DXY is suddenly a safe haven once more.

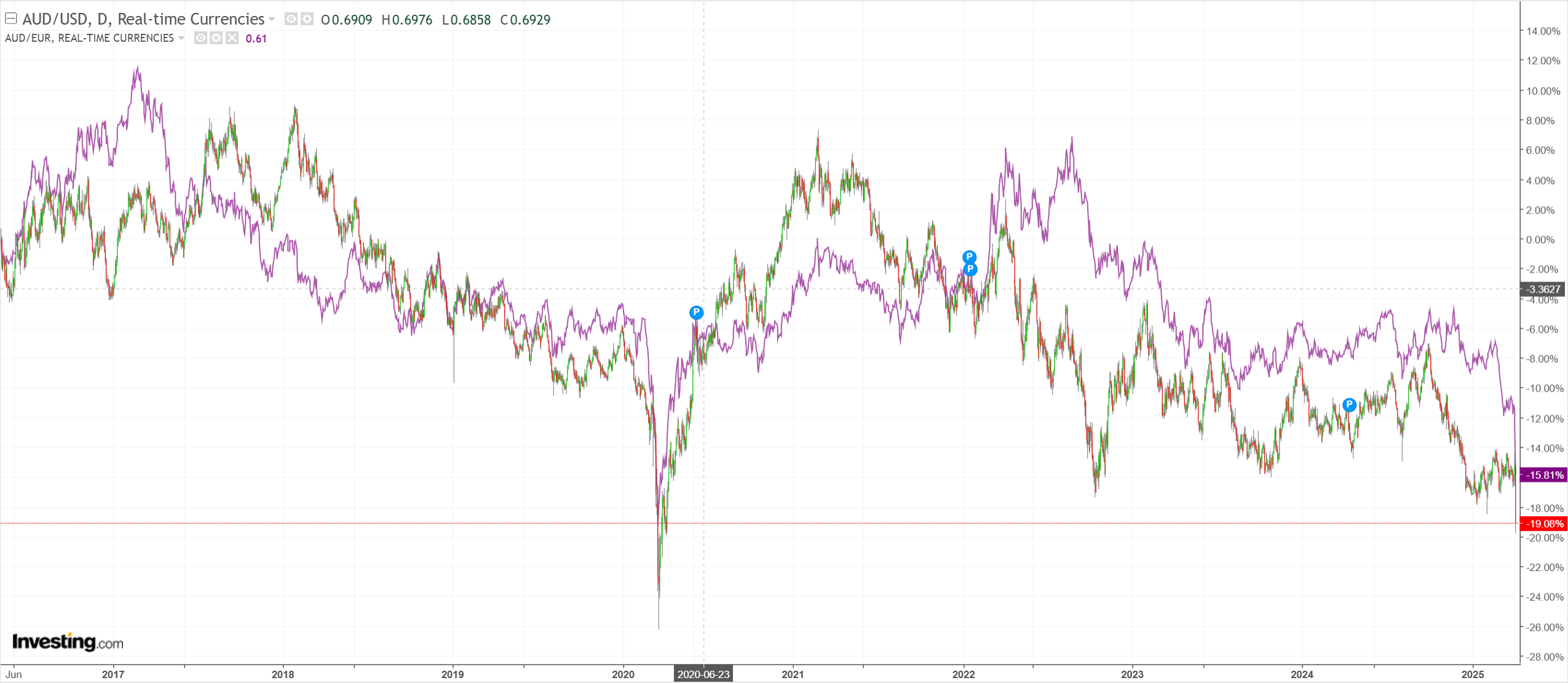

To describe the 4.57% destruction of the AUD in one day as a lesson in arrogance doesn’t quite say it.

Lead boots may be about to become a screaming meteorite of death.

Oil is going to hell. When gold sells like this, you know the margin calls are out.

But nothing can compete with the bursting copper bubble. Hooocoodanode?

Big miners = big bears.

Hope you’re enjoying Chinese stocks!

Credit stress arrives.

