DXY is hanging on…just.

AUD looks poised for higher.

Lead boots are holding.

Gold and oil take a breather.

Advertisement

Metals stall.

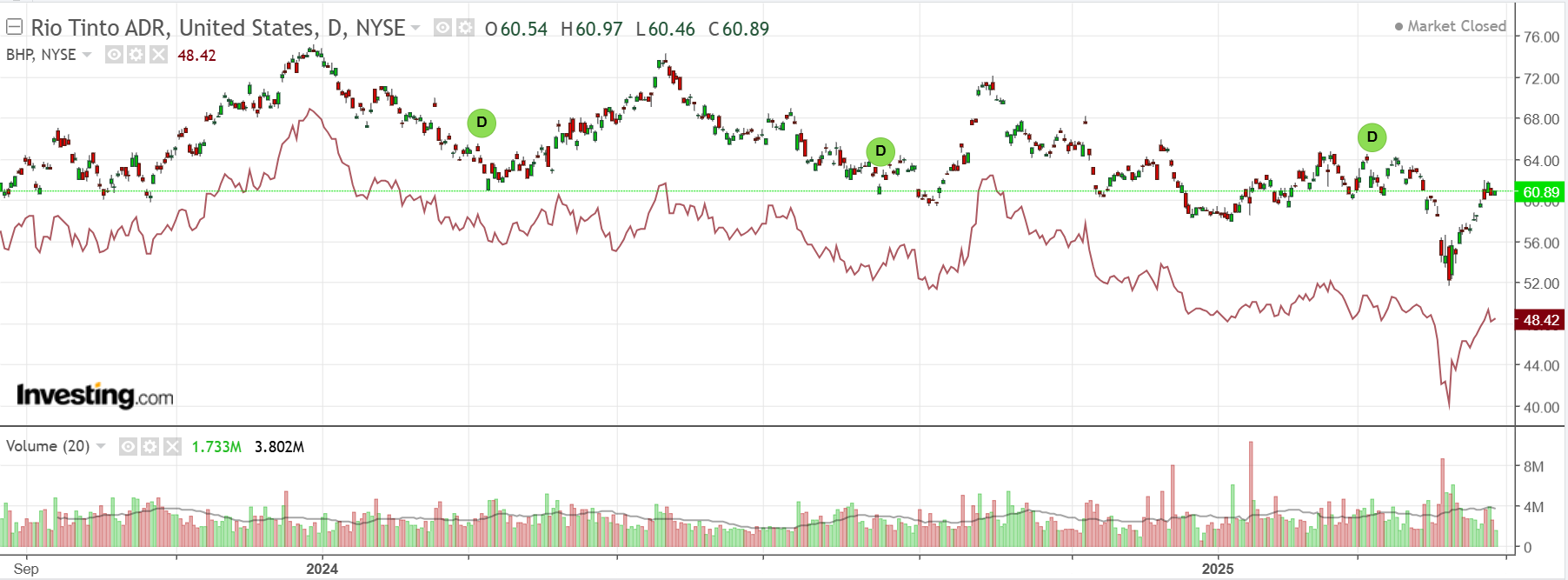

Big miners=big bear.

EM yawn.

Advertisement

Junk unconvincing, either way.

Treasuries are bid again.

Stocks stalled.

Advertisement

There is a lot of tariff pain imminent, both in the US and China. I am still of the view that it will result in near recession for both (though the latter will hide it better).

AUD looks poised for higher, but if Treasuries can remain bid enough to be stable at least through any further stock sell-off, the AUD may also stabilise.

Lots of big “ifs” based largely on the child present not needing to be in the headlines for a time.

Advertisement

So probably wrong!