DXY was firm last night.

AUD was not.

Lead boots are holding on.

Gold parabola. Trump needs to shut up about Iran, or he’ll derail the Bessent Plan via oil.

Another copper bubble goes “pop”.

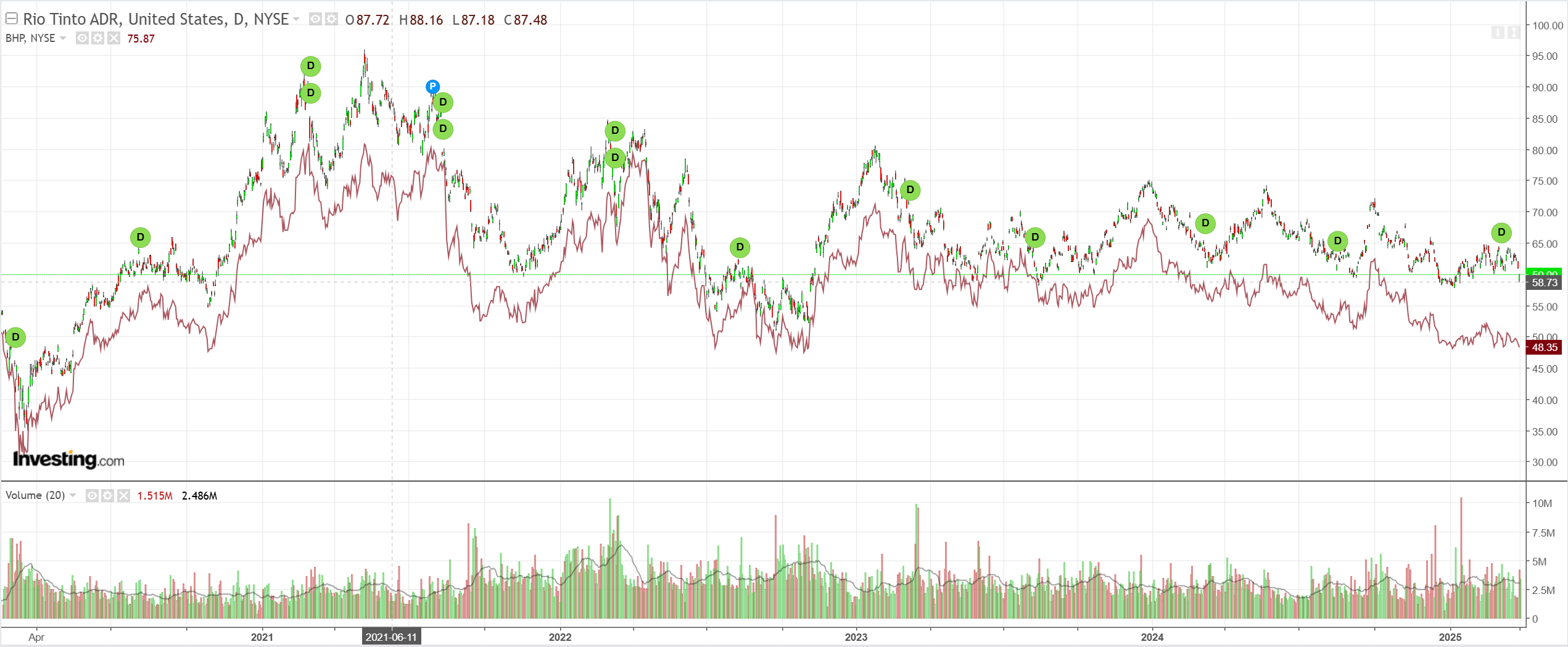

Big Miner’s big bear is still hungry.

EM meh.

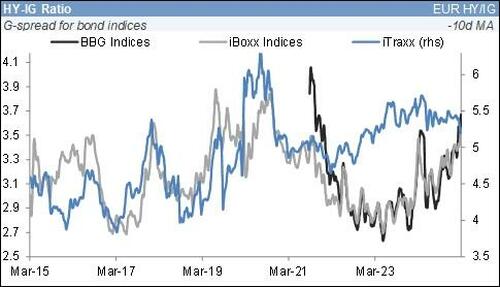

Junk stressy but not enough. Every time it falls, stocks party, reversing falls.

