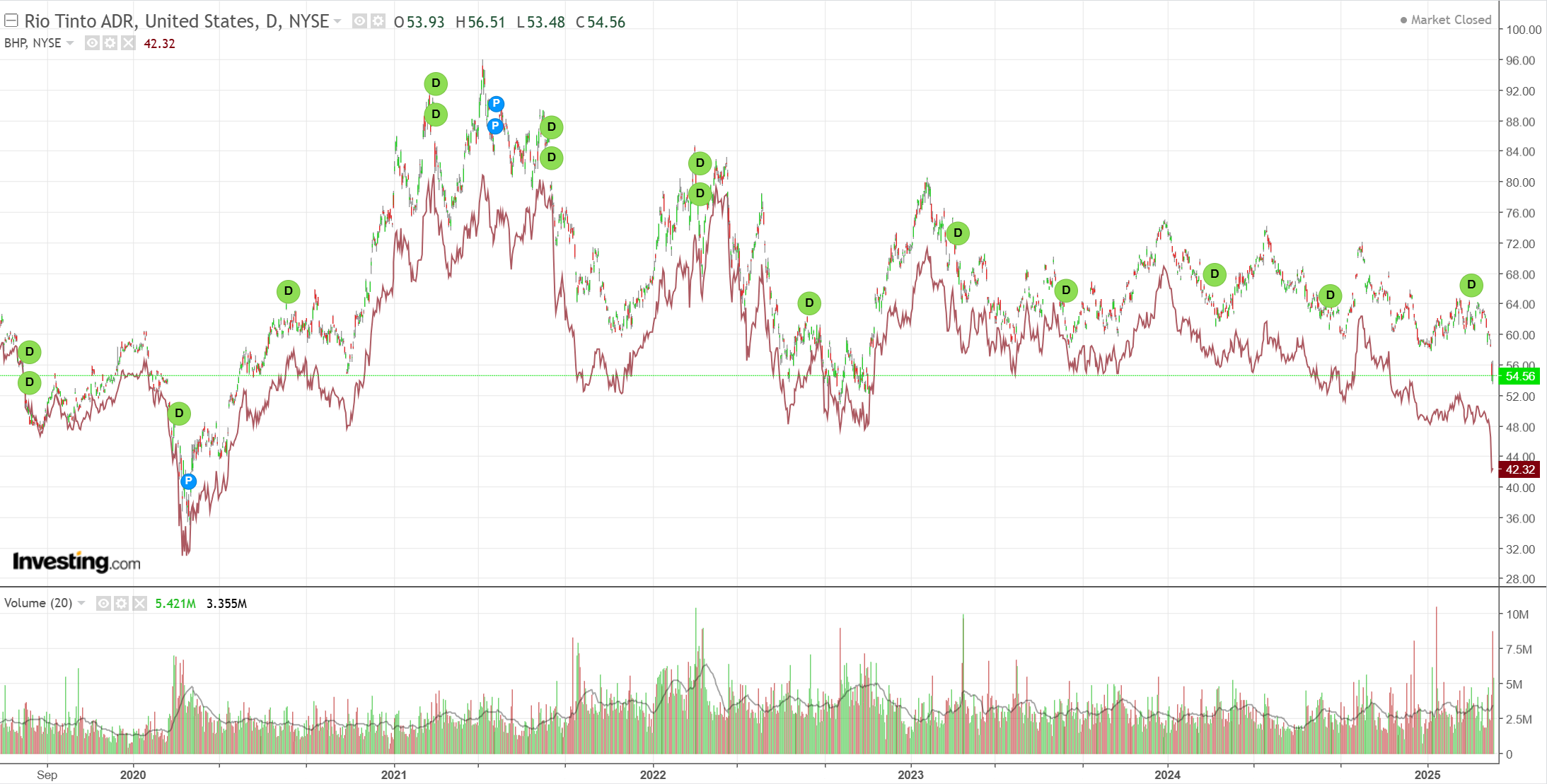

Big mining megabear.

EM not so bad.

That’s the credit stress we’ve been looking for.

