DXY is holding on as Liberation Day passes.

AUD firmed.

Lead boots are heavier.

Oil and gold stalled.

Advertisement

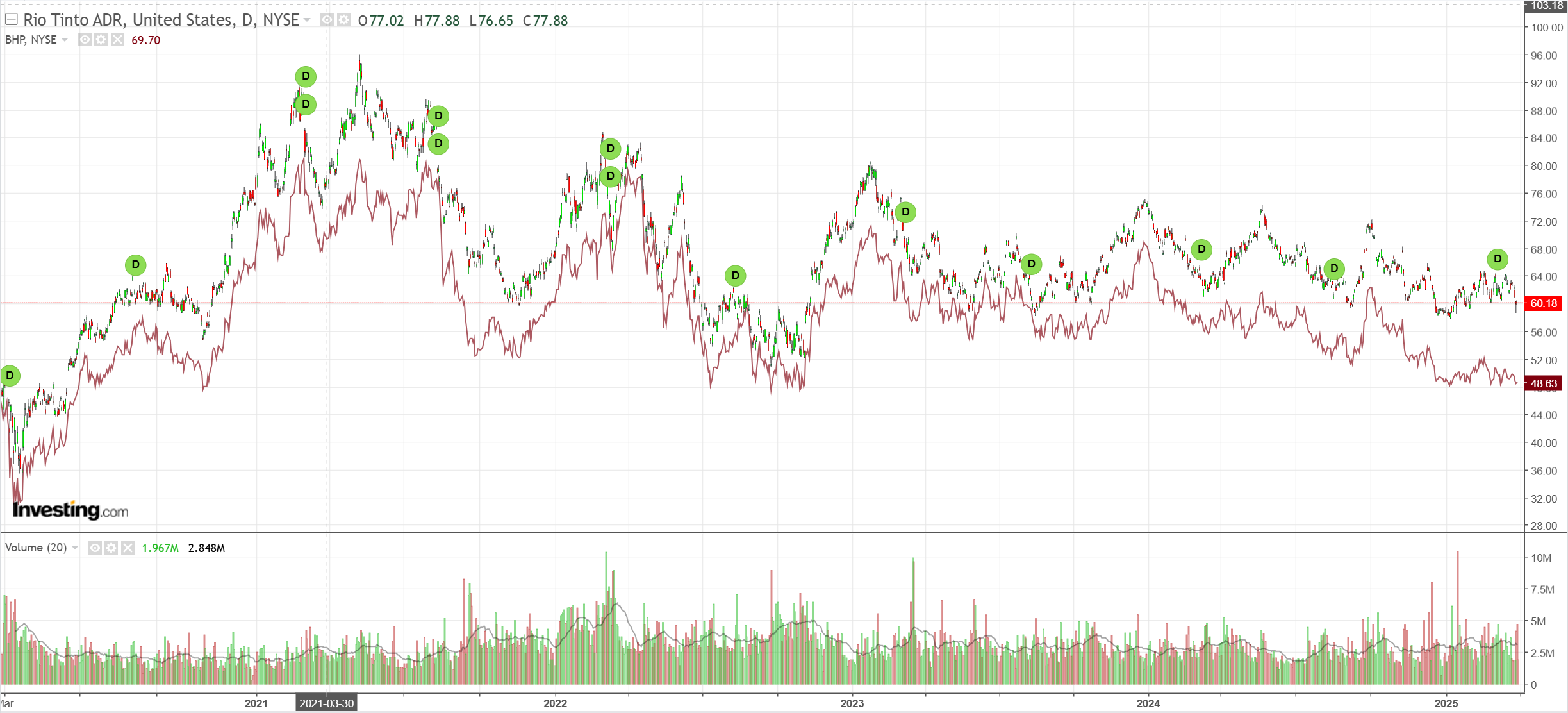

Base metals are pointing at a hard landing.

Big miners, big bears, plod on.

EM meh.

Advertisement

Junk funk not funky enough.