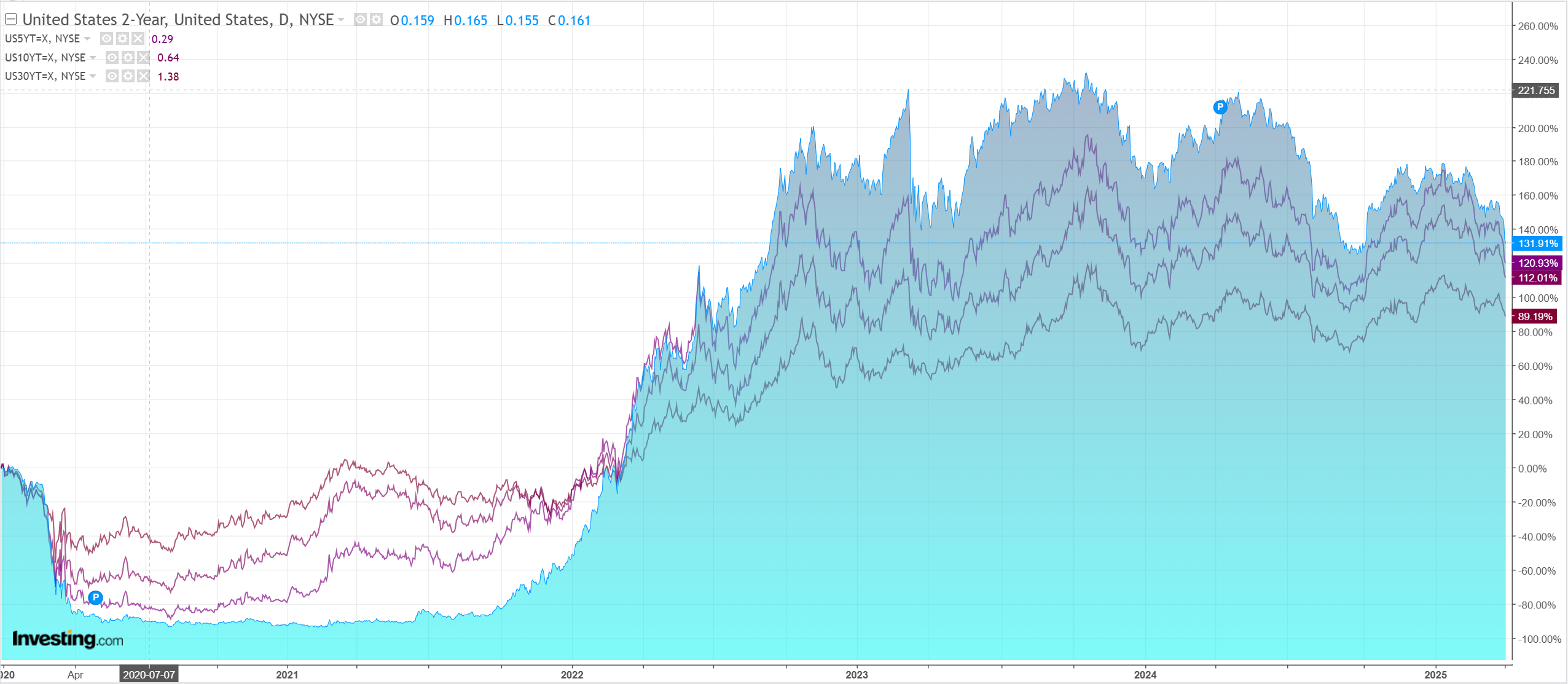

Bonds bid, but there’s a long way to go.

Stocks crash.

The news. Bloomie.

The S&P 500 Index declined to the lowest level in 11 months, slashing $5.4 trillion in market value in just two sessions as Federal Reserve Chairman Jerome Powell said the Trump administration’s tariffs “could have a persistent impact on inflation.”

The S&P 500 closed 6% lower in its worst day since March 2020, with all but 14 members in the red. The Nasdaq 100 plunged 6.1%, entering a bear market.

…The rout came as China imposed a 34% tariff on all American imports starting April 10, in addition to targeted actions against poultry producers and weapons makers, according to the official Xinhua News Agency.

This is not normal, but the AUD is at least making sense again. The idea that massive tariffs on China will turn AUD into a safe haven is crazy.

Beyond that, who knows where this stops? We are going to get slaughtered every time the tariff war gets worse and soar every time Trump makes a deal.

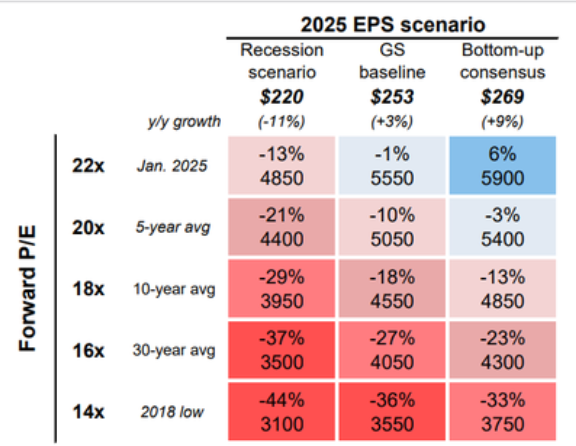

What I would say is that equities are still not priced for the recession, which is now taking center stage not just in the US but everywhere else as decoupling fantasies evaporate.

Price action in all asset classes is turning unruly as liquidity dries up, and the possibility is growing of an endogenous market accident (in which leveraged players themselves begin to melt down) adding to the chaos.

To state the obvious, the AUD does not fall 4.57% in one day when everything is OK.