DXY was stable.

AUD through the roof.

Concrete boots now.

Oil and gold rally.

Copper is the loon metal. Others dour.

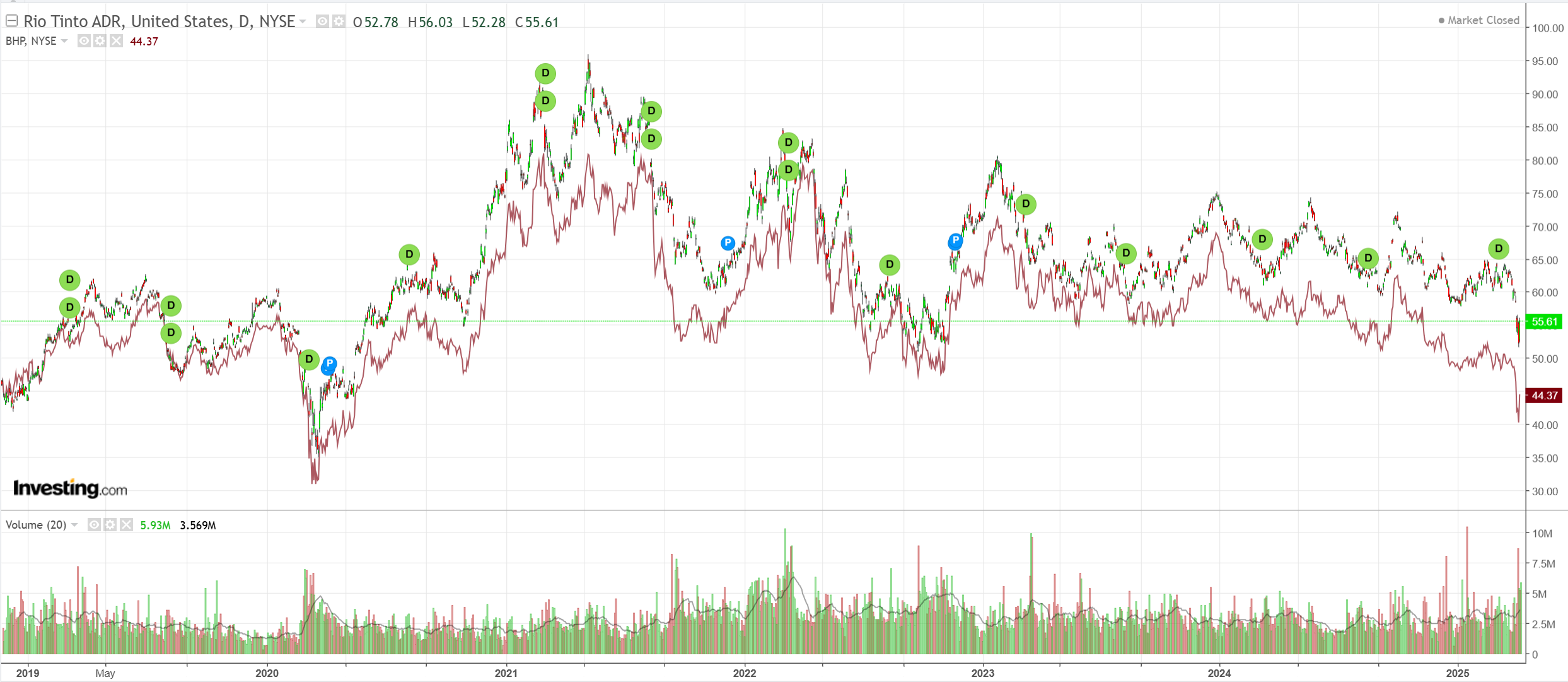

Big miners stuffed.

EM pumped.

Credit stress gone.