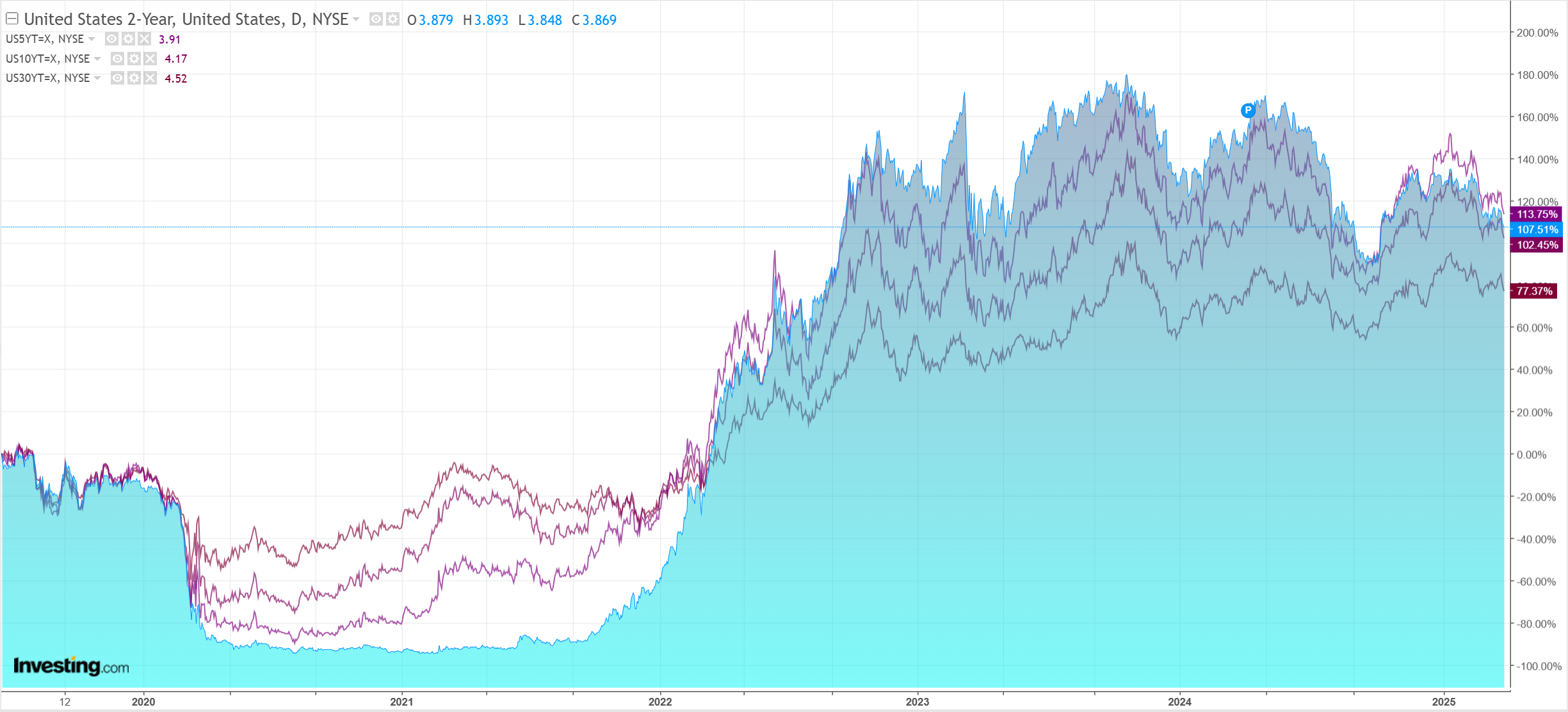

But bonds bid.

Aiding stocks, which rose moderately.

Advertisement

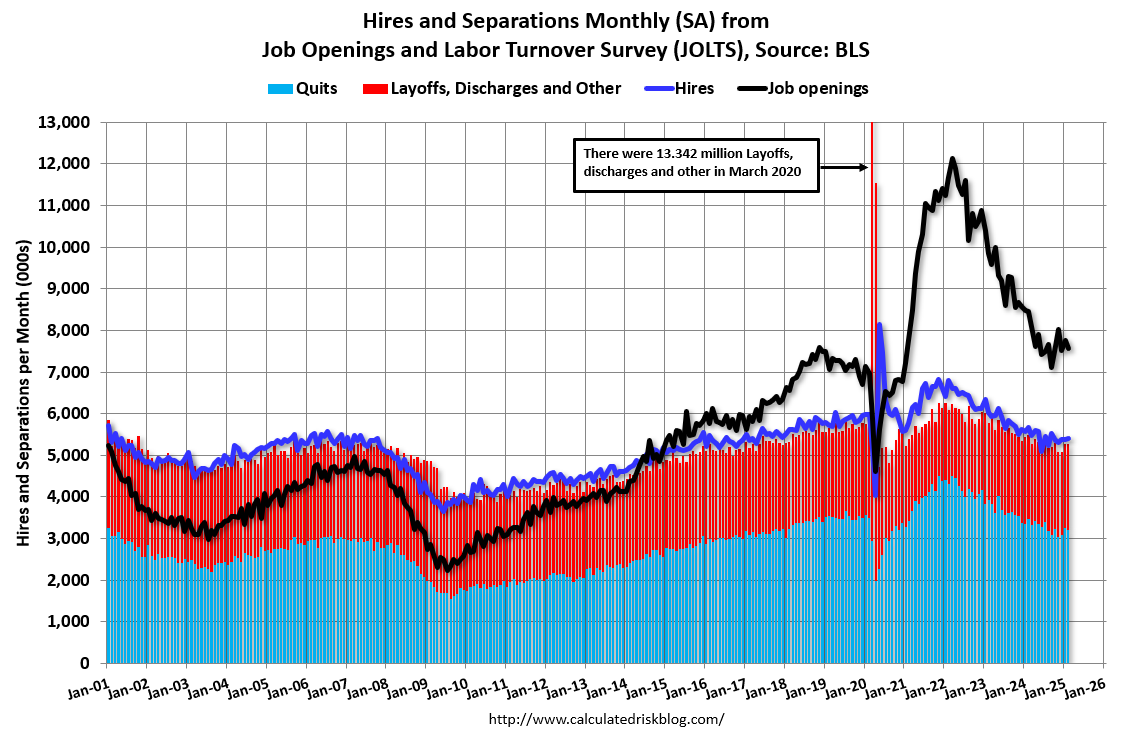

US JOLTS were Goldilocks without showing much harm from DOGE.

The ISM was a stagflationary shocker at 49, with new orders down 3.4% to 45 versus inventories up 3.5% to 53.4.

As the new orders/inventory ratio collapses, that has a hard landing written all over it.

Advertisement

It may be that the employment shock we are all looking for might come after a growth hit, not before.

The US “hard landing” scenario is back, and that does not bode well for AUD.