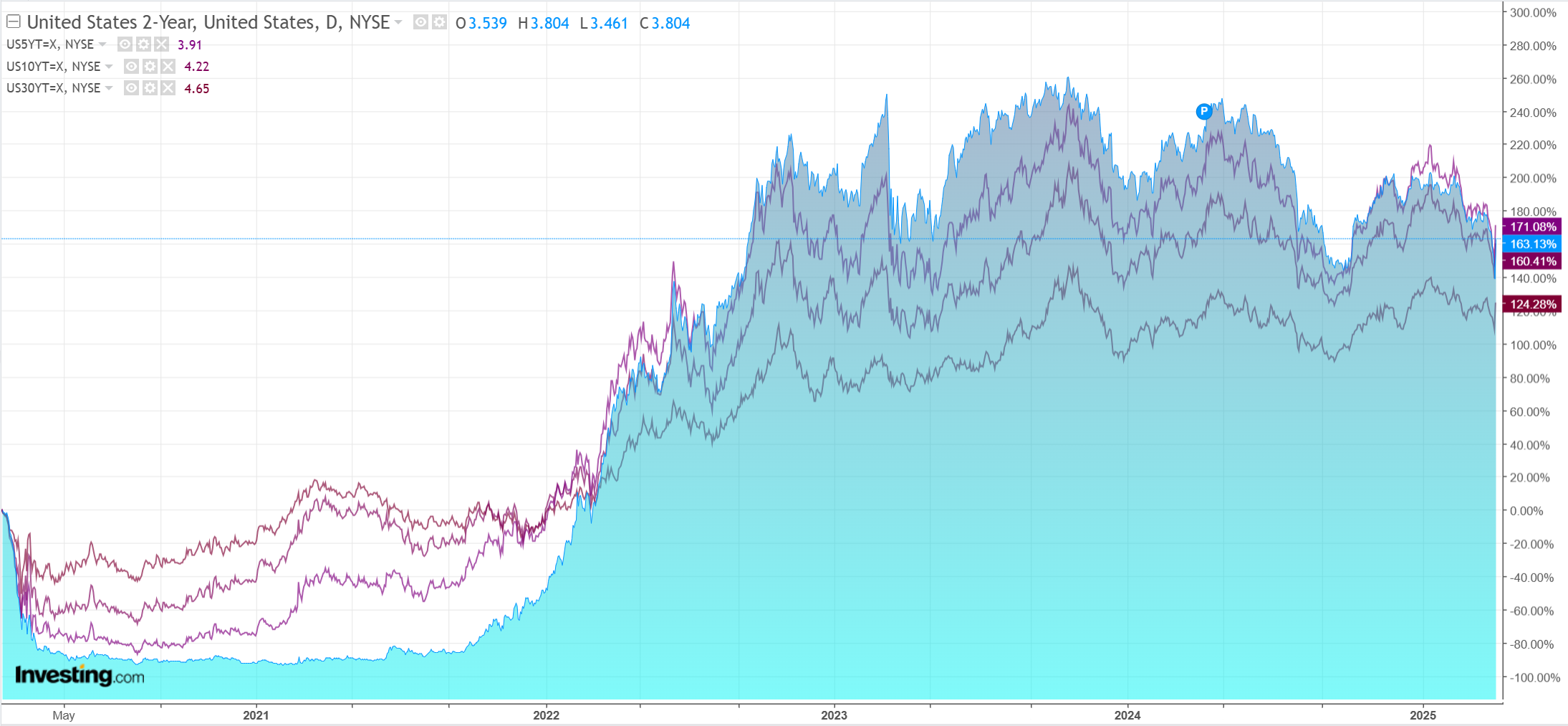

But those are not the sovereign yields that the Bessent Plan needs.

Stocks managed to not fall.

Is the Aussie dollar headed straight through 50 cents, as predicted a year or more ago?

For that to happen, China will probably need to let the CNY go. Will it choose fiscal instead? Deutsche.

New US tariffs are worse than feared, posing significant downside risks to China’s near-term growth.

China’s shift from restraint to retaliation is politically necessary.

Historical precedent suggests tariffs could remain in place for an extended period; risks of a downward spiral in global trade and economic recession have increased substantially.

How should China respond?

In our view, (1) maintaining a stable RMB exchange rate is crucial for China, regardless of whether the US tariffs are temporary or permanent.

China has little to gain and much to lose from competitive devaluation. (2) Boosting domestic demand through fiscal easing and structural reforms is most effective response forChina to navigate these challenges and achieve its growth targets.

We think the April politburo meeting will set the tone, and concrete measures will be announced within a few months.

Hmm, partly. China has plenty to gain from devaluation, not least being some inflation, without which domestic demand will be pushed lower by real interest rates as asset prices keep falling.

That said, its strategy for handling this so far has been to absorb and export deflation, and that will probably continue to all non-US jurisdictions.

There will be rate cuts to pressure the CNY at the margin.

Barring Chinese devaluation, the other triggers for a 50-cent Aussie dollar are escalating trade wars and global recession.

These are high-risk scenarios, so I’m not ruling out another material leg down for AUD.