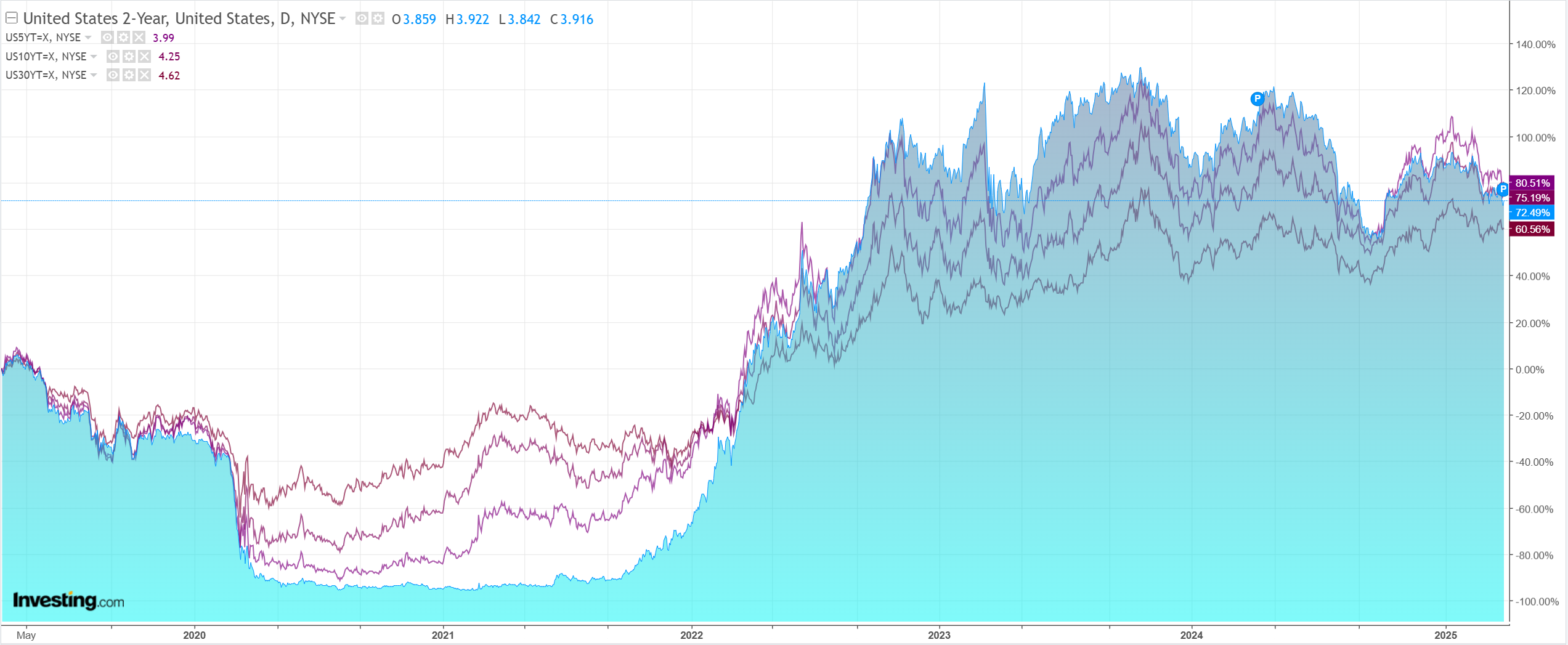

Yields firm.

Stocks all over the place.

It’s not enough. The Bessent Plan needs wider spreads for junk credit if Treasuries are going to be bid for his handoff to private sector growth, recalling that the bond long-end sets interest rates in the US economy.

Goldman has more on spreads.

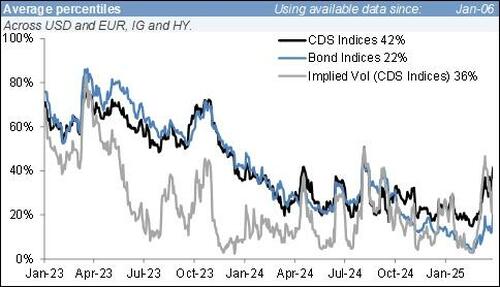

Pricing reflects increasing amounts of hedging. This is positive insofar as pricing of the instruments improves: CDS index spreads have moved above their 40% historical percentile and implied vols are not far from there; bonds though are at much tighter levels (around 20% percentile), which is why we talk about “hedging activity” driving the recent price action and not proper bond selling. Bonds are the tightest part right now and the ones that can underperform the most if the above technicals deteriorate (which is why we tend to like shorts in bond baskets – especially BBB cyclicals and BBs across Europe and the US).

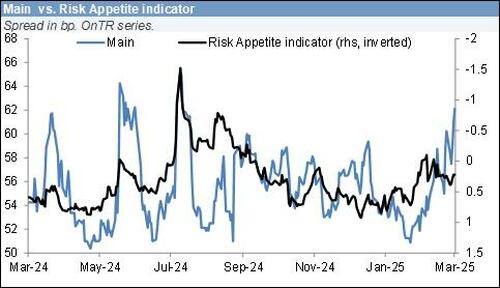

CDS index spreads are moving wider with good speed now: spreads are underperforming EQ vol and GS Research RAI (risk appetite indicator); and their betas to equity are starting to move higher after languishing at the lows for many months. It feels like the credit market is starting to wake up?

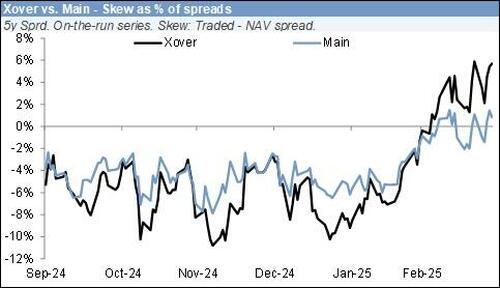

The hedging activity is clear when one looks at different “skews” : CDS indices are widening more than SN CDS, iBoxx TRS trade at a discount to NAV and in options the term structure is flattening and the vol skew is steepening as we move wider. If one is going to position for a Liberation day-triggered squeeze, it is via these hedging products (not via bonds). I.e. from an RV point of view it makes sense to be short risk bond baskets (not iBoxx TRS), and if one needs to fund them one can sell a CDS index payer.

In bonds, the more extended betas of HY funds and the worse flow technical (vs. EUR IG) is creating a decent HY-IG bond decompression (though that’s not the case in iTraxx where the positioning is the other way around). Short risk EUR HY bonds vs Xover implementations are attractive (e.g. here via BB baskets vs 20-35% Xover tranches; or simply BB Bonds vs Xover, ).

A couple of points.

- It’s not enough!

- That stress is intensifying in Europe tells you that when it is enough, the decoupling trade into European and Chinese equaites will also crack.

- In turn, that suggests we’ll know it’s enough when DXY reverses upwards as safe haven flows erupt.

The AUD is still a sucker until the Bessent Plan is complete.