The Australian dollar is falling out of favour again. Goldman.

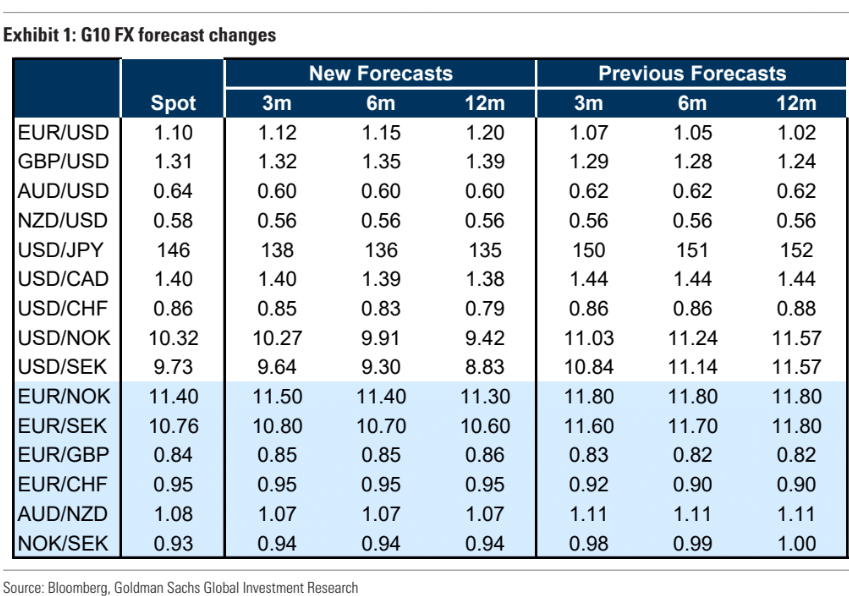

We are making a major shift in our Dollar view for the year ahead: we now see Dollar weakness of the first quarter persisting and deepening further.

The reciprocal tariff announcement itself was close to our economists’ expectations in terms of aggregate tariff rate.

If enacted, it would be the sharpest rise in the US effective tariff rate in more than 100 years.

However, we do not think these tariffs are likely to prove as Dollar supportive as we had previously thought for a number of reasons.

First, the combination of an unnecessary trade war and other uncertainty raising policies is severely eroding consumer and business confidence as we have discussed, so that any Dollar positive impulses are being offset by the likelihood of lower growth.

Second, the negative trends in US governance and institutions are eroding the exorbitant privilege long-enjoyed by US assets, and that is weighing on US asset returns and the Dollar, and may continue to do so in the future unless reversed.

Third, and related, the implementation of the tariffs themselves is eroding the ability of investors to price these.

Despite this DXY downgrade, Goldman also downgraded its AUD view.

At this point, the base case has quickly swung towards a US growth accident.

If not a recession, then certainly a material slowdown that will trigger meaningful EPS downgrades.

A market trading on 20x NTM is not priced for this, so I expect to see more days like we had last week as either the tariff war escalates or the economic data deteriorates in due course.

That makes me see the DXY safe haven as likely strong in short term.

However, as we emerge from the market shock and enter the economic version, I would expect DXY to start to fall again.

Irrespective, as we now know from Friday’s 4.5% obliteration, these are not circumstances in which AUD can prosper.