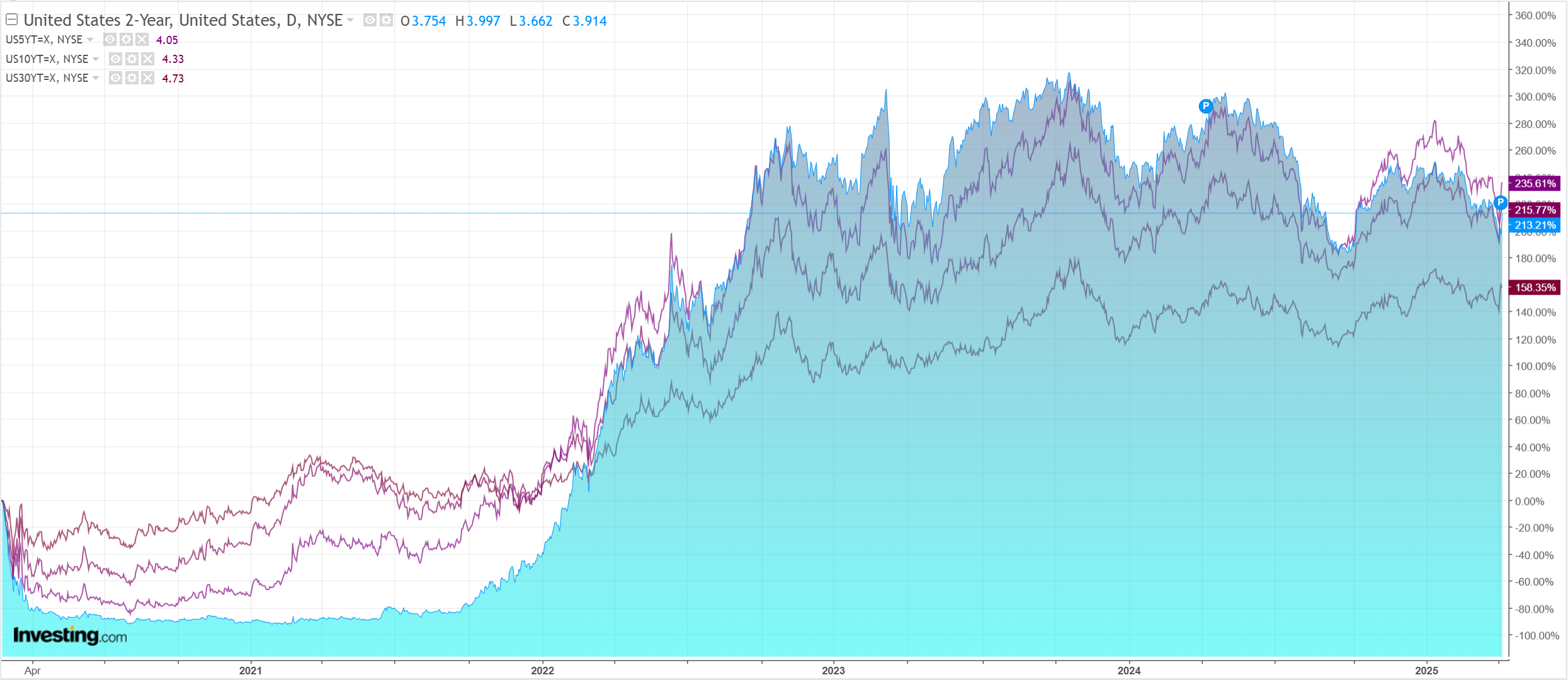

But yields up.

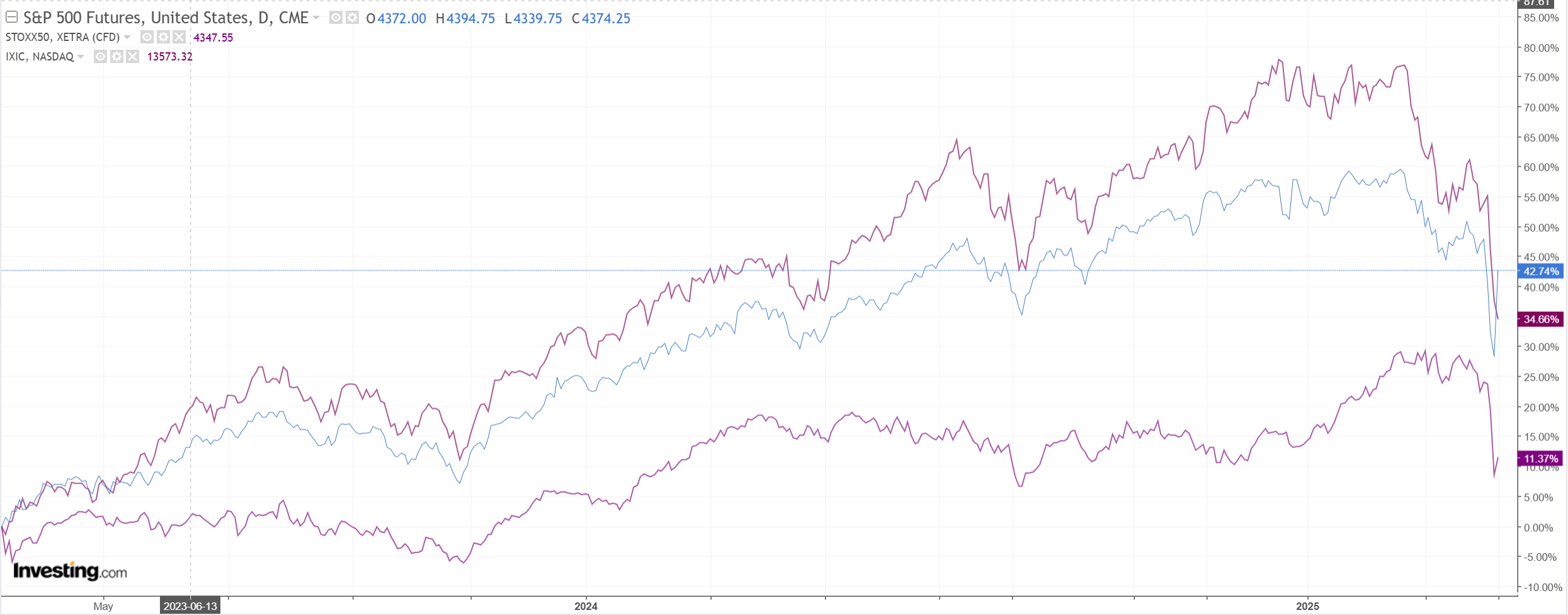

Stocks to the moon!

All markets are now the plaything of the Orange Madman. Bloomberg.

President Donald Trump announced a 90-day pause on higher tariffs that hit dozens of trade partners after midnight, while raising duties on China to 125%.

The president’s about-face came roughly 13 hours after high duties on 56 nations and the European Union took effect, fueling market turmoil and stoking recession fears. Trump faced massive pressure from business leaders and investors to reverse course.

…“The bond market is very tricky,” Trump said. “I was watching it. But if you look at it now, it’s beautiful — the bond market right now. But I saw last night where people were getting a little queasy.”

This was the largest stock market rally since 2008, which is not comforting.

As for AUD, it jumped nearly 3% but arguably underperformed and for good reason.

The China and US decoupling on fast forward is now locked in as Trump can do deals with everybody else.

In a sense, he is now taxing the world to fight China. An eminently improved geopolitical proposition for many countries but not one that takes away the downside risk to the global economy and earnings.

Nor for the AUD. Not least because CNY is breaking down.

I expect we’ll go crazy for a bit and then start to fill the downside gap on everything.

A good chance to reset for AUD bears.